PhysicsWallah shares will be listed on the stock exchanges on November 18, with analysts advising investors to take a long-term view while considering partial profit-booking.

The Edtech firm's Rs 3,480-crore initial public offering (IPO) was subscribed nearly two times during the November 11–13 issue period.

Narendra Solanki, Head of Fundamental Research – Investment Services at Anand Rathi Shares and Stock Brokers, said the company is valued at 10.8 times FY25 price-to-sales at the upper end of the price band, implying a post-issue market capitalisation of about Rs 3,117 crore. He said the company aims to expand its student base by offering free content across platforms and converting users into paying customers through improved technology, targeted marketing and expert-led content.

He aded, the company also plans to widen its course portfolio and launch new categories in multiple Indian languages. "Investors with a long-term view may continue to hold the stock, while others could consider partial profit-booking and retain the remaining position for the long term," he said.

Bhavik Joshi, Business Head at INVasset PMS, said revenue rose from Rs 772 crore in FY23 to more than Rs 3,000 crore in FY25, indicating strong growth momentum. However, he noted that cumulative losses of over Rs 1,400 crore during FY23–FY25 reflect continued pressure on profitability.

Joshi said the valuation and loss profile make the IPO a long-term execution play. While funds from the issue will be deployed toward offline expansion, technology and marketing, he said the timeline for operational improvement will be crucial.

He added that investors with higher risk appetite and a long-term horizon may consider limited participation, while conservative investors may prefer to wait until the company demonstrates consistent profitability.

PhysicsWallah IPO GMP Today Price

Market observers tracking grey market trends said PhysicsWallah shares are quoting a premium of about 7 percent in the unofficial market. Investorgain pegged the grey market premium (GMP) at Rs 7.8 per share, implying a listing gain of around 7.16 percent. IPO Watch also indicated a 7 percent GMP.

PhysicsWallah, Emmvee Photovoltaic IPO shares to list tomorrow; here's what latest GMP suggests

Shravan Shetty, Managing Director at Primus Partners, said the company has scale potential but faces strong competition from players like Unacademy and Byju’s. He added that the valuation remains stretched and sustained growth will depend on execution capabilities and the company’s ability to retain top educational talent.

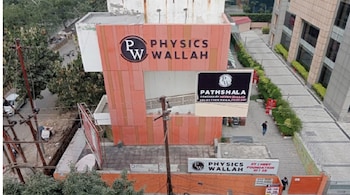

PhysicsWallah, founded by Alakh Pandey and Prateek Boob, is headquartered in Noida and offers online and offline courses for school students and competitive exam aspirants. The platform, which began as a YouTube channel, has expanded to several digital offerings and a growing network of offline centres across major cities.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!