Top 10 Portfolio Management Schemes for the month of February 2025

Wave Asset – Bloom leads the list, followed by Aequitas Investment Consultancy - India Opportunities Product. All other listed strategies recorded negative performances.

1/11

Wave Asset Private Limited – Bloom leads the list with a 4.99% gain, standing out as the only strategy with significant positive returns. Aequitas Investment Consultancy Pvt Ltd - India Opportunities Product also managed a slight positive return of 0.48%, while all other listed strategies recorded negative performances.

2/11

Managed by Ashwin Agarwal, the strategy is centered on acquiring high-quality companies at reasonable valuations through tactical hedging and strategic allocation to foreign equities and gold. Therefore, ensuring diversification. It involves a combination of a top-down and bottom-up approach. Top-down analysis is for deciding tactical asset allocation as well as best sectors for investment while the bottom-up approach aids in finding securities that offer the best risk/return trade-off.

3/11

Under Siddhartha Bhaiya's 13 years of experience in equity research, the strategy focuses on simplicity, transparency, and ease of management. The strategy emphasises margin of safety by targeting undervalued opportunities with strong growth potential. A long-term, contrarian stance is maintained, with an average holding period exceeding five years and minimal portfolio churn, ensuring disciplined capital allocation.

4/11

The strategy, managed by Tej Shah, prioritises companies with a proven track record of disciplined capital allocation. A key focus is maintained on businesses with high barriers to entry, ensuring their ability to sustain returns above the cost of capital over the long term. The approach targets a concentrated portfolio of 10 to 14 high-quality financial institutions, including banks, NBFCs, insurers, asset managers, and brokers, ensuring sustainable returns above the cost of capital.

5/11

Managed by Rishabh Nahar, the investment strategy focuses on constructing a diversified ETF portfolio aimed at delivering risk-adjusted returns. The approach utilises quantitative insights to optimise asset allocation across low-correlated asset classes, ensuring stability and consistent performance across varying market conditions, with an objective to outperform the Nifty.

6/11

The strategy focuses on higher return with higher risk and manages equity-focused portfolio in the large caps and mid-caps. Priority remains adding stocks that have a track of outperforming or with the potential to outperform indices, along with opportunistic arbitrage and derivatives positions.

7/11

This strategy, managed by Pratik Karmakar, leverages data-driven models and machine learning to optimise investment decisions. It continuously refines its approach through back-testing to adapt to evolving market conditions. The strategy employs diversification and tactical shifts between investment models and asset classes, ensuring disciplined risk management.

8/11

Under Nilesh Shah’s management, the strategy focuses on identifying midcap and small-cap companies in their growth phase, with improving market share, sales, and profitability. The portfolio targets stocks not currently in the Nifty 50 or Nifty Next 50 but with the potential for inclusion.

9/11

This strategy prioritises investments in companies with productive assets, viewing shares as part-ownership in businesses with sustainable profitability. Investments are made only when there is a high level of confidence in achieving returns.

10/11

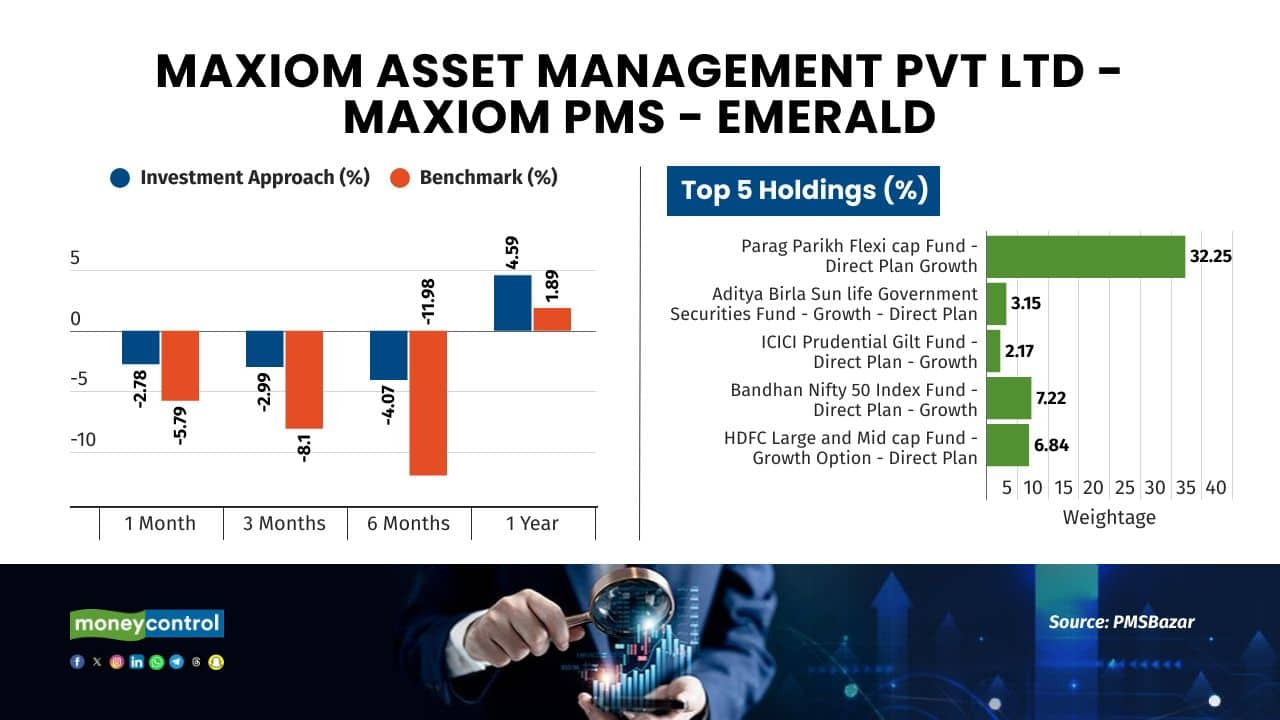

This strategy is based on selecting mutual funds based on diversification across asset classes and sectors. It incorporates credit score monitoring, proprietary fragility assessment, and peer performance ranking through quartile and rolling rank analysis. It uses a multi-asset approach of diversification through mutual funds across multiple asset classes, including equity, debt, and gold.

11/11

Managed by Rishabh Nahar, the strategy follows a momentum-based investment approach, prioritising stocks with strong upward trends while swiftly exiting those that underperform. It integrates advanced timing models and derivatives hedging to manage risk, optimise tax efficiency, and safeguard against market downturns, ensuring steady capital growth.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!