OVERVIEW

THE NEW WEALTH ORDER

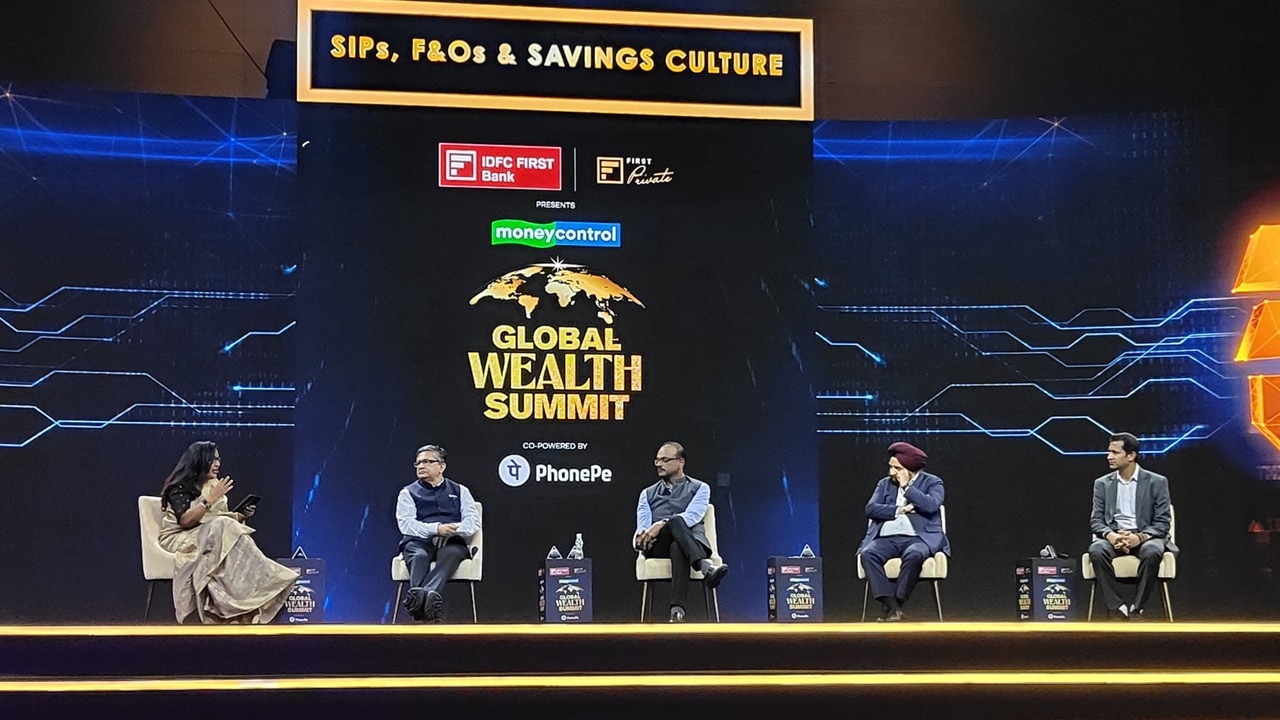

The global investment landscape is being reshaped by AI-led disruption, shifting supply chains, geopolitical realignments and renewed interest in safe-haven assets, reshaping how investors think about risk, returns and portfolio construction.

In this changing order, India remains a structural bright spot, supported by strong fundamentals and growing domestic capital. The second edition of the Moneycontrol Global Wealth Summit brings together global and Indian market leaders, policymakers and investment experts.

15 +

Sessions

10 HRS

Engagement

400 +

networking

25 +

Speakers

WHY GLOBAL WEALTH SUMMIT

Discover strategies shaping the future of global wealth, driven by innovation, resilience, and impactful collaborations.

- Engage with top CEOs, policymakers, and financial experts

- Explore innovations in AI, sustainable finance, and emerging investments.

- Gain clarity on navigating market cycles, valuations, risk and asset allocation in uncertain times.

- Build connections and forge partnerships through networking opportunities.

ARTICLES

China is a good cyclical market to play; India still most expensive relative to other EMs

Arjun Divecha, Partner and Head of Emerging Markets at Boston-based investment firm GMO, is in the middle of roadshows across North America for his ne…

Valuations still 'expensive', even after the drawdown: Expert takes from MC Global Wealth Summit

A panel of top money managers at the Moneycontrol Global Wealth Summit echoed the need for caution in investing in the broader market space, as valuat…

Identifying multi-baggers: Chris Mayer, author of 100-Baggers, shares the key metrics that drive his investment decisions

The best businesses trade at high valuations because they are well discovered but investors shouldn't be too value sensitive, said Chris Mayer, portfo…

Weak currency is a good thing for the country: Arjun Divecha, Emerging Markets Head, GMO

India benefits from strong macroeconomics which gives it an edge over many other emerging markets. A "weak currency" further acts as a favou…

Markets simply don’t predict the future, they’re also compensating for the past: Samir Arora

Samir Arora, founder of Helios Capital, said that he never believes that markets predict the future. They are also compensating for the past Speaking…

