Several companies are announcing their results for the October-December quarter of the current financial year (FY25). Follow our LIVE blog for the latest updates.

LiveNow

Live: ITC to acquire Prasuma, expanding frozen, chilled, and ready-to-cook foods portfolio

Several companies are announcing their results for the October-December quarter of the current financial year (FY25). Follow our LIVE blog for the latest updates.

Aurobindo Pharma Q3 profit falls 9.7% to Rs 846 cr; revenue up 8.5%

Aurobindo Pharma Q3 net profit declines 9.7% to Rs 845.8 crore vs Rs 936 crore (YoY). Revenue rises 8.5% to Rs 7,978.5 crore vs Rs 7,352 crore (YoY). EBITDA down 1.5% at Rs 1,627.7 crore vs Rs 1,601 crore (YoY). Margin at 20.4% vs 21.8% (YoY).

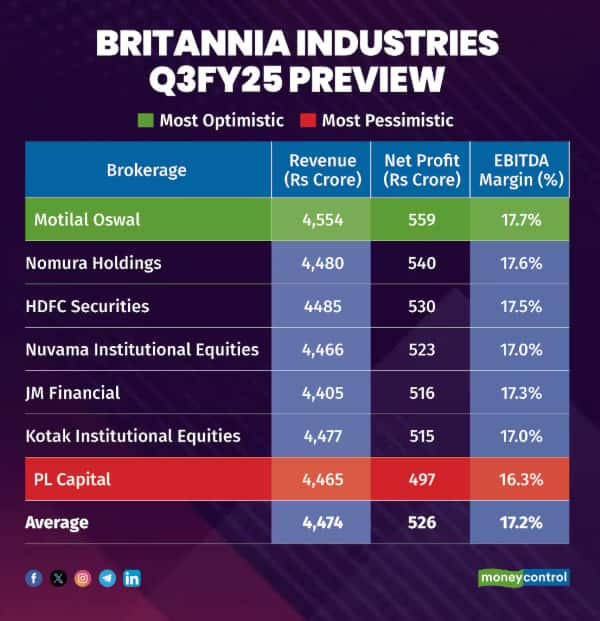

Britannia Q3 net profit rises 4.5% to Rs 582.3 cr, revenue up 7.9%

Britannia Industries reported a 4.5% year-on-year increase in net profit for Q3, reaching Rs 582.3 crore compared to Rs 557 crore last year. Revenue grew 7.9% to Rs 4,592.6 crore from Rs 4,256.3 crore in the same period last year.

EBITDA rose 2.9% to Rs 844.9 crore from Rs 821.1 crore YoY, while margins stood at 18.4%, down from 19.3% in the previous year.

Hero MotoCorp profit rises 12.1% to Rs 1,202.8 cr, revenue up 5%

Hero MotoCorp reported a 12.1% year-on-year rise in net profit for Q3, reaching Rs 1,202.8 crore compared to Rs 1,073 crore last year. Revenue grew 5% to Rs 10,210.8 crore from Rs 9,724 crore. EBITDA increased by 8.4% to Rs 1,476.5 crore, up from Rs 1,362 crore, while margins improved to 14.5% from 14% year-on-year.

ITC Q3 profit up 1.2%, revenue jumps 8.6%

ITC Ltd. reported a marginal growth in its net profit for the third quarter of FY2025, which rose by 1.2% to Rs 5,638.3 crore compared to Rs 5,572 crore in the same quarter last year. The company's revenue saw an 8.6% increase, reaching Rs 17,052.8 crore, up from Rs 16,483 crore in the previous year.

However, the company's EBITDA registered a slight decline of 1.7%, falling to Rs 5,834.3 crore from Rs 6,024 crore year-on-year. The EBITDA margin also narrowed to 34.2% from 36.5% in the previous year.

