The market continued its run for the fifth consecutive session on October 31. The Sensex hit a fresh record high of 40,392.22 intraday but closed off the day's high due to selling pressure in the last hour trade.

The BSE Sensex gained 77.18 points at 40,129.05 while the Nifty 50 rose 33.40 points to 11,877.50, forming a bearish candle resembling a Doji kind of pattern on daily charts. The lower closing than the opening tick hinted indecision in the market. The index gained 2.6 percent in the October series.

No major negative surprise in second-quarter earnings and easing down the global trade tension boosted traders' sentiments.

"Normally, a formation of such pattern after a reasonable up move or near the key overhead resistance could be indicative of tiredness in the market, hence profit booking is likely from the highs. Still, there is no indication of any important trend reversal pattern at the highs," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

He said a decisive weakness below 11,800 levels is likely to open some more downward correction in the market ahead.

The broader markets outperformed frontliners with the Nifty Midcap index rising 1.44 percent amid positive breadth. About three shares advanced for every two shares falling on the NSE.

The net cash flow of foreign institutional investors turned positive for October after five consecutive months. They have also increased their long position in index future by almost 40 percent during the month while the short position remains flat.

"Government has already indicated a cut in personal income tax, and the market is not going to give up until this hope persists. In absence of any major negative surprise, we may see Nifty crossing 12,000 level in the coming month," Rahul Mishra, AVP (Derivatives), Emkay Global Financial Services said.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for the Nifty is placed at 11,840.07, followed by 11,802.63. If the index starts moving up, key resistance levels to watch out for are 11,929.97 and 11,982.43.

Nifty Bank

Nifty Bank gained 78.7 points at 30,066.2 on October 31. The important pivot level, which will act as crucial support for the index, is placed at 29,897.03, followed by 29,727.87. On the upside, key resistance levels are placed at 30,325.53 and 30,584.87.

Call options data

Maximum call open interest (OI) of 38.33 lakh contracts was seen at 12,000 strike price. It will act as a crucial resistance level in the November series.

This is followed by 11,900 strike price, which holds 26.34 lakh contracts in open interest; and 12,500, which has accumulated 13.38 lakh contracts in open interest.

Call writing was seen at the 11,900 strike price, which added 7.64 lakh contracts, followed by a 12,000 strike that added 5.56 lakh contracts.

Call unwinding was witnessed at 11,800 strike price, which shed 12.22 lakh contracts, followed by 11,700 which shed 6.64 lakh contracts and 11,600 which shed 4.19 lakh contracts.

Put options data

Maximum put OI of 36.49 lakh contracts was seen at 11,800 strike price, which will act as crucial support in November series.

This is followed by an 11,500 strike price, which holds 21.60 lakh contracts in open interest; and 11,700 strike price, which has accumulated 21 lakh contracts in OI.

Put writing was seen at the 11,800 strike price, which added 7.40 lakh contracts, followed by an 11,400 strike price, which added 87,750 contracts.

Put unwinding was seen at 11,700 strike price, which shed 7.06 contracts, followed by 11,600 strike that shed 5.62 lakh contracts and 11,300 that shed 2.08 lakh contracts.

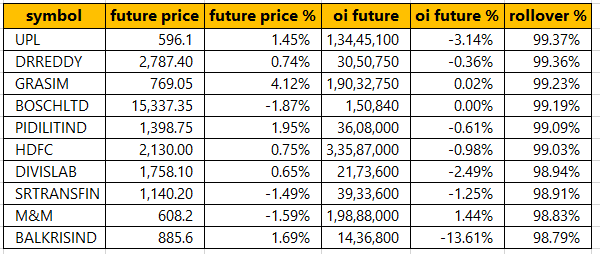

Rollovers

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

5 stocks saw long buildup

82 stocks witnessed short-covering

As per available data, 82 stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering. Based on the lowest open interest (OI) future percentage point, here are the top 10 stocks in which short-covering was seen.

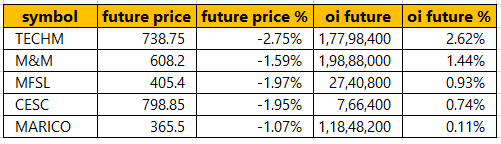

5 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the stocks in which short build-up was seen.

53 stocks saw long unwinding

Based on the lowest open interest (OI) future percentage point, here are the top 10 stocks in which long unwinding was seen.

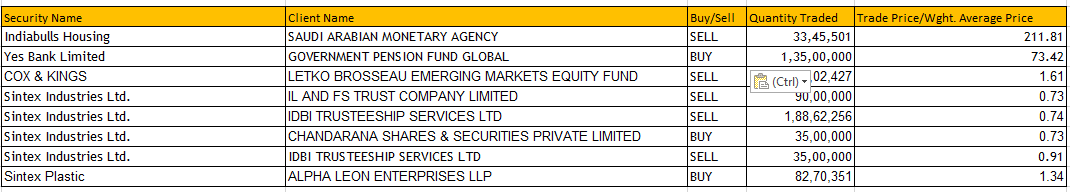

Bulk Deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

PNB Gilts - board meeting on November 6 to consider and approve the financial results for the quarter and half year ended September 30, 2019, and to consider the proposal for raising of funds by way of issuance of commercial paper

Apollo Tyres - board meeting on November 5 to consider Fund Raising

Allahabad Bank - board meeting on November 8 to consider and approve the financial results for the period ended September 30, 2019

Aurobindo Pharma - board meeting on November 12 to consider and approve the financial results for the period ended September 30, 2019, and dividend

SPML Infra - board meeting on November 12 to consider and approve the financial results for the period ended September 30, 2019

Shilpa Medicare - board meeting on November 9 to consider and approve the financial results for the period ended September 30, 2019

Stocks in news

Results on November 1: Yes Bank, Dr Reddy's Laboratories, Bank Of India, Central Bank Of India, JSW Energy, V-Mart Retail, JK Lakshmi Cement, GIC Housing Finance

Results on November 2: 8K Miles Software, BEML, Escorts, Gayatri Sugars, Mangalam Drugs, Relaxo Footwears, Trident, Ucal Fuel, Unichem Laboratories

Jindal Saw Q2: Net profit at Rs 301 crore versus Rs 97.18 crore, revenue down 9.4% at Rs 2,681.6 crore versus Rs 2,960.1 crore, YoY.

Ahluwalia Contracts gets new project worth of Rs 521.71 crore

HCL Technologies launches a dedicated Google Cloud Business Unit to accelerate enterprise cloud adoption

Aarti Drugs incorporates marketing subsidiary namely "Pinnacle Chile SpA" in Chile

Chennai Petroleum Corporation appoints Sobha Surendran as a non-executive independent director of the company w.e.f. October 31, 2019

PTC India appoints K. V. as an independent director of the company w.e.f. October 30, 2019.

TVS Motor and Bajaj Auto amicably settle a decade-old patent dispute

SICAL Logistics board approves KN Ramesh's appointment as MD

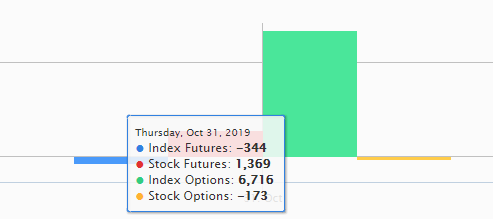

FII & DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,870.87 crore, while domestic institutional investors (DIIs) sold shares of worth Rs 650.73 crore in the Indian equity market on October 31, as per provisional data available on the NSE.

Fund Flow

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!