The market continued its upward journey for the sixth consecutive day on October 18 with the Nifty closing above 11,650 and the Sensex ending comfortably above the 39,000 mark.

Market breadth was in favour of advances as 1,567 shares advanced, 934 shares declined, while 178 shares remained unchanged.

Midcap and smallcap indices outperformed the frontliners by more than 1.5 percent each.

We may see some consolidation in Nifty after the recent surge and stock-specific movement shall continue. In the absence of any major event, global cues and earnings will continue to dictate the market trend, said Ajit Mishra Vice President, Research, Religare Broking.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for the Nifty is placed at 11,581.77, followed by 11,501.73. If the index starts moving up, key resistance levels to watch out for are 11,713.27 and 11,764.73.

Nifty Bank

Nifty Bank closed with a gain of 130.8 points at 29,120.25 on October 18. The important pivot level, which will act as crucial support for the index, is placed at 28,906.36, followed by 28,692.53. On the upside, key resistance levels are placed at 29,291.76 and 29,463.33.

Call options data

Maximum call open interest (OI) of 19.29 lakh contracts was seen at 11,700 strike price. It will act as a crucial resistance level in the October series.

This is followed by 12,000 strike price, which holds 18.70 lakh contracts in open interest; and 11,500, which has accumulated 16.75 lakh contracts in open interest.

Minor call writing was seen at the 11,900 strike price, which added 2.01 lakh contracts, followed by 12,300 strike that added 1.21 lakh contracts.

Call unwinding was seen at the 12,000 strike price, which shed 3.19 lakh contracts, followed by 11,500 strike which shed 1.73 lakh contracts and 11,400 which shed 1.30 lakh contracts.

Put options data

Maximum put OI of 29.09 lakh contracts was seen at 11,000 strike price, which will act as crucial support in October series.

This is followed by 11,400 strike price, which holds 21.55 lakh contracts in open interest; and 11,500 strike price, which has accumulated 20.35 lakh contracts in OI.

Put writing was seen at the 11,500 strike price, which added 5.31 lakh contracts, followed by 11,600 strike price, which added 4.96 lakh contracts and 11,700 which added 1.74 lakh contracts.

Put unwinding was seen at 11,000 strike price, which shed 1.46 lakh contracts, followed by 11,200 strike that shed 1.31 lakh contracts and 11,400 that shed 72,600 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

49 stocks saw long buildup

68 stocks witnessed short-covering

As per available data, 68 stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering. Based on the lowest open interest (OI) future percentage point, here are the top 10 stocks in which short-covering was seen.

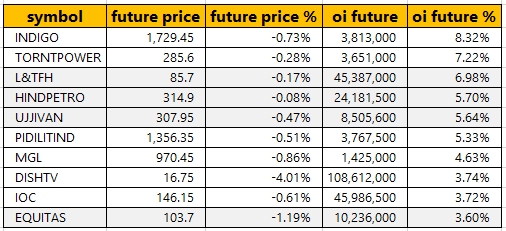

20 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

14 stocks saw long unwinding

Based on the lowest open interest (OI) future percentage point, here are the top 10 stocks in which long unwinding was seen.

