The market gained for the fourth consecutive session on October 30 with the Sensex climbing above 40,000 levels, driven by hopes of tax sops for equity markets. Short covering, improved auto sales growth during the festive season and good quarterly results also lifted sentiment.

The BSE Sensex rallied 220.03 points to 40,051.87 while the Nifty 50 rose 57.20 points to 11,844.10, but formed bearish candle which resembling a Hanging Man kind of pattern on daily charts as closing was lower than opening value.

Experts expect the uptrend to continue in coming sessions along with consolidation and feel the record high could be touched soon.

"We continue with our bullish stance on the Nifty and believe index is likely to test and hit new all-time highs. Any dip near the support zone should be a buying opportunity," Amit Shah, Technical Research Analyst with Indiabulls Ventures told Moneycontrol.

He said markets are much healthier than before as the participation is broader unlike the previous phase when Nifty had hit all-time highs.

The Nifty Midcap index was up 0.64 percent and Smallcap index gained 0.35 percent while among sectors, Nifty PSU Bank gained the most with 3.7 percent upside. FMCG and IT indices rose over a percent each.

Ajit Mishra Vice President- Research at Religare Broking believes the market trend in the near term will be driven by corporate earnings and thus stock-specific volatility may remain high.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for the Nifty is placed at 11,791.07, followed by 11,738.03. If the index starts moving up, key resistance levels to watch out for are 11,890.57 and 11,937.03.

Nifty Bank

Nifty Bank gained 114.45 points at 29,987.50 on October 30. The important pivot level, which will act as crucial support for the index, is placed at 29,776.63, followed by 29,565.77. On the upside, key resistance levels are placed at 30,174.73 and 30,361.97

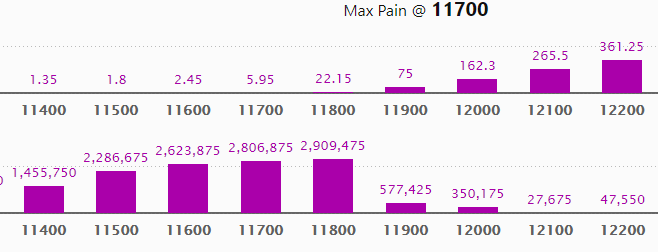

Call options data

Maximum call open interest (OI) of 32.76 lakh contracts was seen at 12,000 strike price. It will act as a crucial resistance level in the October series.

This is followed by 11,800 strike price, which holds 20.98 lakh contracts in open interest; and 11,900, which has accumulated 18.70 lakh contracts in open interest.

Call writing was seen at the 12,000 strike price, which added 2.66 lakh contracts, followed by 11,900 strike that added 1.61 lakh contracts.

Call unwinding was witnessed at 11,500 strike price, which shed 4.52 lakh contracts, followed by 11,800 which shed 4.29 lakh contracts and 11,700 which shed 3.89 lakh contracts.

Put options data

Maximum put OI of 29.09 lakh contracts was seen at 11,800 strike price, which will act as crucial support in October series.

This is followed by 11,700 strike price, which holds 28.06 lakh contracts in open interest; and 11,600 strike price, which has accumulated 26.23 lakh contracts in OI.

Put writing was seen at the 11,800 strike price, which added 14.04 lakh contracts, followed by 11,900 strike price, which added 3.63 lakh contracts.

No major Put unwinding seen.

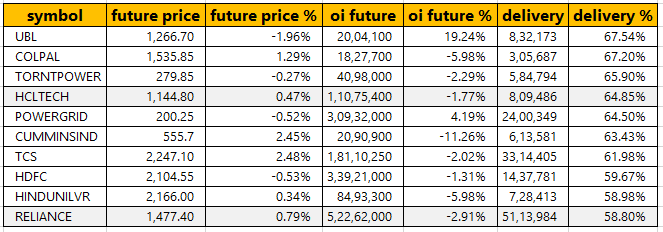

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

19 stocks saw long buildup

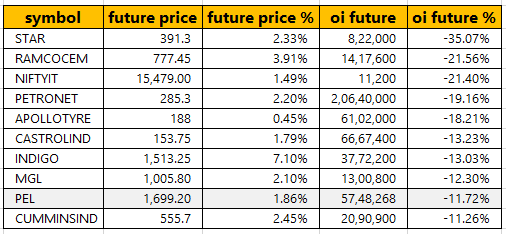

63 stocks witnessed short-covering

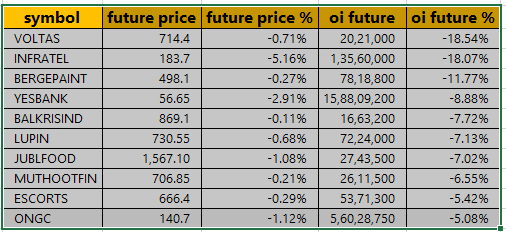

As per available data, 63 stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering. Based on the lowest open interest (OI) future percentage point, here are the top 10 stocks in which short-covering was seen.

