The market saw some consolidation after a day of sharp uptrend and closed the session on a positive note on June 14, ahead of the interest rate decision by the Federal Reserve tonight. Most experts expect the Fed to maintain the status quo.

The benchmark indices continued their upward journey for the third consecutive session. The BSE Sensex rose 85 points to 63,229, while the Nifty50 climbed 40 points to 18,756 and formed a Doji sort of candlestick pattern on the daily charts as the closing was near its opening levels.

"Currently, the market is placed at the hurdle of 18,800 levels and is showing lack of strength to witness any decisive upside breakout of the same," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

The positive chart pattern of higher highs and lows is intact as per the daily timeframe chart. Further upmove above 18,778 levels with a lack of strength could possibly result in another higher top formation for the short term and that could bring the next round of short-term weakness for the market, Nagaraj said.

However, a decisive move above 18,800-18,900 levels could open further upside into all-time highs, while immediate support is placed at 18,625, he added.

The broader markets also continued the upward trend with the Nifty Midcap 100 and Smallcap 100 indices closing with moderate gains.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support, resistance levels on Nifty

According to the pivot point calculator, the Nifty may find support at 18,708, followed by 18,689 and 18,659. If the index advances, then 18,769 will be the key resistance, followed by 18,788 and 18,818.

The Bank Nifty has seen underperformance compared to benchmarks and broader markets, falling 92 points to 43,988 and forming a bearish candlestick pattern on the daily scale but with higher top, higher bottom formation.

The index closed below its opening levels but is holding above its crucial support of 20 DEMA. "It has got stuck in the range of 300 points from past few sessions and requires a decisive close above 44,044 levels for any major momentum," Chandan Taparia, Senior Vice President, Analyst-Derivatives at Motilal Oswal Financial Services said.

"The decisive close above the 44,044 level can take the index towards 44,250, then 44,500 levels, whereas on the downside support is expected at 43,900, and then 43,750 levels," he added.

As per the pivot point calculator, the Bank Nifty is expected to find support at 43,954, followed by 43,894 and 43,796, while the resistance is likely to be at 44,150, then 44,211 and 44,308.

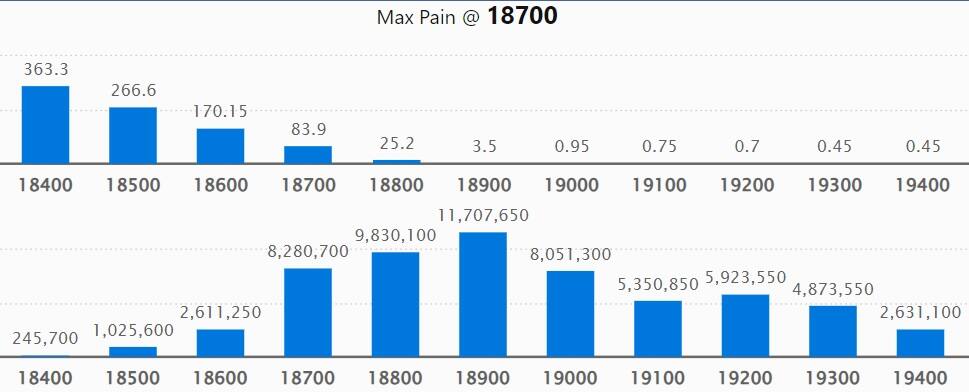

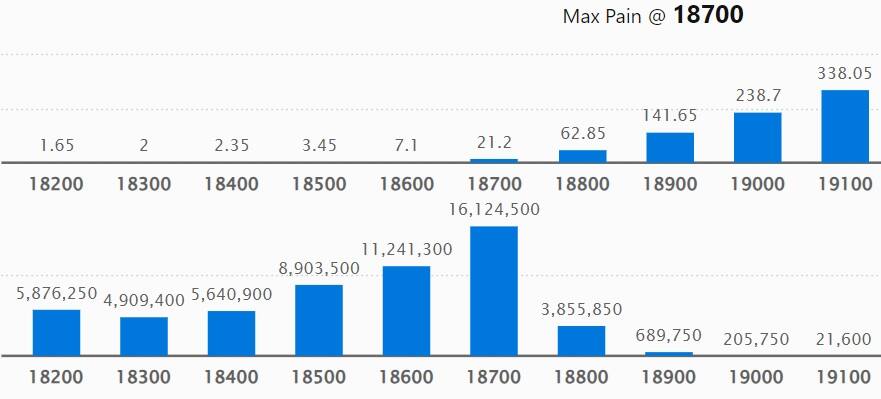

On the weekly options front, the maximum Call open interest (OI) was seen at 18,900 strike, with 1.17 crore contracts, which is expected to be a crucial resistance level for the Nifty.