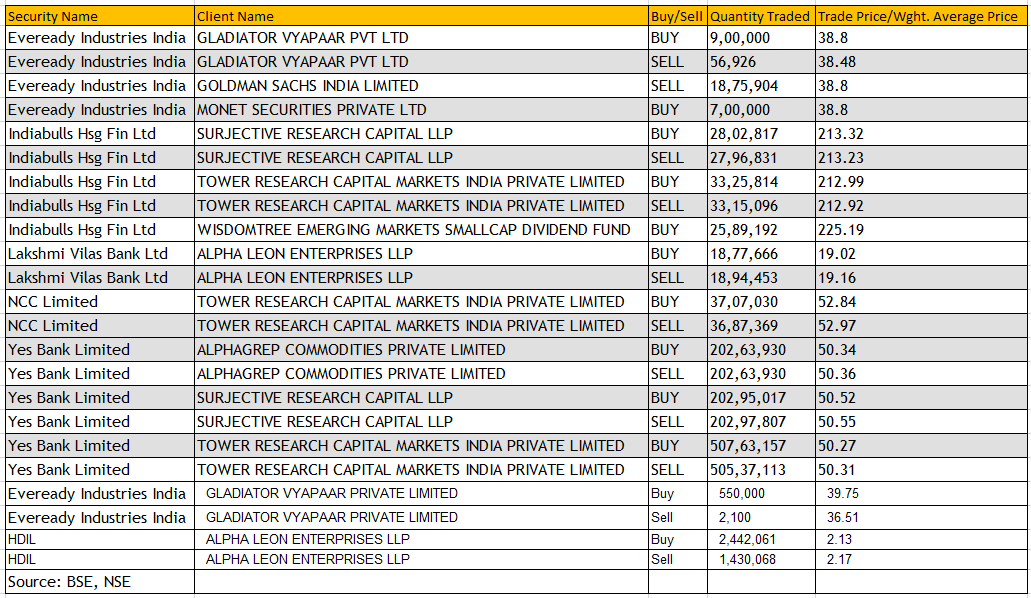

Bulk Deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

JK Cement - board meeting on November 9 to consider and approve the financial results for the period ended September 30, 2019

Sumeet Industries - board meeting on November 12 to consider and approve the financial results for the period ended September 30, 2019

JBM Auto - board meeting on October 31 to consider and approve the financial results for the period ended September 30, 2019

Zydus Wellness - board meeting on November 13 to consider and approve the financial results for the period ended September 30, 2019

Stocks in news

Results on October 22: Axis Bank, RBL Bank, Asian Paints, Bajaj Finserv, Bajaj Finance, Ceat, CCL Products, Granules, Elecon Engineering, ICICI Prudential Life Insurance, Hatsun Agro, Jubilant Foodworks, Jyothy Labs, Kotak Mahindra Bank, Bank of Maharashtra, M&M Financial, OBC, Rallies India, Welspun Corp

Reliance Industries Q2: Net profit up 11.5% at Rs 11,262 crore versus Rs 10,104 crore, revenue down 5.4% at Rs 1.48 lakh crore versus Rs 1.57 lakh crore, QoQ

Ambuja Cements Q3: Standalone net profit up 31.3 percent at Rs 234.6 crore versus Rs 178.6 crore, revenue at Rs 2,626.1 crore against Rs 2,613.9 crore, YoY

L&T Technologies Q2: Consolidated net profit at Rs 205.8 crore versus Rs 204 crore, rupee revenue up 4.1% at Rs 1,402.1 crore versus Rs 1,347.5 crore, QoQ

ICICI Lombard Q2: Net profit up 5% at Rs 307.9 crore against Rs 293.1 crore and total income up 6.5% at Rs 2,738.9 crore versus Rs 2,571.7 crore, YoY

Shree Cement Q2: Net profit at Rs 310.6 crore versus Rs 60.2 crore, revenue up 5.2% at Rs 3,004.4 crore versus Rs 2,885.4 crore, YoY

Tata Motors to consider raising funds by way of issue of one or more instruments on October 25

Punjab National Bank- Brickwork Ratings reaffirms the ratings of 'BWR AA+' for Innovative Perpetual Debt Instrument amounting to Rs 200 crore

ICICI Lombard General Insurance Company declares interim dividend of Rs 3.5 per equity share

Indiabulls Housing Finance - CARE Ratings has reaffirmed long-term rating at “CARE AA+” and perpetual debt at “CARE AA”. The short-term rating has been reaffirmed at “CARE A1+”.

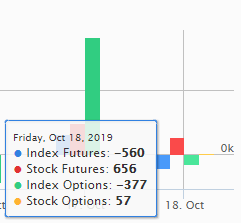

FII & DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 36.56 crore, while domestic institutional investors (DIIs) bought shares of worth Rs 586.88 crore in the Indian equity market on October 18, as per provisional data available on the NSE.

Fund Flow

No stock under ban period on NSE

For October 22, no stock is under F&O ban.

In the F&O segment, companies in which the security has crossed 95 percent of the market-wide position limit are put under a ban for a certain period.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!