Business news updates: Quick commerce unicorn Zepto has postponed its initial public offering (IPO) plans by a year and now plans to tap the public markets in calendar year 2026, people aware of the developments told Moneycontrol. Adani Enterprises’ arm Adani Airports Holdings Ltd (AAHL) said it has raised $750 million from a consortium of international banks, including First Abu Dhabi Bank, Barclays PLC, and Standard Chartered Bank.

LiveNow

Business news updates: Zepto defers IPO to 2026, buzz around HDB Financial Services IPO, and more

Business news updates: Quick commerce unicorn Zepto has postponed its initial public offering (IPO) plans by a year and now plans to tap the public markets in calendar year 2026, people aware of the developments told Moneycontrol. Adani Enterprises’ arm Adani Airports Holdings Ltd (AAHL) said it has raised $750 million from a consortium of international banks, including First Abu Dhabi Bank, Barclays PLC, and Standard Chartered Bank.

Trump's 50% steel tariff to have limited direct impact but China dumping a worry: Analysts

US President Donald Trump's move to raise tariffs on steel to 50 percent will likely have a limited direct impact on Indian steelmakers but dumping by China and other countries can’t be ruled out, analysts have said. Any impact on exports of iron and steel-based products, especially automobiles, auto components, and engineering products, will have to be monitored, they added. (Read more)

NCLAT stays Reliance Infra's IBC proceedings till July 18

Shares of Reliance Infrastructure Ltd jumped over 11% on June 4 after the National Company Law Appellate Tribunal (NCLAT) stayed the corporate insolvency resolution process against the firm till July 18, the next date of hearing. The appellate tribunal was hearing an appeal against the National Company Law Tribunal (NCLT) Mumbai bench's order to admit IDBI Trusteeship Services Ltd.'s insolvency petition against Reliance Infrastructure.

Reliance Infrastructure had argued that it had paid the entire amount to IDBI Trusteeship and the insolvency proceedings should not have been started against them.

Beyond Maggi: Nestlé bets big on out-of-home segment as urbanisation, on-the-go consumption rise

As more consumers spend time commuting, travelling, and socialising, Nestlé India is ramping up its portfolio of ready-to-consume products, including cold coffee, snack bars, and other impulse offerings, to capture the growing demand, the fast-moving consumer goods (FMCG) company said in its annual report. The move marks a strategic shift for the FMCG major, which was once known primarily as the Maggi noodles company. (Read More)

India red flags Pakistan's past track record as Asian Development Bank approves $800 million financial aid

India has flagged the poor financial track record of Pakistan as the Asian Development bank approved a $800 million grant. Sources say that “India shared deep concerns regarding the potential misuse of ADB resources, particularly in light of Pakistan’s increasing defence expenditure, its declining tax-to-GDP ratio, and the lack of demonstrable progress on key macroeconomic reforms.” (Read More)

India’s EV push could face a massive jolt from China's rare earth magnets curb

India’s electric vehicle industry is facing a potential supply chain crisis, triggered by a shortage of a small but vital component: rare earth magnets. Rare earths, a group of elements used in everyday technologies like smartphones and EVs, are difficult and expensive to extract and process—and their production often comes with significant environmental costs. In a fresh flashpoint of geopolitical tensions, China has tightened export controls on these magnets, a move seen as part of its strategic counter to US-led trade pressure, particularly under Donald Trump's administration, which slapped tariffs as high as 145 percent on Chinese goods earlier this year. (Read More)

Zerodha News live: Being Listed On Exchanges Is Tough For A Company Like Us - Zerodha's Kamath tells CNBC-Tv18

- Starting Zerodha Was Critical, Saw Immense Growth During COVID

- Expect 10-20% Drop In Broking Biz

- Our Biz Is Directly Proportional To Market Activity, Which Saw A Slow Start In Q1FY26

- Don’t Expect Any Change In Brokerage Rates

- Co Currently Has 18 m Customers, Hope Market Participation Will Increase Overtime

- Don’t Think Uncertainty Is Factored Into The Price w.r.t Valuations

- Want To Be A Full-fledged Financial Conglomerate In The Next Decade, Including Banking

- Not Giving Up On Aspiration Of Getting A Bank Licence

- India Has The Opportunity To Have 3 Exchanges

- Have Enough Cash To Do Whatever We Wish To Do

- Being Listed On Exchanges Is Tough For A Company Like Us

Sebi considering scheme to settle old violations by Venture Capital Funds

Capital market regulator Sebi is considering another settlement scheme to resolve old cases of violations by erstwhile venture capital funds (VCF), people familiar with the development told Moneycontrol, and the regulation may be presented during the upcoming board meeting on June 18. The settlement scheme could include instances of violations such as failure to wind up funds post expiry of tenure, deviation from stated investment strategy, non-arm’s length transactions without proper disclosures, or lack of governance mechanisms in fund operations. (Read More)

