Anubhav SahuMoneycontrol research

Godrej Consumer Products reported a comparable constant currency growth of 8 percent aided by 10 percent international business growth and 6 percent domestic growth. Indian business performance was disappointing in terms of volume with growth at one percent on a base of 18 percent. The two-year compounded annual growth rate (CAGR) in volumes is 10 percent. In terms of segments, soaps grew 2 percent year-on-year (YoY) and hair colours stayed flat on a high base of 24 percent and 33 percent, respectively.

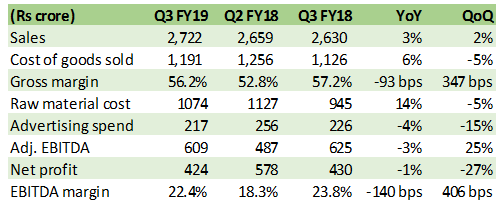

Chart: Q3 financials

Source: Company

Household Insecticides continued to see a stagnant performance with two-year CAGR of mere 3 percent. The company noted flat growth mainly driven by an unfavourable season in South India. However, this is strikingly in contrast to growth seen by Jyothi labs in this segment in Q3 (12 percent YoY). Further, the company highlighted the share of growth is also getting diverted to incense sticks which is a new subsegment initiated by Jyothi labs recently. Godrej Consumer, however, has launched naturals neem incense stick in Andhra Pradesh and Telangana

India business EBITDA margin expansion of 140 basis points (bps) YoY was aided by cost-saving initiatives.

In the case of international business, comparable growth was decent but margins (adjusted EBITDA erosion 300 bps YoY) was disappointing. Margins were weighed by both crude oil and currency depreciation. Overall, comparable constant currency EBITDA growth of 2 percent YoY was weaker than the FMCG peers.

As far as the stock is concerned, it has consolidated by 9 percent from its recent highs broadly in line with its peers. Currently, it trades at 36 times FY20 estimated earnings or about 8-10 percent discount to the likes of Marico and Dabur. We believe an FMCG stock with relatively high exposure to international markets (50 percent of sales) and with growth visibility and earnings stability lower than the Indian domestic market warrants a lower multiple.

(Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!