This was followed by 98.3 lakh contracts at 18,800 strike, while 18,700 strike has 82.80 lakh contracts.

Maximum Call writing was seen at 18,900 strike, which added 13.84 lakh contracts, followed by 19,200 and 18,800 strike, which added 10.9 lakh and 9.53 lakh contracts, respectively.

Maximum Call unwinding was at 18,600 strike, which shed 15.97 lakh contracts, followed by 19,400 and 18,700 strikes, which shed 9.1 lakh and 6.48 lakh contracts, respectively.

On the Put side, we have seen the maximum open interest at 18,700 strike, with 1.61 crore contracts, which is expected to be an immediate support level for the Nifty50 in the coming sessions.

This was followed by the 18,600 strike, comprising 1.12 crore contracts, and the 18,500 strike, which has 89.03 lakh contracts.

Put writing was seen at 18,700 strike, which added 53.47 lakh contracts, followed by 18,200 and 18,800 strike, which added 21.82 lakh and 15.01 lakh contracts, respectively.

Put unwinding was seen at 18,000 strike, which shed 8.51 lakh contracts, followed by 17,900 and 18,100 strikes, which shed 6.54 lakh and 5.79 lakh contracts, respectively.

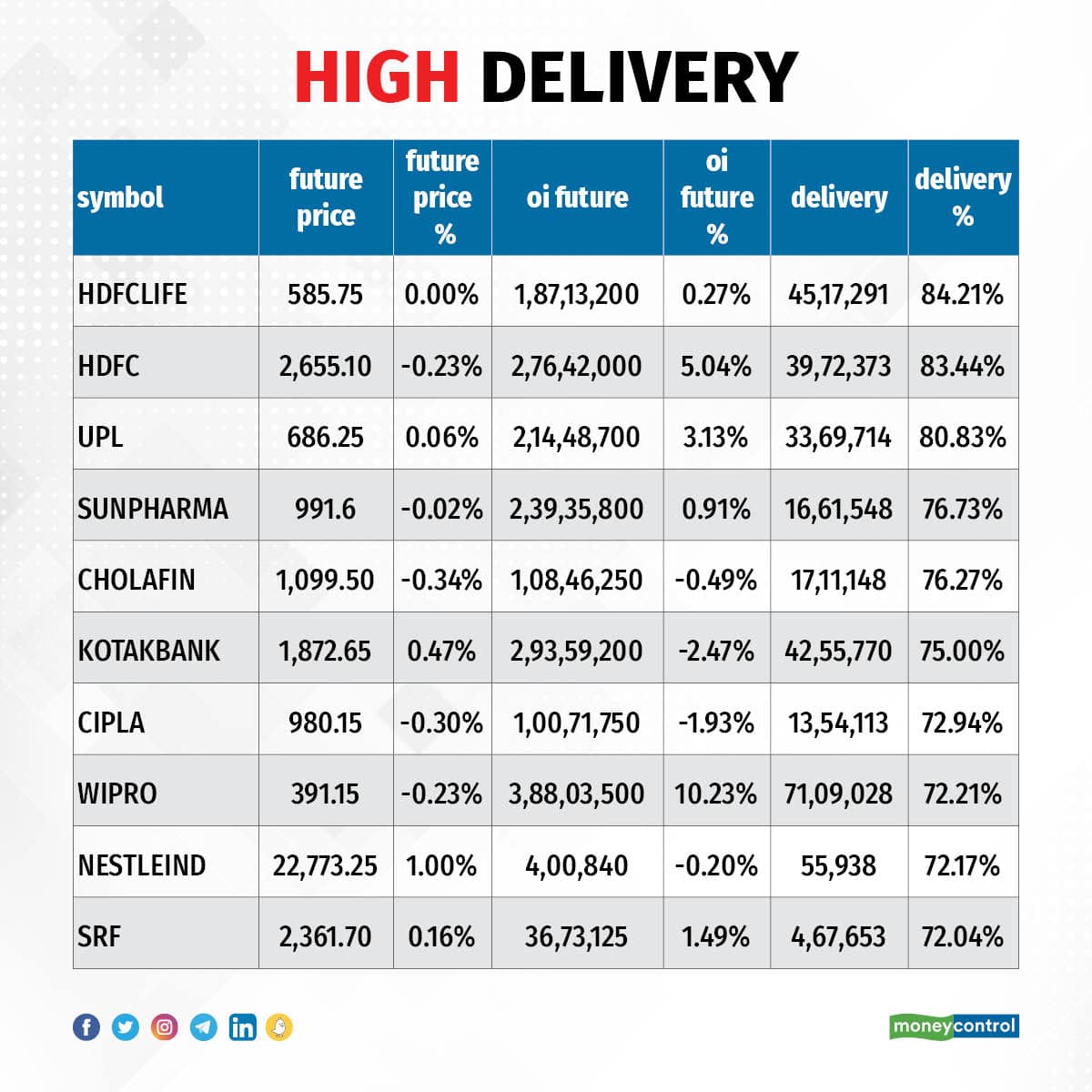

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in HDFC Life Insurance Company, HDFC, UPL, Sun Pharmaceutical Industries, and Cholamandalam Investment & Finance among others.

An increase in open interest (OI) and price indicates a build-up of long positions. Based on the OI percentage, 58 stocks, including Oracle Financial, Tata Consumer Products, Atul, GNFC, and Tata Communications, saw a long build-up.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 41 stocks, including Ipca Laboratories, BHEL, Aurobindo Pharma, Laurus Labs, and Manappuram Finance saw a long unwinding.