'Last 5 years taught me that ...': Devendra Fadnavis on potential alliance with Uddhav Thackeray, Sharad Pawar

Maharashtra chief minister Devendra Fadnavis on Friday ruled out the possibility of joining hands with Uddhav Thackeray or Sharad Pawar but added that…

'He has that face': Fadnavis quashes 'sulking' Shinde rumours

Maharashtra Chief Minister Devendra Fadnavis on Friday refuted rift rumours of rift with his deputy Eknath Shinde. Fadnavis, in an interview to Money…

Will turn Maharashtra into $1 trillion economy by 2030: Devendra Fadnavis at GWS 2025

Chief minister Devendra Fadnavis on Friday expressed confidence that his government will turn Maharashtra into a $1 trillion economy by 2030, noting t…

'Mumbai becoming startup capital of India': Devendra Fadnavis's top quotes at GWS 2025

Chief Minister Devendra Fadnavis on Friday said Maharashtra will be a $1 trillion economy by 2030. He was speaking to Moneycontrol's managing direct…

Devendra Fadnavis says startups returning to Mumbai from Bengaluru: 'We are seeing reverse migration'

Maharashtra chief minister Devendra Fadnavis on Friday asserted that Mumbai is now becoming the leading startup hub in India, with a reverse migration…

Don't expect a V-shaped market recovery as that needs govt's intervention: Samir Arora

Ace market investor and Helios Capital founder Samir Arora on March 7 said he doesn't expect a V-shaped market recovery as that would require "go…

Shankar Sharma and Samir Arora face off: Who will win?

Renowned markets investors Shankar Sharma, founder of GQuant Investech, and Samir Arora, founder of Helios Capital, faced off in a fiery debate at the…

'Real bear market only in India': Veteran investor Shankar Sharma says Nifty will give zero returns for the next 5 years

Ace investor Shankar Sharma held a bearish view on the Indian stock market, saying that the benchmark index Nifty 50 is set to give zero returns from …

Full transcript: Ashmore Group CEO Mark Coombs's interview at Moneycontrol Global Wealth Summit

At the Moneycontrol Global Wealth Summit, Ashmore Group CEO Mark Coombs on Friday shared his insights on emerging markets, US tariffs, India’s investm…

Unable to sell some of my smallcap holdings, hoping for bull market in 2030: Shankar Sharma

Shankar Sharma, ace market investor and founder, GQuant Investech on March 7 said he's unable to sell some of his smallcap holdings and is waiting for…

Daily SIP will become an even bigger 'rage' than Rs 250 SIP, says SBI MF's DP Singh

One of India’s largest mutual funds in terms of assets under management, SBI MF’s Joint CEO DP Singh said the fund house is very excited about daily S…

Derivative curbs were 'necessary', says Sebi's Ananth Narayan, NSE's CEO says contract sizes still 'very small'

Capital market regulator Sebi's whole-time member Ananth Narayan said it saw as 'necessary' the need to reduce options activity in the derivatives mar…

GWS 2025: Offices will continue to dominate REIT space, say industry players

Top leaders of the office real estate investment trust (REIT) space said that offices will continue to dominate the segment, with Blackstone and Sattv…

All exchanges need to have common day for F&O expiry: NSE CEO Ashish Chauhan

NSE MD & CEO Ashish Chauhan on March 7 said all exchanges need to have a common expiry day for derivatives contracts, as otherwise many other …

Full transcript: Ace investor Howard Marks' interview at GWS 2025

Veteran investor Howard Marks on Friday had a wide-ranging conversation at the MoneycontroL Global Wealth Summit 2025 on the global business environme…

A lot of family offices currently haven't seen a bear cycle: Sharrp Venture's Abishek Laxminarayan

Newer Indian family business offices which have started working in the last few year, have not been a part of a bear cycle, and therefore have a diffe…

Market veterans Utpal Sheth, Sunil Singhania, Prashant Jain, Ashmore's Rashi Talwar on ideas for wealth

India’s top money managers and veteran market voices weighed in on the global factors and the recent selling in equities, during a panel discussion at…

As more women enter workforce, consumption trends will emerge: Ashmore Investment's Rashi Talwar Bhatia

The transformation of consumer behavior, driven by the increasing participation of women in the workforce, is shaping the next big business opportunit…

Every market euphoria needs a correction; resets are healthy; says Sunil Singhania of Abakkus

Every market euphoria or excess eventually requires a reset, and what follows is often healthier, said Sunil Singhania, founder of Abakkus Asset Manag…

Singling out IPO companies as big cause of value destruction is not right: Jefferies' Jibi Jacob

Jibi Jacob, MD and Head of Equity Capital Markets, Jefferies India said on March 7 said it won't be fair to single out IPO companies alone as a big ca…

Full transcript: SEBI chief Tuhin Kanta Pandey's address at Moneycontrol Global Wealth Summit 2025

SEBI chairman Tuhin Kanta Pandey on Friday praised India's economic resilience and emphasised on the need for long-term capital to drive economic grow…