Zepto defers IPO to 2026, seeks private funding from overseas and domestic investors

Quick commerce unicorn Zepto has postponed its initial public offering (IPO) plans by a year and now plans to tap the public markets in calendar year 2026, people aware of the developments told Moneycontrol. Aadit Palicha, chief executive officer and co-founder, Zepto had earlier said in media reports that the company was confident of going public in 2025. (Read More)

HDB Financial Services IPO Live: Key details

HDFC Bank, in a regulatory filing to the stock exchanges, stated that the IPO of HDB Financial Services (HDBFS) will consist of equity shares with a face value of Rs10 each, amounting to a total of Rs12,500 crore. This includes a fresh issue of equity shares worth up to Rs2,500 crore and an offer for sale (OFS) of shares valued up to Rs10,000 crore.

Rupee weakens by half a percent near 86/USD

Rupee weakens by half a percent near 86/USD

Adani Airports raises $750 mn from consortium of international banks

Adani Enterprises' arm Adani Airports Holdings Ltd (AAHL) on June 4 said it has raised $750 million from a consortium of international banks, including First Abu Dhabi Bank, Barclays PLC, and Standard Chartered Bank. AAHL, which is India’s largest private airport operator, raised the funds via external commercial borrowings, a stock exchange filing said. (Read More)

HDB Financial Services IPO Live: What you need to know about Rs 12,500-crore public offer

HDB Financial Services Ltd (HDBFS), a subsidiary of HDFC Bank—India’s largest private-sector lender—has secured SEBI approval to raise Rs12,500 crore through its upcoming IPO. In conjunction with the issue, HDFC Bank, which currently holds a 94.6% stake in HDBFS, plans to divest shares worth Rs10,000 crore via an offer-for-sale. This move represents the HDFC Bank group’s first public listing in six years.

Cash and bank balances of listed firms cross Rs 10 lakh crore in FY25

India Inc’s total cash and bank balances exceeded Rs 10 lakh crore for the first time in FY25, a development analysts attribute to a strategic recalibration in corporate treasury management amid persistent economic and geopolitical uncertainty. Data from ACE Equities shows that 3,611 listed companies—excluding those in the BFSI and oil & gas sectors—reported aggregate cash and bank holdings of Rs 10.67 lakh crore at the end of FY25, marking a 15 percent increase over the previous year. (Read More)

PMI numbers out!

Services activity rises to a three-month high of 58.8 in May compared with 58.7 in the previous month

RBI MPC meeting begins, likely to announce third straight rate cut on June 6 as inflation undershoots

India's central bank is widely expected to deliver a third consecutive rate cut on Friday as muted inflation provides ample space to focus on boosting economic growth further. A strong majority of economists, 53 of 61, in a Reuters poll expect the Reserve Bank of India's monetary policy committee (MPC) to cut the repo rate to 5.75%. Two respondents see a cut of 50 basis points and the remaining six expect no change. (Read More)

Yes Bank shares gain as board approves Rs 16,000 cr fund raise via debt, equity mix

Shares of Yes Bank gained 2 percent to Rs 21.24 per share on June 4 after its board approved fundraising plan of Rs 16,000 crore through a combination of debt and equity issuances. The private lender plans to raise Rs 7,500 crore via equity issuance and Rs 8,500 crore through eligible debt securities denominated in Indian or foreign currency, in one or more tranches. Both modes of fundraising are subject to shareholder approval and other regulatory and statutory clearances. (Read More)

Opening bell

Sensex climbs 230.17 points to 80,967.68 in early trade; Nifty up 70.25 points to 24,612

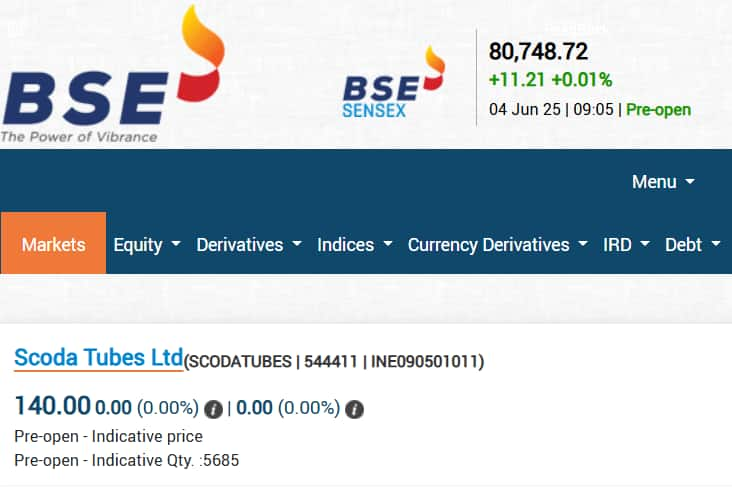

Scoda Tubes Share Price: Ahead of listing, Scoda Tubes shares trade at Rs 140 in BSE pre-open