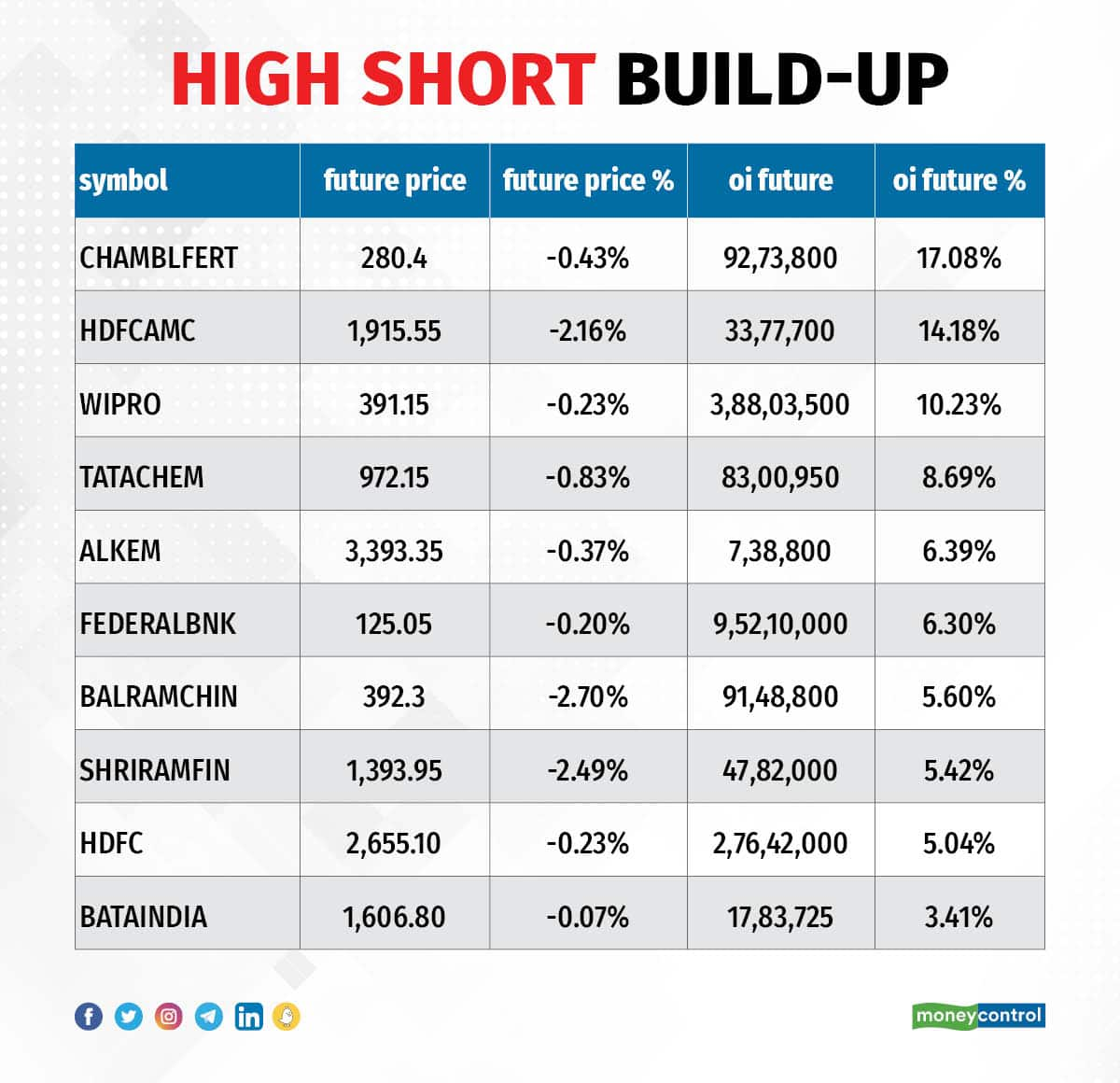

39 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 39 stocks including Chambal Fertilisers, HDFC AMC, Wipro, Tata Chemicals and Alkem Laboratories saw a short build-up.

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 51 stocks were on the short-covering list. These included Petronet LNG, Deepak Nitrite, Coforge, Hindustan Petroleum Corporation and Can Fin Homes.

(For more bulk deals, click here)

Investors Meetings on June 15

Stocks in the news

Axis Bank: Global private investment firm Bain Capital is likely to sell a stake up to $267 million in the private sector lender, reports CNBC-TV18, quoting sources. The stake sale is likely to take place in the offer price range of Rs 964-977.70 per share.

KFin Technologies: The registrar and transfer agency has reconsidered its decision to become the depository participant with National Securities Depository. And it has withdrawn the application to become a depository participant. KFin had filed an application to become a depository participant with NSDL on October 17, 2022.

HCL Technologies: The IT services company and Google Cloud expanded their strategic partnership to help enterprises leverage generative artificial intelligence (AI) and develop joint solutions powered by Google Cloud’s generative AI technologies. HCL Tech’s AI platforms and solutions will utilise Google Cloud's full suite of enterprise generative AI products and services.

