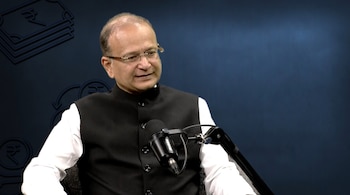

The manufacturing segment will throw up both big winners and losers because of the reordering of the global supply chain following US President Donald Trump’s policies, according to Utpal Sheth, Founder, Trust Group. In an exclusive conversation with Moneycontrol on the Wealth Formula Podcast with N Mahalakahsmi, Sheth noted that globally, investors are probably witnessing a once-in-a-lifetime event in terms of reordering of the global trade.

Sheth said, the reality is that China accounts for 30–35% of global manufacturing output in many sectors. If a meaningful portion of that output needs to find buyers outside the US, it could create a supply shock in other parts of the world—one that may trigger significant price pressures. How that, in turn, affects India and Indian companies is still an open question. He added that, fortunately, the Indian government has been very proactive and is coming in with safeguards wherever required.

Yet, looking at the evolving scenario, the manufacturing sector will see divergence in performance. Companies that seize the global displacement opportunity will emerge as winners. “There will be one set of companies which will be the winners and the other set might not be the winners. Those companies which will benefit from maybe a global market share displacement, they will surely be the winners. But those companies which do not… and are vulnerable to global pricing pressures, those will be having challenges.”

Sheth’s framework to identify winners is built on five pillars: Resilience, Adaptability, Competitiveness, Execution, and Scalability.

Besides Resilience and Adaptability, Competitiveness is now a non-negotiable. Execution is another key differentiator. Sheth points out that China's greatest strength has been execution—an area where India has historically lagged. A handful of Indian companies have cracked this code, but world-class execution at scale remains a rare capability. “We need to see that execution at global scale from Indian companies,” he says.

Scalability, especially in manufacturing, could be a game-changer. While India has built digital-scale platforms, companies that can scale in the physical formats will be winners. Sheth sees potential in a few sectors where companies have already become national leaders. “If they can now scale their platforms globally, that would be phenomenal,” he says.

Even though Indian markets have made a comeback, the Sheth noted that in the rebound in Indian markets in April should not be interpreted as an indicator that the Trump risks are fully factored in, as the rally was largely led by financials where the valuations were compelling and there is no risk due to global trade disruption. “The leader in this time frame has been the financials… which are not being impacted by the trade upheavals,” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!