Sachin Pal

Moneycontrol Research

Highlights:

- Gujarat Ambuja Exports is planning on expanding its maize processing capacity

- Focus on maize processing aiding margin and return ratios

- Operating profit nearly doubled during H1

- US-China trade war could be a potential business opportunity

- Attractive valued at nine times estimated FY19 earnings

-------------------------------------------------

Maize processing company Gujarat Ambuja Exports (GAEL) has been growing at a healthy clip in the recent past. In the last few years, the company has shifted its focus to manufacturing from trading of agro commodities and is now planning to further enhance its manufacturing capabilities by setting up a greenfield maize processing unit in West Bengal. The business appears to be on a strong footing considering the rise in domestic consumption, improving capital allocation and recent capacity expansion.

Healthy jump in H1 margin and return ratios

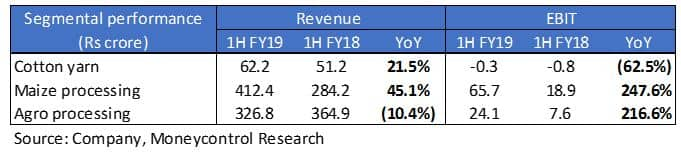

GAEL operates in three business segments - agro processing, maize processing and cotton yarn. The agro processing division consists of six solvent extraction plants having a combined crushing capacity of 4,500 tonne per day (TPD), which produces a range of products from de-oiled cakes to edible oil. The maize processing segment manufactures a range of products such as dextrose monohydrate, sorbitol, starch and liquid glucose, which find usage across textile, paper, pharma and FMCG sectors. The cotton yarn division engages in the spinning, knitting and weaving of cotton and mainly focuses on the export market.

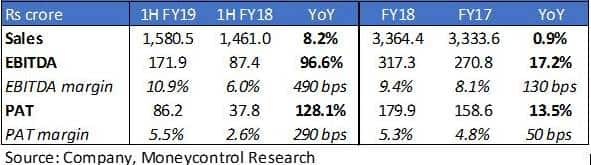

Result snapshot

In terms of financials, topline growth in H1 FY19 was fairly robust despite reduction in trading activity. Operating profit nearly doubled as margin expanded on the back of higher capacity utilisation and increased contribution from manufacturing capacities.

On a segmental basis, cotton yarn division continues to witness cyclicity and remains a drag on bottomline as well as return ratios. However, return ratios are on a rise on the back of improving capital allocation. Recent capex activity has majorly been directed towards the maize processing division, which generates mid-teen return ratios. The agro processing segment has also delivered return ratios in excess of 20 percent even at the current capacity utilisation of 30-35 percent.

Greenfield plant in West Bengal

In early 2018, the first phase of its 1,000 TPD maize processing plant at Chalisgaon (Maharashtra) started commercial operations. With this plant, GAEL has emerged as the largest maize processor in India with a total capacity of 3,000 TPD and a market share of 21-22 percent.

The Chalisgaon unit has seen a sharp ramp-up in capacity utilisation, which has moved higher to around 80 percent within 12 months of plant initiation. The second phase of expansion at Chalisgaon, Maharashtra is underway and is expected to come on-stream by Q4 FY19.

The company is planning to set-up a 1,000 TPD maize processing greenfield plant at Malda in West Bengal at an estimated cost of Rs 300 crore. The new plant will manufacture starch, liquid glucose and sorbitol and will cater to demand of eastern markets in India and other markets in Southeast Asia. The land acquisition has been complete but project execution will take 18-24 months.

Maize consumption on the rise

GAEL derives more than 60 percent of its profits from the maize processing division and the segment has benefited from rise in annual maize consumption in India, which has grown at a CAGR of 10-11 percent in the last five years. Maize consumption in India can broadly be divided into three categories: feed, food and industrial/non-food products (mainly starch). Maize is an important constituent for poultry and livestock feed and this segment alone accounts for 60 percent of the consumption and remains the key driver for market expansion. Food segment, which includes direct as well processed form, constitutes around 20 percent.

Like most agro commodities, maize production in India is heavily reliant on the southwest monsoon as more than three-fourth of the maize is produced in the kharif season, which spans June to October. Although the government has implemented various agriculture and irrigation schemes to safeguard the interest of farmers, the sector remains exposed to the vagaries of nature and poor monsoon rainfall can affect the yield, production and prices of the agricultural crops as well as operational metrics of GAEL.

Trade war could turn beneficial for exporters

The US and China are the first and second largest producers and consumers of maize. The ongoing trade tensions between the US and China could realign global trade activity and throw up interesting export opportunities for Indian companies in the agro commodities space. Also, there exists a significant scope for maize exports from India as it currently constitutes a small portion of around 6-7 percent of overall Indian production.

Trading at attractive valuationsWe remain optimistic on the long term prospects of GAEL as execution has picked up strongly in the past 12 months. While the business has been performing well, valuations seem equally attractive at current levels (9 times FY19 estimated earnings) considering the long headroom for growth and earnings visibility.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!