Jitendra Kumar Gupta

Moneycontrol Research

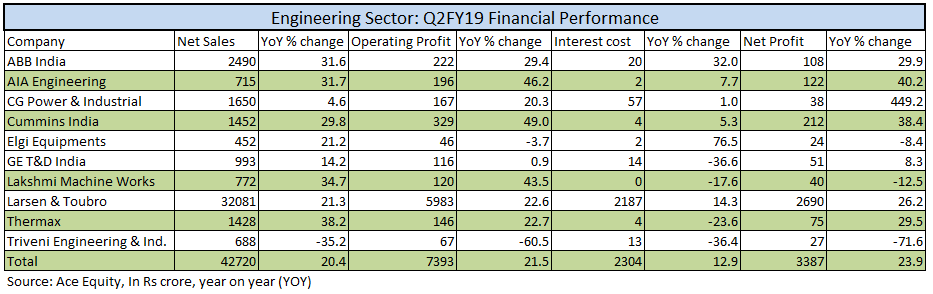

Despite apprehensions about a capex cycle recovery, the engineering sector as a whole has surprised investors delivering strong growth in the July-September quarter. On an aggregate basis, 10 companies that we have covered in this study have delivered 20 percent revenue growth as they benefitted from improved execution.

Projects, which were moving slowly and getting postponed, have seen an uptick because of the government’s emphasis on delivering or completing some of these milestone projects ahead of next year’s general elections.

However, the recovery was quite selective and was confined to sectors such as power transmission and distribution (T&D), railways, defence, road construction and certain consumer facing industries such as food processing that have seen a pick up in capex.

Despite the cost pressures, companies have been able to gain pricing power and benefitted because of scale economies. This is also reflected in their operating performance.

Companies have delivered a 21.5 percent growth in operating profits, with margins improving marginally to 17.31 percent. It is worth noting that this time around most companies have had a tighter control over interest costs and because of that they have been able to reduce interest expenses. On an aggregate basis, interest cost grew a mere 13 percent as companies were able to manage their working capital efficiently.

On a strong ground

For engineering companies, the next half is going to be extremely important in terms of managing growth. Companies have highlighted liquidity issues (because of the liquidity and bad loan crisis in the NBFC and banking space, respectively) and absence of public and private capex prior to general elections next year.

Nevertheless, none of managements seem to be worried as strong order wins will continue to propel growth in the second half of the current fiscal.

Most companies have built strong balance sheet and restructured their portfolios in such a way that they are largely insulated from a slowdown in the larger market. This also reflects in the overall tone as companies have maintained their revenue and earnings guidance. In certain cases, the margin guidance has been increased.

While companies are cautiously optimistic, going by their first half performance, we expect most of them to deliver better-than-expectations, or guided, numbers.

Ready for the next waveThis is the best time to find opportunities in the engineering space, considering that valuations are low and earnings growth is at an inflection point.

Despite concerns, these companies have been delivering strong growth. Next year, once the elections are over and liquidity issues ease, they would have a larger market to address and thus growth would meaningfully pick up.

Among companies we like Larsen & Toubro (L&T), Thermax and Lakshmi Machine Works in this space. L&T recently bought back its shares and it has strong revenue and earnings visibility.

Thermax could be a great candidate for a recovery in private sector capex. Also, it should be a beneficiary of changes in emission norms of coal-based power plants.

In case of Lakshmi Machine Works, while the textile machinery business continues to do well, its machine tools and foundry segment catering to automotive, railways, defence and earth moving equipment are in high demand. The company recently announced buy-back of its shares.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!