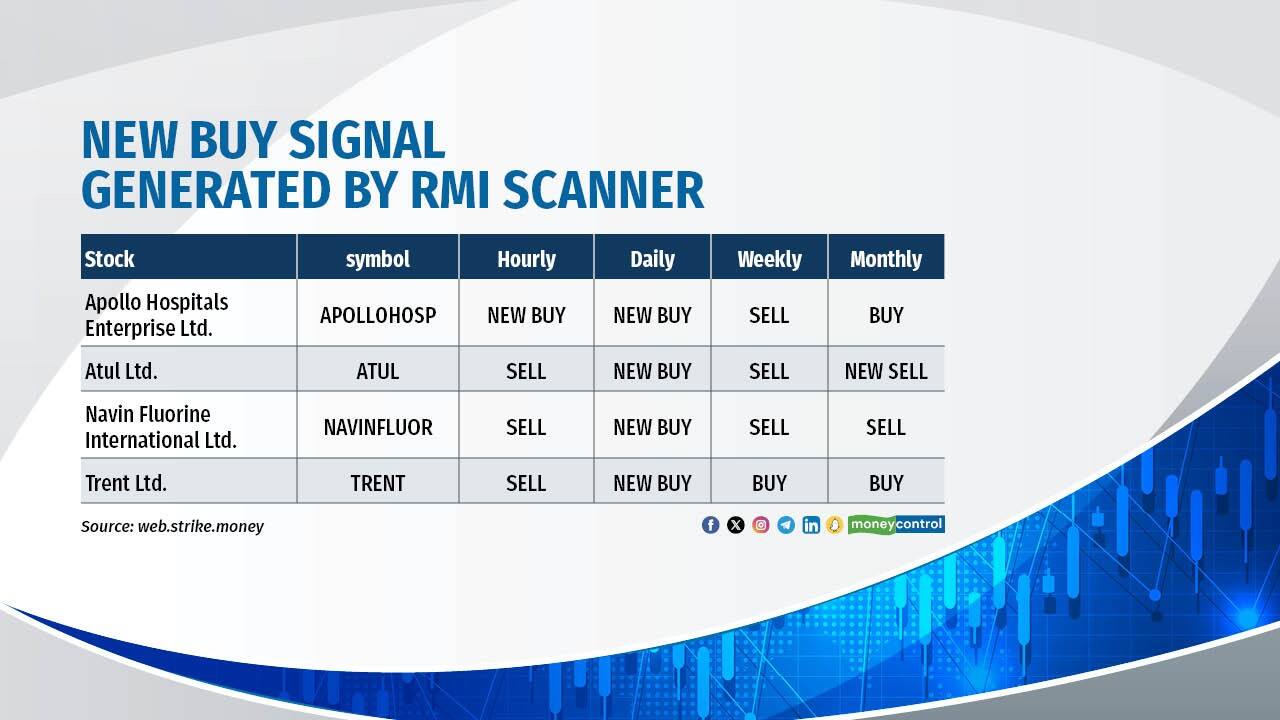

From the basket of F&O stocks, we find fresh aggressive new long positions were made in Bajaj Auto and Eicher Motors. We find some shares generating a "new buy" signal on the daily time frame, according to the RMI scanner. The Rohit Momentum Indicator (RMI) generates buy and sell signals. It is a non-range bound indicator.

Heavy buying was seen in these stocks in a weak market. As many as 1,188 stocks advanced, while 2,633 declined during the March 19 trading session. Ninety-five stocks made a fresh 52-week high, while 66 sank to a new 52-week low on BSE. Semiconductor sector probable beneficiaries stocks such as Linde India and CG Power traded at life highs or close to life highs.

Stocks that are making higher highs and higher lows in a weak market reflect relative strength. According to the Dow Trend Scanner on daily time frame, these stocks have shown trend reversal by making higher highs and higher lows.

The Nifty Smallcap 100 index slipped more than a percent on March 19. Only nine out of 100 Nifty Smallcap 100 index constituents traded above their 20-day simple moving average (SMA). At the beginning of the year, at least 80 of the 100 index constituents were above their 20-day SMA.

BSE 500 slipped by more than 364 points, or 1.16 percent, on March 19. TCS and Infosys put together contributed to 18 percent of the BSE 500 index fall. Amber featured among the top BSE 500 losers, while India Bulls Real Estate was the top loser of the smallcap index. Weakness was seen in IT, pharma, media and FMCG stocks. Financial Services and banks showed relative strength by falling the least among the sectoral indices. All sectoral indices ended in red.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!