- Net profit falls 37 percent QoQ to Rs 219.67 crore

- Revenue from operations rises 4 percent QoQ to Rs 773.54 crore

- Total expenses at Rs 368.13 crore

- Net profit falls 66 percent YoY to Rs 65.18 crore

- Revenue from operations falls 7 percent YoY to Rs 1,010.4 crore

- Total expenses at Rs 939 crore

- Net profit jumps 17 percent YoY to Rs 239.34 crore

- Revenue from operations rises 6 percent YoY to Rs 797.61 crore

- Total expenses at Rs 489.96 crore

- Net profit jumps 116 percent YoY to Rs 182.38 crore

- Revenue from operations falls 6 percent YoY to Rs 1,983 crore

- Total expenses at Rs 1,992 crore

- Net profit falls 32 percent YoY to Rs 337.2 crore

- Revenue from operations rises 5 percent YoY to Rs 6,928 crore

- Total expenses at Rs 6,467 crore

- Net profit jumps 505 percent YoY to Rs 14,781 crore

- Revenue from operations increases 19 percent YoY to Rs 45,129 crore

- Total expenses at Rs 20,533 crore

- Net profit rises 24 percent YoY to Rs 261 crore

- Revenue from operations increases 25 percent YoY to Rs 2,251 crore

- Total expenses at Rs 1,099 crore

Q3 Results LIVE: NCC net profit falls 13%

Net Profit: Rs 193.2 Cr, down 12.5% from Rs 220.7 Cr YoY

Revenue: Rs 5,344.5 Cr, up 1.6% from Rs 5,260 Cr YoY

EBITDA: Rs 420.9 Cr, down 16.6% from Rs 504.4 Cr YoY

Margin: 7.9%, compared to 9.6% YoY

- Net profit jumps 35 percent YoY to Rs 153.72 crore

- Revenue from operations increases 18 percent YoY to Rs 1,962.63 crore

- Total income rises to Rs 1,966.5 crore

- Total expenses at Rs 1,736.6 crore

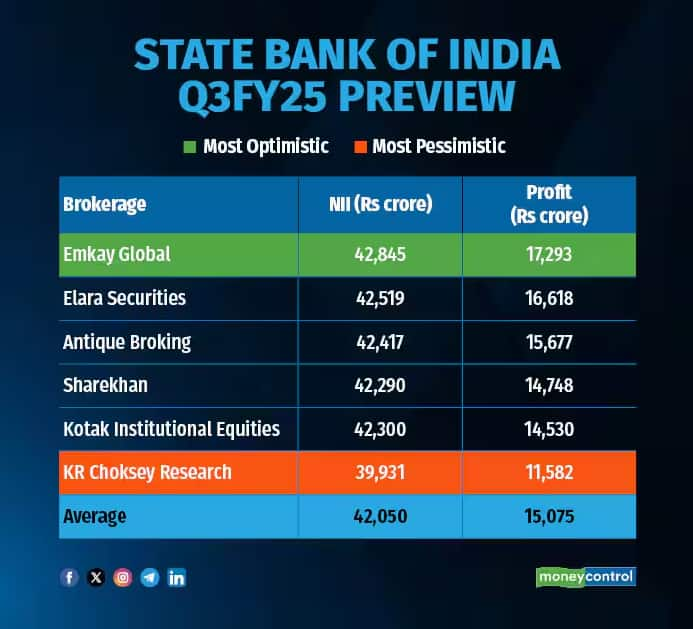

Q3 Results LIVE: SBI Q3 net profit beats estimates

SBI reported 84 percent YoY rise in net profit to Rs 16,891 crore. This is higher than MC poll’s estimate of 64 percent rise to Rs 15,075 crore.

- Net profit jumps 84 percent YoY to Rs 16,891.44 crore

- Total income increases to Rs 1.28 lakh crore

- Net NPA improves marginally to Rs 21,377.64 crore

- Net NPA margin at 0.53 percent

- Net profit rises 180 percent YoY to Rs 35.9 crore

- Revenue from operations rises 11 percent YoY to Rs 1,717.3 crore

- Total income increases to Rs 1,759.1 crore

- Total expenses at Rs 1,712.8 crore

- Net profit rises 16 percent YoY to Rs 534.42 crore

- Revenue from operations rises 13 percent YoY to Rs 4,918.06 crore

- Total income increases to Rs 4,982.69 crore

- Total expenses at Rs 4,230.10 crore

- Net profit rises 34 percent YoY to Rs 496.54 crore

- Revenue from operations rises 34 percent YoY to Rs 4,656.56 crore

- Total income increases to Rs 4,715.64 crore

- Total expenses at Rs 4,096.08 crore

- Net profit falls 34 percent YoY to Rs 330.27 crore

- Revenue from operations rises 14 percent YoY to Rs 7,000.82 crore

- Total income increases to Rs 7,098.90 crore

- Total expenses at Rs 6,674.72 crore

Q3 Results LIVE: BEML shares fall 3% after Q3 results

Shares of BEML tumbled 3 percent to trade at Rs 3,288 apiece after the company reported a 49 percent year-on-year drop in Q3 net profit.

- Net profit falls 49 percent YoY to Rs 24.41 crore

- Revenue from operations down 16 percent YoY to Rs 875.77 crore

- Total income falls to Rs 880.28 crore

- Total expenses at Rs 850.70 crore

- Interim dividend of Rs 5 per equity share announced

Q3 Results LIVE: KP Energy shares hit 5% upper circuit after Q3 results

Shares of KP Energy jumped 5 percent to get locked in the upper circuit at Rs 440.90 after the company reported a 185 percent year-on-year rise in net profit to Rs 26 crore in Q3.