Tega Industries: The National Company Law Tribunal (NCLT) has given its approval for the Composite Scheme of Arrangement between Nihal Fiscal Services (NFSPL), promoter of Tega Industries, Marudhar Food & Credit (MFCL) and MM Group Holdings, which all are part of the promoter group of the company. With this approval, MFCL will merge into NFSPL, and the entire shareholding of MFCL (1.96 percent equity) in Tega will stand transferred to NFSPL, resulting in NFSPL holding a 57.05 percent stake in Tega.

Indian Overseas Bank: The public sector lender has decided to increase the base rate by 20 bps to 9.10 percent, from 8.90 percent earlier. The base rate hike will be effective from June 15.

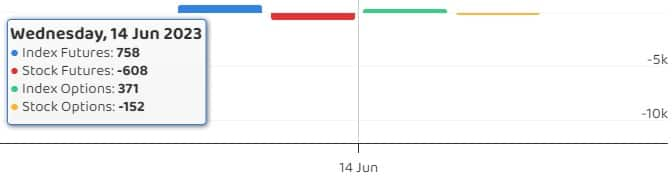

Fund Flow

FII and DII data

Foreign institutional investors (FII) purchased shares worth Rs 1,714.72 crore, whereas domestic institutional investors (DII) offloaded shares worth Rs 654.77 crore on June 14, provisional data from the National Stock Exchange shows.

Stocks under F&O ban on NSE

The National Stock Exchange has added Zee Entertainment Enterprises to its F&O ban list for June 15 and retained BHEL, Delta Corp, Indiabulls Housing Finance, Indian Energy Exchange, India Cements, and Manappuram Finance. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!