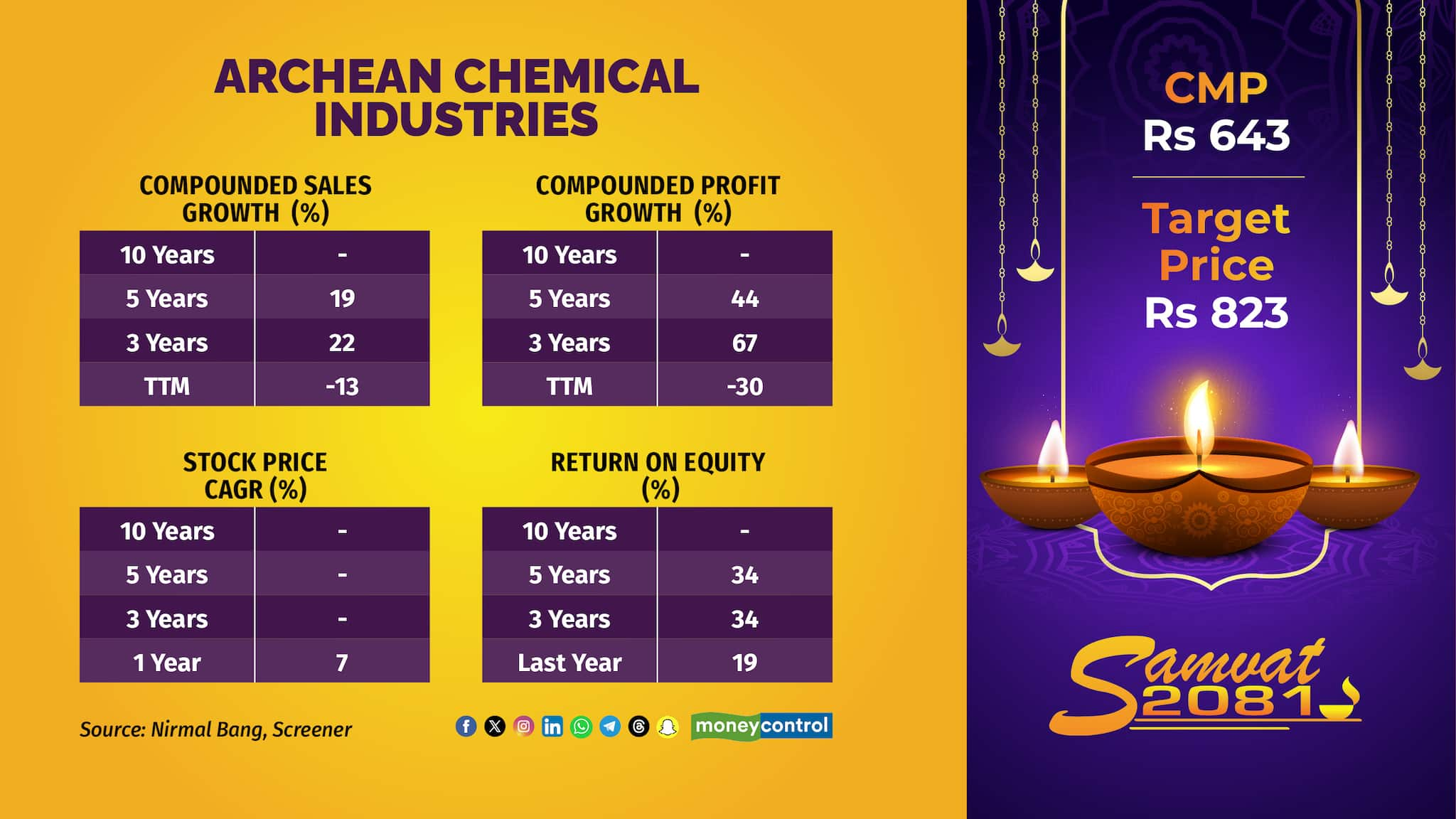

Archean Chemicals | Despite a slowdown in bromine, the company but expects growth from bromine derivatives and newly acquired Oren Hydrocarbon. Delayed shipments affected Q1FY25 industrial salt performance, but recovery is expected. Sales from a second-grade SOP pilot plant are projected by Q3. Analysts expect topline growth of ~16% from FY24-27, with a target price of Rs 823/share.

Fineotex Chemical | The company is poised for continued growth, with plans to expand capacity by 40K MTPA in two phases by FY25. It raised Rs 343 Cr to support its long-term expansion through organic and inorganic routes. Focused on sustainable products, Fineotex aims to maintain strong financials and healthy return ratios (ROCE 34.3%, ROE 29.9%), driving future growth and profitability.

