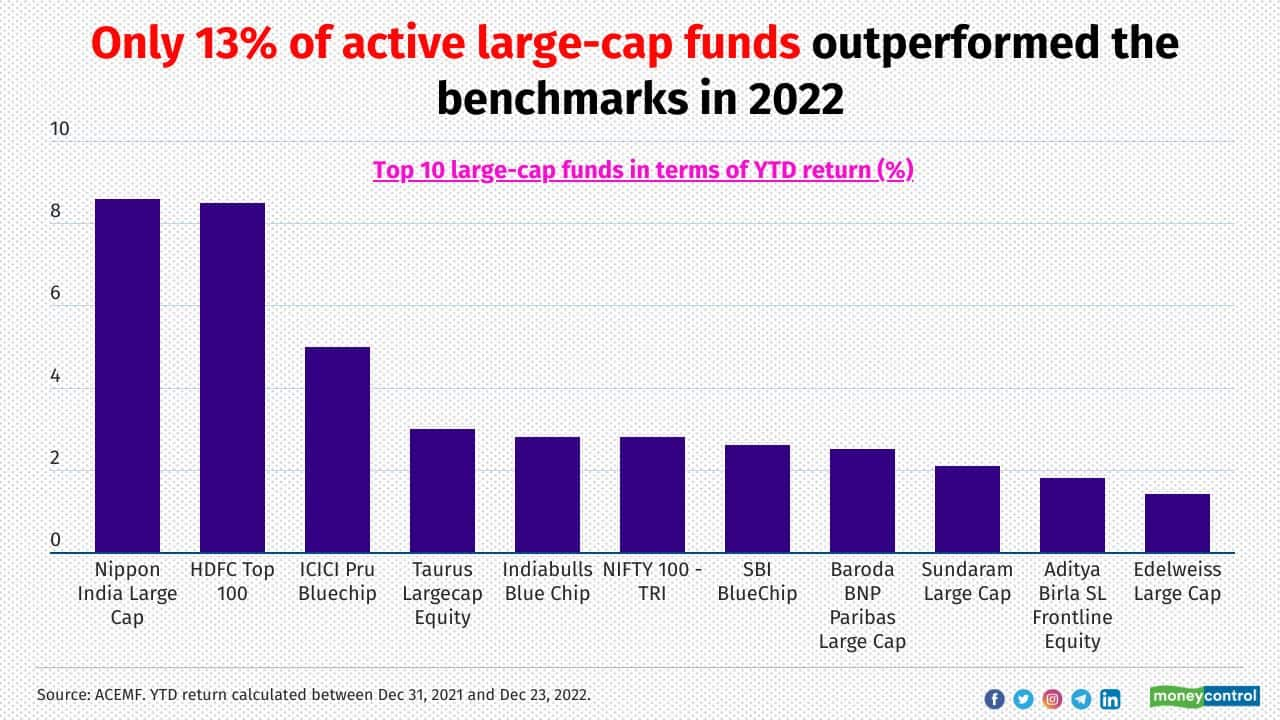

Out of the 31 schemes in the large-cap category, only four have outperformed their respective benchmark indices; either Nifty 100 TRI or S&P BSE 100 TRI. The Securities and Exchange Board of India’s 2018 category recategorisation rule may have made large-cap funds truer to label and benchmark against Total Returns Index (TRI) has made the life tougher for large-cap funds. Expense ratios further squeeze their performances. That is why a large-cap fund constructs its top 10 portfolio Typically, these constitute about 50-60 percent of the overall portfolio. Let's take a look at the top 10 stock holdings of those large-cap funds that outperformed the benchmarks in 2022 and compare them with the weightage in their respective indices. Portfolio data as of November 30, 2022. [Source: ACEMF]

Nippon India Large Cap Fund

YTD return of the scheme: 8.6%

YTD return of the benchmark (S&P BSE 100 – TRI): 4%

Fund manager: Sailesh Raj Bhan

AUM: Rs 12,922 crore

Allocation to top-10 holdings: 55%

Break-up of large-cap, mid-cap, small-cap and cash in the portfolio: 85:9:5:1

Sample of mid and smallcap stocks in the portfolio: 3M India, ABB India, Ashok Leyland, Chalet Hotels and EIH

HDFC Top 100 Fund

YTD return of the scheme: 8.5%

YTD return of the benchmark (Nifty 100 TRI): 2.8%

Fund manager: Rahul Baijal

AUM: Rs 23,453 crore

Allocation to top-10 holdings: 56%

Break-up of large-cap, mid-cap, small-cap and cash in the portfolio: 87:7:0:6

Sample of mid and smallcap stocks in the portfolio: ABB India, Aurobindo Pharma, Container Corporation Of India, Hindustan Petroleum Corporation and Lupin

ICICI Prudential Bluechip Fund

YTD return of the scheme: 5%

YTD return of the benchmark (Nifty 100 TRI): 2.8%

Fund manager: Vaibhav Dusad

AUM: Rs 35,929 crore

Allocation to top-10 holdings: 58%

Break-up of large-cap, mid-cap, small-cap and cash in the portfolio: 83:8:1:8

Sample of mid and smallcap stocks in the portfolio: Alkem Laboratories, Bharat Forge, Biocon, Cummins India and Gujarat Pipavav Port

Indiabulls Blue Chip Fund

YTD return of the scheme: 2.83%

YTD return of the benchmark (Nifty 100 TRI): 2.8%

Fund manager: Sumit Bhatnagar

AUM: Rs 103 crore

Allocation to top-10 holdings: 59%

Break-up of large-cap, mid-cap, small-cap and cash in the portfolio: 87:7:2:4

Sample of mid and smallcap stocks in the portfolio: Bata India, Container Corporation Of India, IDBI Bank and Birla Corporation

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!