- Net profit jumps 185 percent YoY to Rs 26.39 crore

- Total income rises to Rs 212.50 crore

- Total expenses at Rs 178.57 crore

- Interim dividend of Rs 0.20 per share announced

- Net profit rises 20 percent YoY to Rs 232.56 crore

- Revenue from operations up 19 percent YoY to Rs 4,183.99 crore

- Total income rises to Rs 4,192.44 crore

- Total expenses at Rs 3,931.93 crore

Q3 Results LIVE: Hero MotoCorp likely to see muted growth in revenue

Analysts expect muted growth in revenue, led by low motorcycle sales and a weak domestic market. Margins could face pressure due to higher discounts and rising electric vehicle (EV) contributions. According to a Moneycontrol poll of seven brokerage firms, the Harley Davidson maker is anticipated to record a 3.8 percent year-on-year increase in revenue to Rs 10,099 crore. Net profit is projected to rise 4 percent year-on-year to Rs 1,114 crore. (Read more)

- Net profit rises 9 percent YoY to Rs 147.13 crore

- Revenue from operations up 38 percent YoY to Rs 832.14 crore

- Total income rises to Rs 916.56 crore

- Total expenses at Rs 723.67 crore

Q3 Results LIVE: Airtel shares drop 1.25% ahead of Q3 results

Shares of Bharti Airtel dropped 1.25 percent and are currently trading at Rs 1,639.9 apiece. The company is set to announce its Q3 results today.

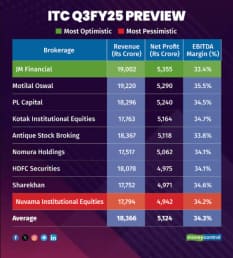

Q3 Results LIVE: ITC net profit may slip 8% on high base

The FMCG player is likely to report the highest revenue among all its listed peers. According to a Moneycontrol poll of nine brokerages, ITC is likely to report a revenue of Rs 18,366 crore, rising 11.4 percent year-on-year compared to Rs 16,483 crore in the October to December quarter of FY24.

Net profit is likely to come in at Rs 5,124 crore in Q3FY25 as against Rs 5,578 crore in the year-ago period, a degrowth of 8.1 percent. As a result of a low effective tax rate in Q3FY24, where ITC saw a tax reversal of around Rs 470 crore, the profit is likely to see a fall on a high base. (Read more)

Q3 Results LIVE: Britannia Industries profit may slip 6%

The biscuit maker is likely to see a degrowth in net profit as the quarter was impacted by price hikes and subdued consumption environment. According to a Moneycontrol poll of seven brokerages, Britannia Industries is likely to report a 5.1 percent revenue growth at Rs 4,488 crore. Net profit is likely to come in at Rs 562 crore from Rs 559 crore from the corresponding quarter last year, falling six percent on-year. (Read more)

Q3 Results LIVE: Bharti Airtel's net profit expected to double

A Moneycontrol poll of seven brokerage firms estimates Bharti Airtel's consolidated net profit to double year-on-year to Rs 5,039 crore, with revenue expected to rise nearly 16 percent to Rs 43,874 crore. A poll of six brokerages projects the company's EBITDA margin at 54 percent. Analysts are expecting strong sequential growth driven by higher ARPU (Average Revenue Per User) following the July 2024 tariff hike, continued 4G migration, and the Indus Towers consolidation. However, muted subscriber additions and subdued performance in Airtel Africa could be limiting factors. (Read more)

Q3 Results LIVE: SBI likely to see 64% rise in Q3 net profit

India's largest lender, the State Bank of India (SBI), is on track to post 64 percent year-on-year (YoY) surge in Q3 net. This robust performance comes on the back of lower employee costs, stable asset quality and healthy growth in both loans and deposits, according to analysts. According to Moneycontrol poll of 6 brokerages, SBI is poised to report a net profit of Rs 15,075 crore for Q3FY25. Meanwhile, net interest income (NII) is expected to see a modest 6 percent rise, reaching Rs 42,050 crore. (Read more)

Q3 Results LIVE: Which companies are announcing their Q3 results today?

Around 174 companies are set to announce their results for the October-December quarter of the current financial year. Bharti Airtel, Britannia Industries, Hero MotoCorp, ITC, State Bank of India (SBI), Trent, REC, Apollo Tyres, Aurobindo Pharma, Bharti Hexacom, Cochin Shipyard, Motherson Sumi Wiring India, MRF, NMDC, PI Industries, UNO Minda and Emcure Pharma are some of the notable names among them.