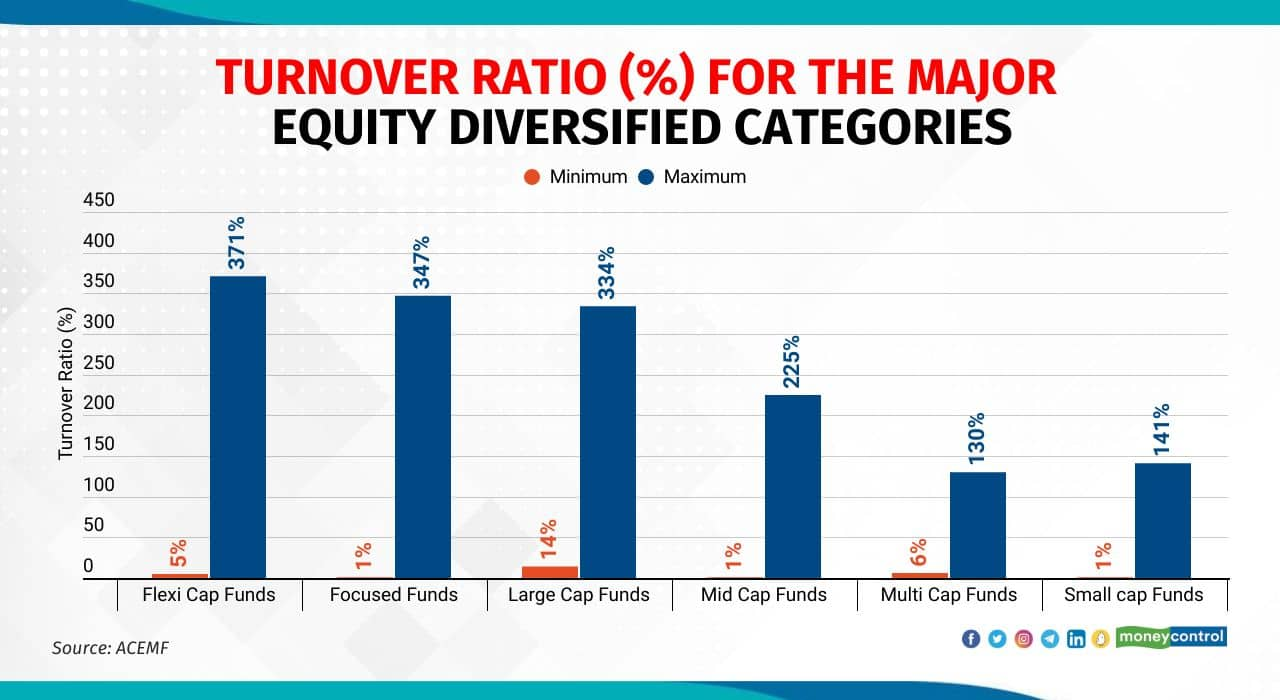

How frequently a fund manager churns his portfolio is measured by a scheme’s Turnover Ratio (TR). A higher TR implies more trading costs borne by the scheme, thereby increasing the expense ratio that, in turn, impacting the returns. But, a higher TR is not automatically bad. If the fund manager’s calls are mostly correct, a high TR is no impediment to good performance. On the other hand, a high TR could also mean that the fund manager trades frequently.

A lower portfolio turnover ratio is also an indication of the buy-and-hold strategy. A Moneycontrol Personal Finance compilation of TR (average of last 3 years) of major equity diversified categories has thrown up an interesting result. Of the top 10 schemes, six are from the smallcap category. Vinit Sambre, head of equities, DSP Mutual Fund explains that smallcaps in nature take a longer time to produce results hence smallcap fund managers prefer the buy-and-hold strategy. Secondly, the liquidity is low. So, the ability to churn is low for smallcap funds, he adds.

Here are the top ten equity diversified schemes with the lowest Turnover Ratio (average of last 3 years). Only major equity diversified categories such as midcap, smallcap, flexicap, multicap and focused funds are considered for the study. Source: ACEMF.

Top 10: Franklin India Smaller Cos Fund

Average Turnover Ratio (over the last 3 years): 17%

Category: Small Cap

Fund manager: R Janakiraman and Akhil Kalluri

Date of launch: 13-Jan-2006

5-year return (Point-to-point) (CAGR): 16%

Top 9: DSP Small Cap Fund

Average Turnover Ratio (over the last 3 years): 16%

Category: Small Cap

Fund manager: Vinit Sambre, Abhishek Ghosh and Resham Jain

Date of launch: 14-Jun-2007

5-year return (Point-to-point) (CAGR): 19%

Top 8: Axis Small Cap Fund

Average Turnover Ratio (over the last 3 years): 15%

Category: Small Cap

Fund manager: Shreyash Devalkar and Mayank Hyanki

Date of launch: 29-Nov-2013

5-year return (Point-to-point) (CAGR): 22%

Also see: MC30 scheme review: Why PGIM India Midcap Opportunities Fund is a long-term wealth creator

Top 7: HDFC Mid-Cap Opportunities Fund

Average Turnover Ratio (over the last 3 years): 14%

Category: Mid Cap

Fund manager: Chirag Setalvad

Date of launch: 25-Jun-2007

5-year return (Point-to-point) (CAGR): 17%

Top 6: Kotak Flexicap Fund

Average Turnover Ratio (over the last 3 years): 13%

Category: Flexicap

Fund manager: Harsha Upadhyaya

Date of launch: 11-Sep-2009

5-year return (Point-to-point) (CAGR): 11%

Top 5: Kotak Small Cap Fund

Average Turnover Ratio (over the last 3 years): 12%

Category: Small Cap

Fund manager: Pankaj Tibrewal

Date of launch: 24-Feb-2005

5-year return (Point-to-point) (CAGR): 21%

Also see: 10 most popular large-cap stocks among PMS to withstand volatility

Top 4: UTI Flexi Cap Fund

Average Turnover Ratio (over the last 3 years): 10%

Category: Flexicap

Fund manager: Ajay Tyagi

Date of launch: 18-May-1992

5-year return (Point-to-point) (CAGR): 11%

Top 3: HDFC Small Cap Fund

Average Turnover Ratio (over the last 3 years): 9%

Category: Small Cap

Fund manager: Chirag Setalvad

Date of launch: 03-Apr-2008

5-year return (Point-to-point) (CAGR): 18%

Top 2: Kotak Emerging Equity Fund

Average Turn Over Ratio (over the last 3 years): 8%

Category: Mid Cap

Fund manager: Pankaj Tibrewal

Date of launch: 30-Mar-2007

5-year return (Point-to-point) (CAGR): 17%

Top 1: UTI Small Cap Fund

Average Turn Over Ratio (over the last 3 years): 9%

Category: Small Cap Fund

Fund manager: Ankit Agarwal

Date of launch: 22-Dec-2020

5-year return (Point-to-point) (CAGR): NA

Read here: Hot small-cap pharma and healthcare stocks that MFs hold currently

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!