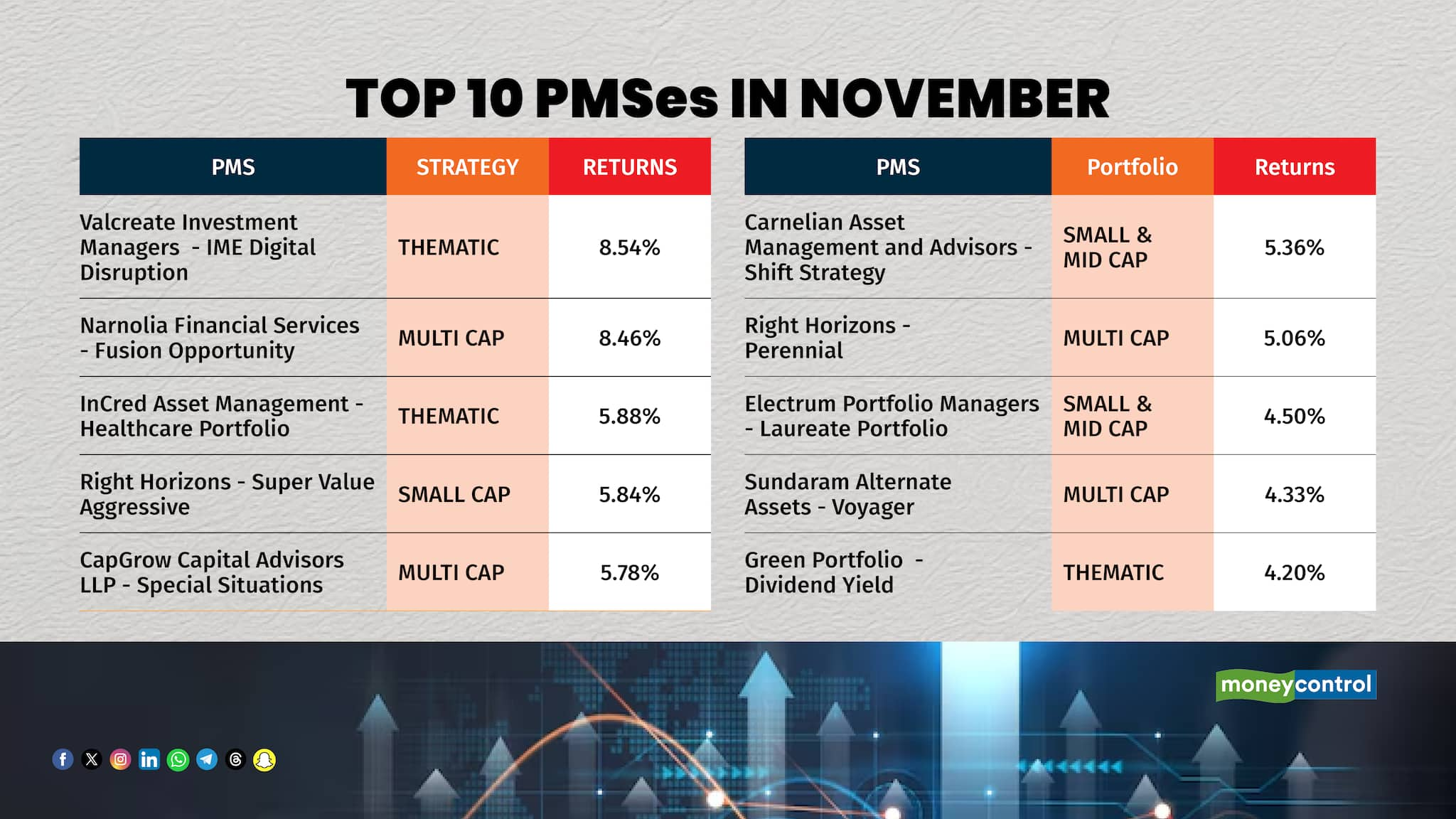

The top ten PMSes in November have delivered returns between 5-8 percent in November. Among the top names were Carnellian, Incred Asset Management, Right Horizons, and others as per data by PMS Bazaar.

The strategy invests in digital platforms. It invests in sectors like hyperlocal commerce, insurance tech, and fintech. It is managed by Ashi Anand.

The strategy is managed by Shailendra Kumar and was started in 2022.

The thematic healthcare portfolio, managed by Aditya Khemka, was launched in 2021. It has allocated nearly 90 percent of its investments to small-cap stocks. The strategy focuses on sectors such as pharmaceuticals, hospitals, diagnostics, insurance, and others.

It is a smallcap oriented scheme and is managed by Prabhat Jain.

The strategy aims to benefit from special situations like buy-backs, delisting, demergers, mergers, and others. It is managed by Arun Malhotra.

The fund looks for themes like manufacturing and tech evolution as it sees a $500 billion manufacturing opportunity and a $90 billion digital opportunity over the next 5 years. It invests in sectors like pharma, API, IT, and others.

The portfolio is sector and market cap agnostic and it was started in 2021.

The strategy invests in small and midcap opportunity and is managed by Romil Jain.

The strategy looks for structural, cyclical, and turnaround opportunities while selecting stocks. It is managed by Madangopal Ramu.

The fund was managed by Divam Sharma and was started in 2019.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!