'Buffett won the lottery by being born as a white male in America,' says legendary investor Howard Marks

Oaktree Capital Management Co-Chairman Howard Marks said he and veteran investor Warren Buffett had "won the lottery" by being born as a whi…

It's just a matter of time that private capex will happen, says Mahindra Group's Anish Shah

Anish Shah, Group CEO & MD, Mahindra Group on March 7 said he's very optimistic about Indian economy and that "it's just a matter of time…

IDFC First Bank CEO bats for digitalisation, says 'super important' to multiply savings of middle class

Growing digitalisation can make "wealth management more accessible" to all rungs of society, IDFC FIRST Bank CEO V Vaidyanathan has said, ad…

India needs a ministry like DOGE, says Neelkanth Mishra

Neelkanth Mishra, Chief Economist at Axis Bank, Head of Global Research at Axis Capital and UIDAI Chief, said in a fireside interaction at Moneycontro…

Every indicator points that gold prices will go up, says World Gold Council CEO David Tait

Gold is an important asset class to have in a portfolio and even the central banking community sees it so, World Gold Council chief executive officer …

India on its way to becoming an asset class, holds lot of long-term potential: Ashmore Group's Mark Coombs

"India is one of the economies that we've decided we want to be a long term investor in", says Mark Coombs, CEO, Ashmore Group. During a fireside cha…

Bold reforms need not be big bang, says Sebi chairman Tuhin Kanta Pandey

Bold reforms need not be big bang, and going forward, the capital market regulator will use the right mix to achieve its objectives, Sebi chairman Tuh…

Howard Marks at GWS 2025: ‘US interest rates are not high, just higher than the recent past’

US interest rates are not historically high but rather within the bounds of normalcy, according to Howard Marks, Co-Chairman of Oaktree Capital Manage…

We need foreign investors to support growth, happy to engage with FPIs, AIFs: SEBI chief Tuhin Kanta Pandey

The new SEBI chief Tuhin Kanta Pandey on March 7 said India needs both domestic and foreign investors to support growth. Speaking at Moneycontrol Glo…

SEBI needs to be more transparent on issues of conflict of interest: Tuhin Kanta Pandey

The Securities and Exchange Board of India (SEBI) needs to be more transparent on conflicts of interest of its board, said capital markets chief Tuhin…

SEBI chief Tuhin Kanta Pandey praises India's resilience despite global headwinds

SEBI chief Tuhin Kanta Pandey on Friday said that India is looking to spur growth beyond the projected outlook and praised the economy for exhitibing …

‘Growing Indian miracle’: Legendary investor Howard Marks says don’t want to miss out on India of the next 10 years

Oaktree Capital Management Co-Chairman Howard Marks said an investor who is not confident about making risky bets and can’t be a high-level thinker, s…

India more attractive than China structurally, says Ashmore Group’s Mark Coombs

Ashmore Group CEO Mark Coombs on Friday highlighted India’s long-term structural appeal compared to China. He noted that while China is poised to beco…

Optimism has prevailed for the past 16 years, said Howard Marks, Oaktree Capital

The pandemic-related downturn didn't last or have a profound effect on the markets. Optimism has prevailed for the past 16 years, since the Global Fin…

Howard Marks says AI will change the world but market judgement awaited on stocks’ valuation

Artificial Intelligence is expected to change the world, much like the internet did in the late 1990s, but assumptions about its market impact and the…

Howard Marks says he is optimistic on India, lauds its 'incredibly constructive government'

Oaktree Capital Management Co-Chairman Howard Marks said he is currently very optimistic on India. While speaking at the Moneycontrol Global Wealth Su…

'I don’t see massive psychological excesses today,' says Oaktree's Howard Marks

Howard S. Marks, co-chairman of Oaktree Capital Management, said he does not see excessive investor exuberance and noted that recent economic and mark…

GWS 2025: Howard Marks on India's potential, Trump impact, value investments & more | Top quotes

Billionaire investor Howard Marks on Friday shared his perspective on the global business environment, current investment trends and the future of eme…

PARTNERS

-

Presented By

Faq's

The summit brings together global leaders, policymakers, investors and industry experts to explore strategies for wealth creation, understand evolving market dynamics, and discover innovative investment opportunities shaping the future of global finance. It serves as a platform for exchanging ideas, fostering collaboration, and driving actionable insights that empower participants to navigate uncertainties and capitalise on emerging trends in a rapidly changing economic landscape.

The summit is being held in Mumbai on Saturday, March 14th, 2026.

The summit does double up as a networking session and social event where you can connect with fellow attendees, speakers, and experts in the field.

While event recordings or materials may not be distributed, we encourage attendees to participate in person and take notes. Follow the event’s social media channels for key updates and insights.

To make the most of the conference, review the schedule to familiarise yourself with the speakers and their work. The summit also allows guests to engage with other attendees to maximise learning and networking opportunities.

Yes, throughout the day, there will be tea/coffee, lunch, and dinner in the networking zone.