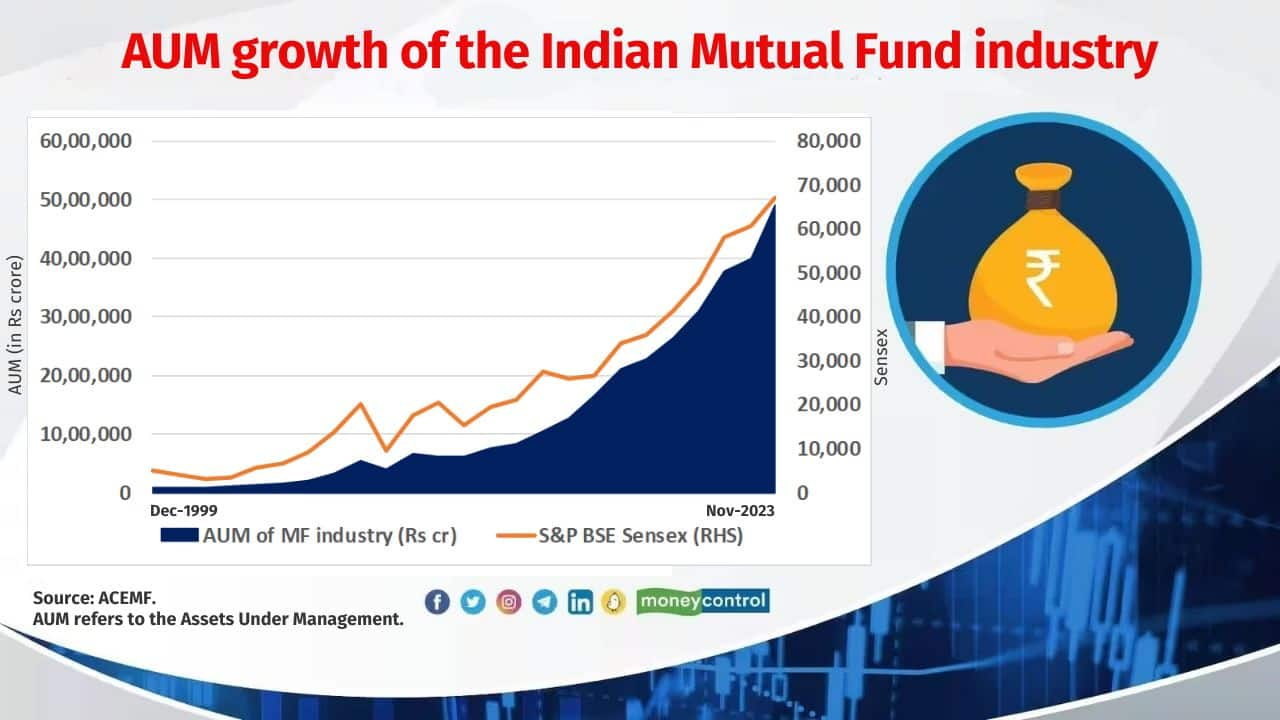

When equity markets climb to new highs, it poses different challenges to large-sized equity funds, depending on what their mandates are. The S&P BSE Sensex index crossed the 71,000-point mark for the first time on December 15. The equity mutual funds schemes with large asset sizes became larger not only by the capital appreciation but also due to the significant inflows.

Rising equity markets bring more inflows, especially from retail investors. Typically, the larger schemes get more inflows, as investors find comfort in track record. Hence, it’s interesting to check how the largest equity funds tweaked their strategy and adapted to rising markets. Moneycontrol considered 14 active equity schemes that have the asset size of more than Rs 30,000 crore for the study.

Here are the top newly added stocks of the larger asset-sized schemes in the last six months. Portfolio data as of November 2023. Source: ACEMF.

Also see: Opportunity in market correction: New midcap stocks that MFs added lately

HDFC Mid-Cap Opportunities Fund

Category: Mid cap fund

Fund manager(s): Chirag Setalvad

5 year return (CAGR): 22.9%

Parag Parikh Flexi Cap Fund

Category: Flexi Cap Fund

Fund manager(s): Rajeev Thakkar, Rukun Tarachandani, Raunak Onkar and Raj Mehta

5 year return (CAGR): 22.4%

ICICI Prudential Bluechip Fund

Category: Large Cap Fund

Fund manager(s): Anish Tawakley and Vaibhav Dusad

5 year return (CAGR): 16.8%

Also see: Small-cap stocks with innovative business models that mutual funds love to hold

HDFC Flexi Cap Fund

Category: Flexi Cap Fund

Fund manager(s): Roshi Jain

5 year return (CAGR): 19.2%

Kotak Flexicap Fund

Category: Flexi Cap Fund

Fund manager(s): Harsha Upadhyaya

5 year return (CAGR): 15.2%

Nippon India Small Cap Fund

Category: Small Cap Fund

Fund manager(s): Samir Rachh and Tejas Sheth

5 year return (CAGR): 28%

SBI BlueChip Fund

Category: Large Cap Fund

Fund manager(s): Sohini Andani

5 year return (CAGR): 15.8%

Also see: To get multibaggers, you have to buy into absolute stupidity: Siddhartha Bhaiya, MD, Aequitas PMS

Kotak Emerging Equity Fund

Category: Mid Cap Fund

Fund manager(s): Harsha Upadhyaya

5 year return (CAGR): 22%

Mirae Asset Large Cap Fund

Category: Large Cap Fund

Fund manager(s): Gaurav Misra and Gaurav Khandelwal

5 year return (CAGR):14.4 %

Also see: Powering small-cap funds: Stocks in top holding that drive performance

ICICI Pru Value Discovery Fund

Category: Value Fund

Fund manager(s): Sankaran Naren and Dharmesh Kakkad

5-year return (CAGR): 20.8%

Axis ELSS Tax Saver Fund

Category: ELSS

Fund manager(s): Shreyash Devalkar and Ashish Naik

5-year return (CAGR): 12.8%

Axis Bluechip Fund

Category: Large Cap Fund

Fund manager(s): Shreyash Devalkar, Ashish Naik and Vinayak Jayanath

5-year return (CAGR): 13.4%

Also see: Playing Safe: Large-Cap stocks that Mutual Funds have consistently added

SBI Focused Equity Fund

Category: Focused Fund

Fund manager(s): R. Srinivasan and Mohit Jain

5-year return (CAGR): 16.5%

Mirae Asset Large & Midcap Fund (Formerly, Mirae Asset Emerging Bluechip Fund)

Category: Large & Mid Cap

Fund manager(s): Neelesh Surana and Ankit Jain

5-year return (CAGR): 19.7%

Also see: Small-cap, Innovation, logistics: Hot stocks that recently launched NFOs invest in

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!