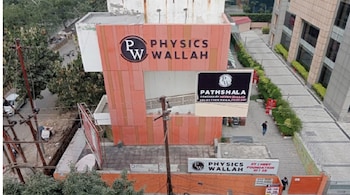

PhysicsWallah, the online education platform backed by WestBridge Capital, Hornbill Capital Partner, and GSV Ventures, has raised Rs 1,562.8 crore from 57 institutional investors via anchor book on November 10. This is a day before the IPO opening for subscription on November 11.

The company approached capital markets to raise Rs 3,100 crore via fresh shares and Rs 380 crore through offer-for-sale route. The price band for the offer, which will remain open for subscription till November 13, has been fixed at Rs 103-109 per share.

Alakh Pandey and Prateek Boob-founded PhysicsWallah has finalised allocation of 14.33 crore equity shares to anchor investors at the upper price band.

Marquee global investors participated in the anchor book were Goldman Sachs, Smallcap World Fund, Franklin Templeton, FundPartner Solutions, Fidelity Funds, TIMF Holdings, Pinebridge Global Funds, and Eastspring Investments.

Several domestic institutional investors including ICICI Prudential MF, Kotak Mahindra AMC, Nippon Life India, 360 ONE, Aditya Birla Sun Life AMC, Motilal Oswal AMC, Tata MF, Invesco India, Edelweiss, Canara Robeco MF, PGIM India, IIFL Asset Management, Axis Max Life Insurance, and Bharti Axa Life Insuance also showed strong interest in the edtech company by investing in the anchor book.

PhysicsWallah that offers test preparation courses for competitive examinations such as JEE, NEET and UPSC, and upskilling courses has attracted 14 domestic mutual funds which picked 55.5 percent shares of the anchor book through their 35 schemes.

Click Here To Read All IPO News

The Noida-based company intends to utilise Rs 460.5 crore of fresh issue proceeds for fit-outs of new offline and hybrid centers, Rs 548.3 crore for lease payments of existing identified offline and hybrid centers, and Rs 47.2 crore for investment in subsidiary Xylem Learning.

Further, Rs 28 crore will be used for lease payments for subsidiary Utkarsh Classes & Edutech's existing identified offline centers, and acquisition of additional shareholding in the said subsidiary. Apart from this, the edtech platform will spend Rs 200.1 crore for server and cloud related infrastructure costs, Rs 710 crore for marketing initiatives, and the remainder amount for its inorganic growth through unidentified acquisitions and general corporate purposes.

PhysicsWallah will finalise the IPO share allotment by November 14, and its shares will be available for trading on the BSE and NSE effective November 18.

Kotak Mahindra Capital Company, JP Morgan India, Goldman Sachs (India) Securities, and Axis Capital are the managing the PhysicsWallah IPO as merchant bankers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!