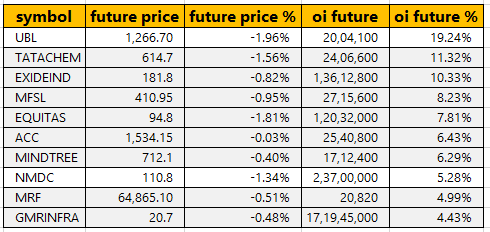

22 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

45 stocks saw long unwinding

Based on the lowest open interest (OI) future percentage point, here are the top 10 stocks in which long unwinding was seen.

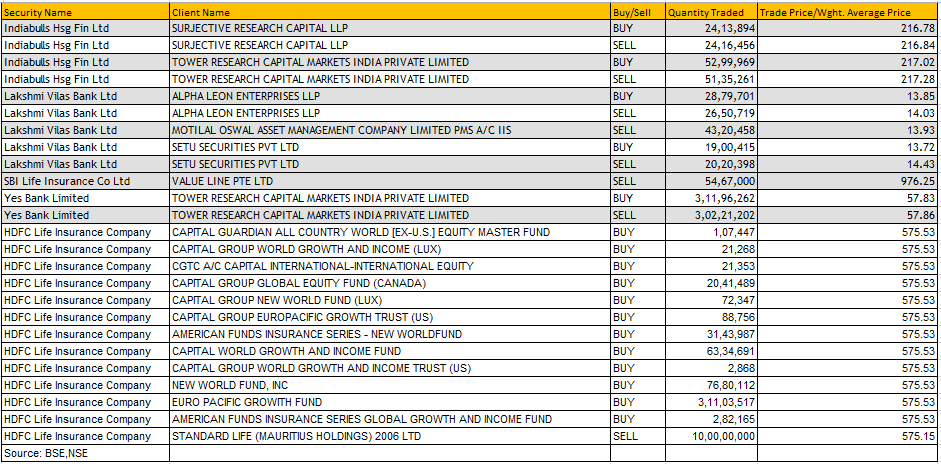

Bulk Deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

UCO Bank - board meeting on November 7 to consider and approve the financial results for the period ended September 30, 2019

BGR Energy - board meeting on November 12 to consider and approve the financial results for the period ended September 30, 2019

Apollo Tyres - board meeting on November 5 to consider and approve the financial results for the period ended September 30, 2019

MRF - board meeting on November 8 to consider and approve the Standalone and Consolidated Unaudited Financial Results of the company for the quarter and half year ended 30th September, 2019, interim dividend, if any and issue of non-convertible debentures.

Siti Networks - board meeting on November 6 to consider and approve the financial results for the period ended September 30, 2019

Stocks in news

Results on October 31: IOC, Dhanlaxmi Bank, Blue Dart Express, IOC, Jindal SAW, Laurus Labs, Ramco Industries, Syndicate Bank, Vaibhav GlobalBharti Airtel: Fitch placed Bharti Airtel on Rating Watch Negative on Supreme Court ruling.

RPG Life Sciences: Q2 Profit jumps to Rs 9.8 crore against Rs 2.2 crore, revenue increases 8.8 percent to Rs 98.5 crore versus Rs 90.5 crore YoY.

Sonata Software: Q2 Profit rises 7.8 percent to Rs 72.2 crore versus Rs 67 crore, revenue dips 19.6 percent to Rs 703.1 crore versus Rs 874.6 crore QoQ.

Ramco Industries: Q2 Profit jumps 39.8 percent to Rs 50.6 crore versus Rs 36.2 crore, revenue declines 2.7 percent to Rs 220.6 crore versus Rs 226.8 crore YoY.

Balaji Amines: Q2 profit rises 1.5 percent to Rs 31.43 crore versus Rs 30.98 crore, revenue increases 5 percent to Rs 227.25 crore versus Rs 216.34 crore YoY.

TVS Motor: Company partnered with Cadisa in Guatemala, El Salvador to open flagship TVS outlets.

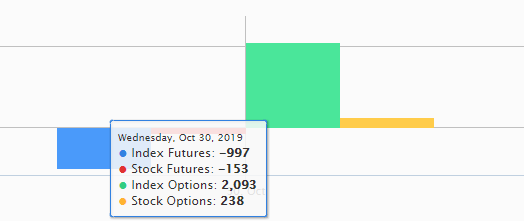

FII & DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 7,192.42 crore, while domestic institutional investors (DIIs) sold shares of worth Rs 185.87 crore in the Indian equity market on October 30, as per provisional data available on the NSE.

Fund Flow

No stock under ban period on NSE

For October 31, no stock is under F&O ban.

In the F&O segment, companies in which the security has crossed 95 percent of the market-wide position limit are put under a ban for a certain period.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!