Rupee to drop on potential equity outflows, test key support

- The Indian rupee is likely to open weaker on Wednesday, weighed down by equity outflows and corporate dollar demand for hedging and payment needs.

- The 1-month non-deliverable forward indicated an open in the 85.66-85.68 range, versus 85.59 in the previous session.

- The Indian rupee has been mostly on the back foot in recent sessions, with bankers pointing to sustained dollar demand for immediate payments, muted equity flows, and hedging activity during dollar dips. - Reuters

Scoda Tubes Share Price: Check out the investors response during bidding period

The public issue witnessed an overall subscription of 53.78 times. Within this, the retail investors' segment was subscribed 19.40 times, while the non-institutional investors (NII) category saw a robust response with 113.03 times subscription. Meanwhile, the qualified institutional buyers (QIBs) portion was subscribed 69.51 times.

Scoda Tubes Share Price: What you need to know about Scoda Tubes - Brief profile

Scoda Tubes Ltd., an India-based manufacturer of stainless-steel tubes and pipes, brings over 14 years of industry experience. The sector outlook remains positive, with the Indian stainless-steel pipes and tubes market expected to grow at a compound annual growth rate (CAGR) of 6% to 8% during the FY2024 to FY2029E period.

Nvidia beats Microsoft to become world’s most valuable company

Nvidia has reclaimed the title of the world’s most valuable publicly traded company, surpassing Microsoft in market capitalization on Tuesday. According to a report by CNBC, shares of the AI chip giant rose by 3% to $141.40, pushing its market value to an astonishing $3.45 trillion — narrowly edging out Microsoft’s $3.44 trillion. (Read More)

Scoda Tubes Share Price Live: Valuation in line with peers; moderate listing gains expected

- Valuation Metrics:

- Price-to-Earnings (P/E) ratio: 30.43x (FY24 basis)

- Price-to-Book (P/B) ratio: 8.76x

- These figures are broadly in line with industry peers.

- Expected Listing Gains:

- Analysts predict listing gains of 10% to 12%.

- Investment Recommendation:

- IPO allottees are advised to hold the stock for the medium to long term.

- Expert Opinion:

- Insights shared by Mahesh Ojha, AVP – Research and Business Development, Hensex Securities Pvt Ltd.

Scoda Tubes Share Price Live: Analysts expect a premium listing for Scoda Tubes shares

Market analysts anticipate that Scoda Tubes Ltd will list at a premium over its issue price. This expectation is based on the current trend in the grey market, where the IPO has been showing signs of strong investor interest. The consistent demand and sentiment around the offering suggest that the stock could open higher than its allotment price once it debuts on the exchanges. While the premium is expected to be modest, it reflects positive market confidence in the company’s fundamentals and growth potential.

Scoda Tubes Share Price Live: What are the grey market expectations

- Investors are tracking the Grey Market Premium (GMP) today to estimate the potential listing price.

- As per analysts, Scoda Tubes shares are likely to list at a modest premium over the issue price.

Scoda Tubes Share Price Live: What is the trading schedule

- Scoda Tubes shares will be part of the Special Pre-open Session (SPOS) on listing day.

- Trading will begin at 10:00 AM today.

Scoda Tubes Share Price Live: What does the BSE notice says

- According to the BSE notification, Scoda Tubes shares will be listed in the ‘T’ Group of Securities.

- This group implies that the stock will be subject to trade-for-trade settlement, meaning no intraday trading is allowed for the first 10 sessions.

Scoda Tubes Share Price Live: Scoda Tubes IPO timeline

- The IPO subscription window was open from May 28 to May 30.

- IPO allotment was finalised on June 2.

- Listing day is Wednesday, June 4, 2025.

Scoda Tubes Share Price Live: Hello

Hello and welcome to Moneycontrol. Today, we are tracking the listing of Scoda Tubes IPO. There's lot of buzz in the primary markets with SEBI giving nod to HDFC arm's public offer. In other news, US President Donald Trump has announced fresh levies on metals. Stay with us for latest business updates from India and around the globe.