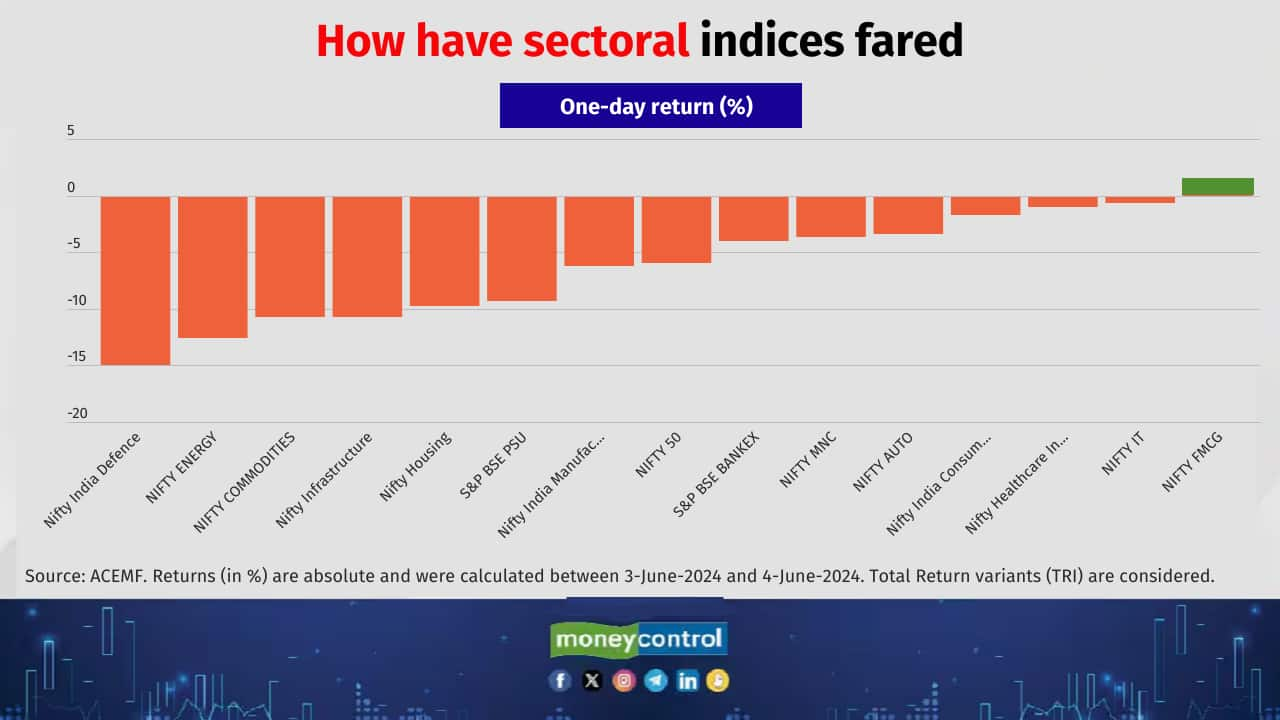

The Indian stock market crashed on June 4 with the benchmark indices experiencing their sharpest single-day fall since March 2020, as investors turned jittery after the BJP failed to secure a majority on its own in the Lok Sabha election 2024. The Sensex closed 5.7 percent down, while the Nifty plunged 5.9 percent. Mid and small-cap indices, too, tanked. The Nifty midcap 150 and Nifty smallcap 250 ended 7.1 percent and 7.5 percent down. Equity mutual funds followed suit. While experts advise investors not to be swayed by short-term gyrations and focus on long-term goals, here’s a list of schemes in the major equity categories which saw the sharpest one-day fall on June 4:

Category average of Large cap funds: -6.2%

Also see: Ignore short-term gyrations. Here are five simple index funds for long-term wealth creation

Category average of Mid cap funds: -6.7%

Category average of Small cap funds: -6.1%

Also see: Midcap and smallcap funds: How should retail investors approach them?

Category average of Flexi cap funds: -6.5%

Category average of ELSS: -6.3%

Category average of Banks & Financial Services funds: -7.7%

Also see: Sector, thematic funds: How to choose the best of the lot

Category average of Consumption Funds: -1.9%

Category average of Infrastructure Funds: -9.6%

Category average of Pharma & Health Care funds: -1.9%

Category average of Technology Funds: -2.5%

Category average of PSU funds: -14%

Also see: Check out these election-proof sectors; Are you invested in them?

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!