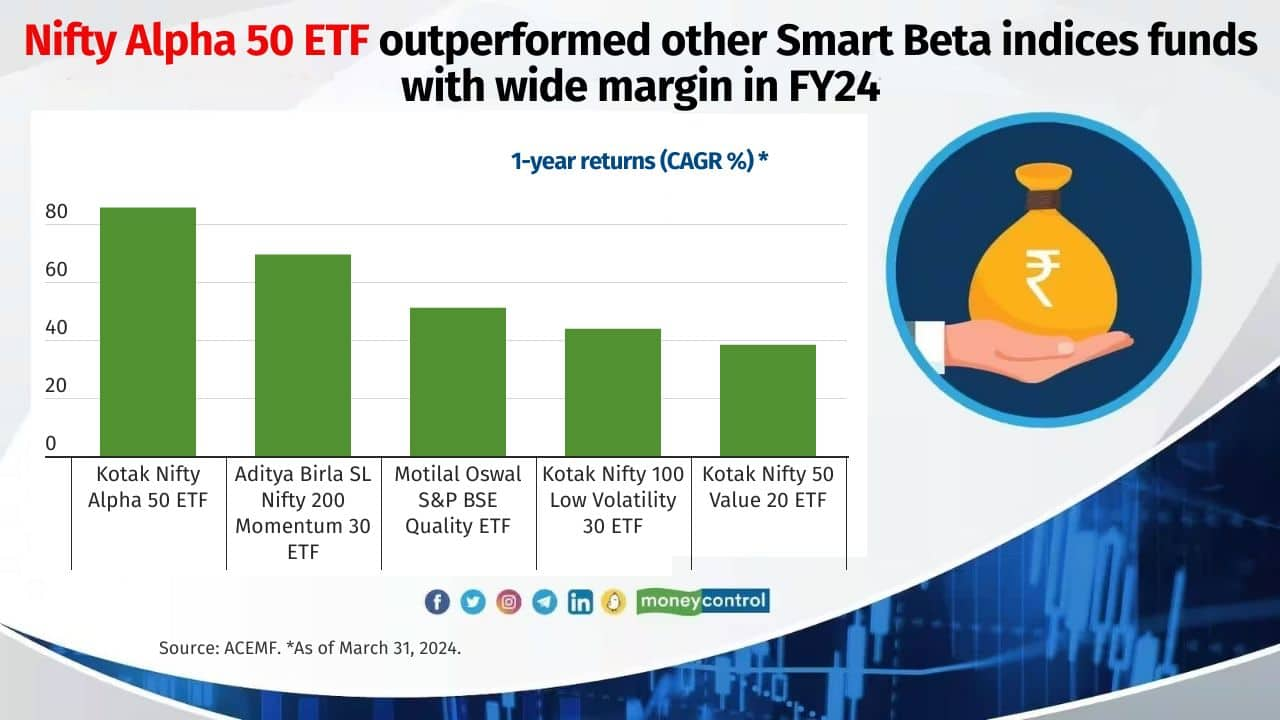

Factor-based investing has been gaining attention in India. Mutual funds have launched schemes that track group of stocks based on quality, value, alpha, volatility, and momentum. Kotak Nifty Alpha 50 ETF (KNA50) is one such. With a return of 86 percent, KNA50 has been the top performer among smart-beta funds over the last one year.

How does it curate its portfolio? The Nifty Alpha 50 consists of stocks with the highest alpha, among the 300 largest listed stocks, and the average daily turnover for the last six months. For this, it looks at the trailing one-year price data. Simply put, Alpha is an excess return generated by the stock against the market return.

Commenting on the performance of KNA50, Satish Dondapati, Fund Manager, Kotak Mahindra AMC, pointed out that the financial services sectors that constitutes 28 percent of the index, which has a lot of PSU names Such as PFC, REC, IRFC, PNB etc., gave 100-400% returns in the last 1 year and added significantly to the index returns.

In its latest rebalancing (quarterly) exercise in March 2024, NSE replaced 12 stocks in the basket of the Nifty Alpha 50 Index. Here are top 10 stocks of the portfolio of KNA50. Source: Niftyindices.com and ACEMF. Portfolio data of active schemes below are as of February 2024.

BSE

Weight(%): 4.7%

No of active equity schemes that hold the stock: 62

Suzlon Energy

Weight(%): 4.3%

No of active equity schemes that hold the stock: 29

Also see: The winners’ club: Here’s the list of the top performing equity mutual funds across categories in 2023-24

Indian Railway Finance Corporation

Weight(%): 3.8%

No of active equity schemes that hold the stock: 4

Kalyan Jewellers India

Weight(%): 3.3%

No of active equity schemes that hold the stock: 32

Also see: 10 mid-cap gems that children-oriented MFs love to hold for the long term

Rail Vikas Nigam

Weight(%): 2.2%

No of active equity schemes that hold the stock: 6

Adani Green Energy

Weight(%): 3.1%

No of active equity schemes that hold the stock: 10

REC

Weight(%): 2.8%

No of active equity schemes that hold the stock: 134

Also see: These large-cap multibaggers rewarded MF investors up to 400% in last one year

Adani Power

Weight(%): 2.8%

No of active equity schemes that hold the stock: 21

Bharat Heavy Electricals

Weight(%): 2.6%

No of active equity schemes that hold the stock: 87

Trent

Weight(%): 2.6%

No of active equity schemes that hold the stock: 135

Also see: Mutual funds call for easing RBI's limit on overseas investments amid growing opportunities

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!