Five Star Business Finance | The company is well-positioned to capture growth in the underserved business loan market with its focus on secured loans to unbanked, self-employed individuals. With an average loan ticket size of Rs 3.5 Lakh, secured by self-occupied residential properties, and a robust 28% AUM CAGR expected over FY24-27E, Five Star has built a resilient model in a difficult segment. The company’s strong RoA (8%) and RoE (19%) for FY25E highlight its profitability potential. Analysts recommend a 'BUY' with a target of Rs 1,165, driven by higher return ratios and stable credit costs.

Garware Hi-Tech Films (GHFL) | The company is poised to capture growth in India's expanding premium vehicle market by leveraging its strong network of 650+ OEM dealerships and 120+ channel partners. The increasing demand for premium protective films (PPF) driven by SUV, luxury car, and EV sales, as well as the China-plus-one strategy for shrink film manufacturing, positions GHFL for robust future growth. With ongoing capacity expansion of 300 LSF to meet demand, and a shift to higher-margin, value-added products (89% of revenue in FY24), the company's long-term prospects remain strong. The firm recommends a ‘BUY’ with a price target of Rs 4,848, offering a 20% upside.

Jyoti Resins (JRAL) | The company is well-positioned for continued growth with its strong presence across 14 states in India and plans to expand into new regions, including New Delhi and UP. The company aims to further increase its market share by adding branches and distributors, while also enhancing storage capacity to support future growth. The firm's EBITDA margins are expected to normalize due to decreasing raw material costs, JRAL’s growth prospects remain robust, with projected revenue growth of 18% CAGR from FY24-26E.

L&T Technology Services (LTTS) | The firm is poised for recovery, maintaining its FY25 growth guidance of 8-10%. The company is focused on digitization demand in the ER&D space and expects strong traction in key verticals. Recent large deals, milestone payments from a $100 million cybersecurity project. Additionally, LTTS is actively exploring inorganic growth opportunities in automotive, hyperscalers, and healthcare sectors. With a net cash position of Rs 1,114 crore and an attractive valuation at a P/E of 32x FY26E earnings, analysts recommended a ‘BUY’ with solid prospects for growth.

Macpower CNC Machines | The 8th largest CNC machine manufacturer in India, is set for significant growth, driven by its expanded capacity to 2,000 machines and strong industrial capex. With a booming manufacturing sector and demand for import substitution, the CNC industry is expected to grow at 20% CAGR. Macpower, with its market share of ~1%, is positioned to benefit from this trend, as evidenced by its robust order book of Rs 283 crore (+60% YoY). Analysts project 28% topline and 44% bottom-line growth over FY24-26E and value the stock at Rs 1,800 based on 36x FY26E EPS.

REC | The GOI entity, is well-positioned to capitalize on India’s power and infrastructure expansion. With plans to add 360GW of capacity by FY30 and a growing focus on green financing, REC’s AUM is projected to rise to Rs 6 lakh crore by FY25 (+17% YoY) and Rs 10 lakh crore by FY28-29, with renewable projects making up 30% of its portfolio. With NNPAs down to 0.8%, REC is in a strong financial position. The brokerage values the stock at 2.0x Sep 2026 BVPS, setting a target price of Rs 776.

Sai Silks Kalamandir (SSKL) | The leading apparel retailer in South India operates 62 stores across 6.53 lakh sq. ft., with diverse formats catering to various market segments. The company is expanding its premium Varamahalakshmi format, which is expected to enhance margins and reduce dependency on lower-margin segments. Despite a 12.3% YoY revenue decline in Q1FY25 due to fewer wedding dates, SSKL maintained gross margins at 41% and anticipates a recovery in Q2FY25. With plans to expand to 8.2 lakh sq. ft. by FY26E, analysts value the stock at an attractive EV/EBITDA of 8.3x FY26E EBITDA, recommending a BUY with a target price of Rs 281 (14x EV/EBITDA on FY26E).

Transformers & Rectifiers India Limited (TRIL) | The prominent transformer manufacturer with a capacity of 40,000 MVA, is well-positioned to capitalize on India's surging power demand and the green energy transition. With plans to expand capacity by an additional 15,000 MVA for renewable transformers, TRIL is set to become the largest transformer company in India by December 2024. The company boasts a robust order book of Rs 3,500 Cr (2.7x FY24 revenue) and a pipeline of Rs 17,500 Cr, supported by opportunities in railways, green hydrogen, and data centers. Analysts anticipate TRIL's revenue and profit to grow at CAGRs of 49% and 122%, respectively, over FY24-27E. Valued at 40x FY26 EPS, we set a target price of Rs 1,070, reflecting a premium due to its strong growth potential.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!