The momentum strategy of investing follows a ‘buy high and sell higher’ approach. It involves buying securities which are exhibiting strong price momentum, with a view that the momentum would persist in the future.

Currently, 11 of the 13 schemes that follow the momentum strategy are passively managed. Within these, nine track the Nifty 200 Momentum 30 Index (NM30) as their benchmark, and two schemes track the Nifty Midcap150 Momentum 50 Index. There are two active momentum funds from SAMCO and Quant mutual funds (MF).

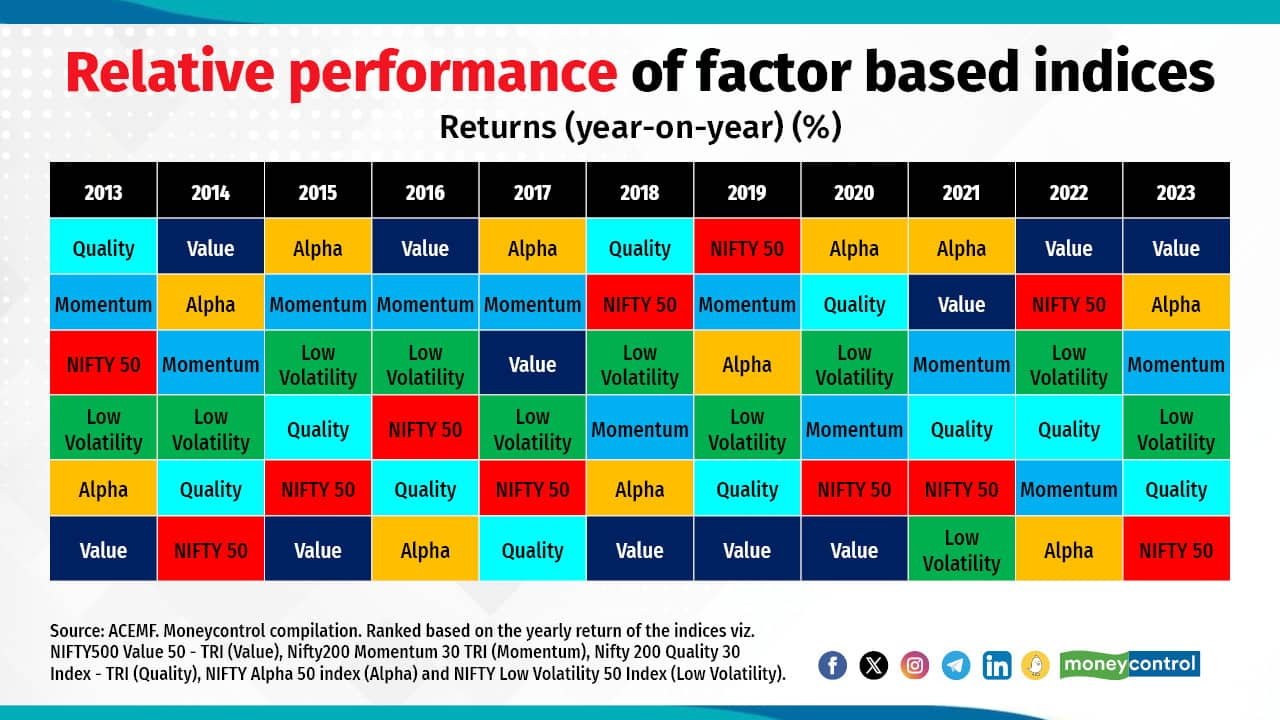

Though momentum investing can be rewarding in the long run, it might not outperform all factors through the year. Within the single-factor based indices, the momentum strategy has outperformed the low volatility and quality indices, but underperformed the value and alpha indices in 2023.

Paras Matalia, Fund Manager, SAMCO Mutual Fund, says, “The year 2023 witnessed an upswing in prices, especially post April. Momentum strategies, in general, have delivered almost double the standard free-float index returns. Microcaps, smallcaps, and some midcaps have done better. Defence, railway, PSU, and capital goods sector stocks have hugely outperformed their peers.”

The Nifty 200 Momentum 30 Index comprises 30 stocks that are selected from the Nifty 200 basket based on the momentum score calculated from their recent six and 12-month price returns, adjusted for volatility. In its latest semi-annual rebalancing exercise in December 2023, NSE replaced 16 of these stocks, 12 of which are midcaps. Here are the midcap stocks added to the NM30 basket in December 2023. Source: ACEMF and https://www.niftyindices.com

Also see: Midcap gems that large-cap funds added lately

Sun TV Network

Sector: entertainment.

No. of actively managed MFs that hold the stock: 27.

Escorts Kubota

Sectors: agricultural, commercial, and construction vehicles.

No. of actively managed MFs that hold the stock: 54.

L&T Finance Holdings

Sector: finance.

No. of actively managed MFs that hold the stock: 28.

Also see: Good returns and tax-savings: A winning combo by top tax-saving MFs

Ipca Laboratories

Sector: pharmaceuticals.

No. of actively managed MFs that hold the stock: 67.

Oberoi Realty

Sector: realty.

No. of actively managed MFs that hold the stock: 68

Bharat Forge

Sector: industrial products

No. of actively managed MFs that hold the stock: 115.

NMDC

Sector: minerals and mining.

No. of actively managed MFs that hold the stock: 64.

Also see: Find the best asset allocation mix that will maximise your returns

Alkem Laboratories

Sector: pharmaceuticals.

No. of actively managed MFs that hold the stock: 101.

Bharat Heavy Electricals

Sector: electrical equipments.

No. of actively managed MFs that hold the stock: 59.

Also see: Chasing multibaggers: 5 stocks that jumped from microcap to midcap in AMFI’s rejig

Colgate-Palmolive (India)

Sector: personal products.

No. of actively managed MFs that hold the stock: 40.

Lupin

Sector: pharmaceuticals.

No. of actively managed MFs that hold the stock: 108.

Hero MotoCorp

Sector: automobiles

No. of actively managed MFs that hold the stock: 127.

Also see: Momentum continues in value funds: Here are their top newly added stocks

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!