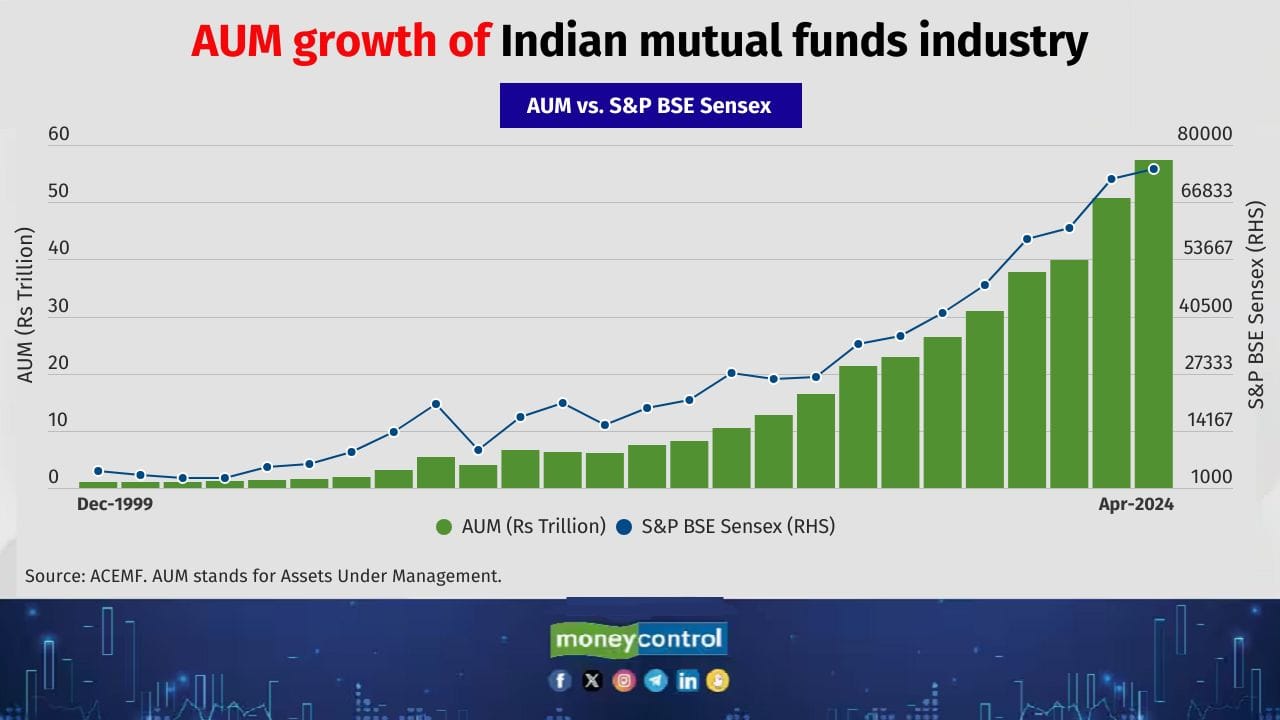

Small investors have been the growth drivers of the mutual fund industry in recent years. The industry's total assets under management (AUMs) have grown more than five times in just over 10 years, reaching the Rs 57-trillion mark in April.

Retail investors' account for 27 percent of the AUM pie. Small investors have benefited from the record run of the equity market. According to the Association of Mutual Funds of India (AMFI), there were 17.8 crore mutual fund accounts as on March 2024. Of these, 91.4 percent were those of retail investors. Those who invest with a ticket size of less than Rs 2 lakhs are defined as retail investors by the industry body

The record retail participation has been driven by a couple of factors including AMFI’s "Mutual Fund Sahi Hai campaign", rally in the equity markets and significant improvement in ease of investing through digital platforms. Systematic investment plans have become a popular route for small investors, as the number of SIP accounts hit a new high of 8.7 crore in April.

We look at how retail investors have invested in the various categories of mutual funds as compared to the large and institutional investors.

Equity Oriented Funds

Retail AUM as of March 2024: Rs 12.4 lakh crore

Growth of retail AUM over the last four years: 297%

Number of retail accounts: 11.4 crore

Also see: Mid-cap and Small-cap Funds: How can retail investors get the best out of them?

Index Funds

Retail AUM as of March 2024: Rs 33,405 crore

Growth of retail AUM over the last four years: 1,568%

No. of retail accounts: 71 lakh

ETFs (Equity, Debt and Overseas)

Retail AUM as of March 2024: Rs 14,418 crore

Growth of retail AUM over the last four years: 256%

No. of retail accounts: 1.3 crore

Also see: 10 mid-cap stocks that large-cap MFs love to hold for higher returns

Hybrid Funds

Retail AUM as of March 2024: Rs 1.2 lakh crore

Growth of retail AUM over the last four years: 129%

No. of retail accounts: 1.1 crore

Solution Oriented Funds

Retail AUM as of March 2024: Rs 30,134 crore

Growth of retail AUM over the last four years: 170%

No. of retail accounts: 57 lakh

Fund of Funds investing Overseas

Retail AUM as of March 2024: Rs 7,243 crore

Growth of retail AUM over the last four years: 1,046%

No. of retail accounts: 14 lakh

Also see: SIPs in MC30 top mutual funds deliver consistent returns

Liquid / Money Market / Floater Funds

Retail AUM as of March 2024: Rs 10,231 crore

Growth of retail AUM over the last four years: 18%

No. of retail accounts: 26 lakh

Gilt Funds / Glit Fund with 10 year constant duration

Retail AUM as of March 2024: Rs 1,469 crore

Growth of retail AUM over the last four years: 82%

No. of retail accounts: 1.7 lakh

Remaining Income/ Debt Oriented Funds

Retail AUM as of March 2024: Rs 25,375 crore

Growth of retail AUM over the last four years: -4%

No. of retail accounts: 27 lakh

Gold ETFs

Retail AUM as of March 2024: Rs 3,189 crore

Growth of retail AUM over the last four years: 149%

No. of retail accounts: 50 lakh

Also see: Explained in charts: The spectacular rise of Gold ETFs and what lies ahead

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!