Indian banks have aggressively ramped up lending to mid-sized companies sensing an opportunity in the booming market. Banks are tapping their own channels and fintech partnerships to reach out to potential borrowers.

An analysis of the numbers released by the banks shows that micro, small and medium enterprises (MSME) portfolios of major banks have seen double-digit growth on a year-on-year basis (YoY) as of March 2023.

Fund-starved Indian MSMEs have a credit demand of Rs 53,000 crore, according to an April 2023 Avendus Capital report on MSME credit demand

The numbers

To give a perspective, the State Bank of India (SBI) recorded an 18 percent YoY growth in its MSME portfolio over one last year. The bank’s MSME advances stood at Rs 3.59 lakh crore in March 2023 compared to Rs 3.05 lakh crore in March 2022. The segment had seen just 8 percent growth from March 2021, when the bank’s portfolio stood at Rs 2.78 lakh crore, to March 2022.

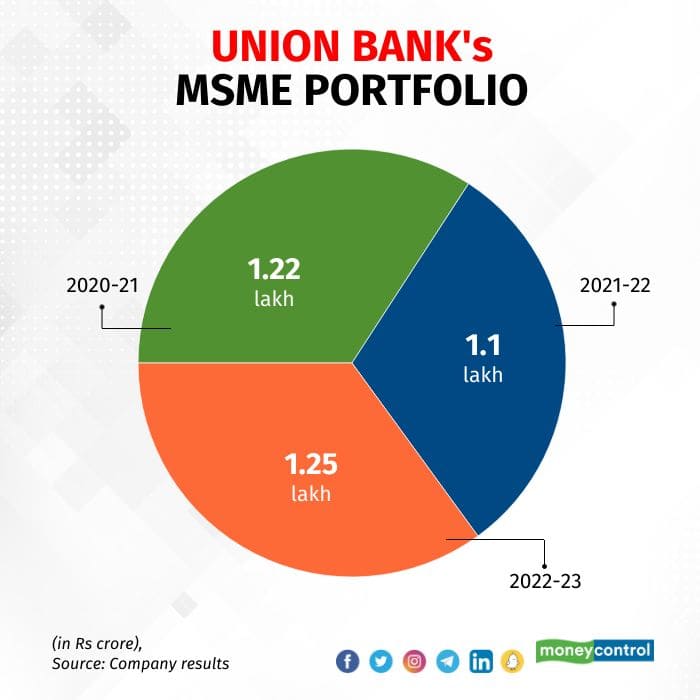

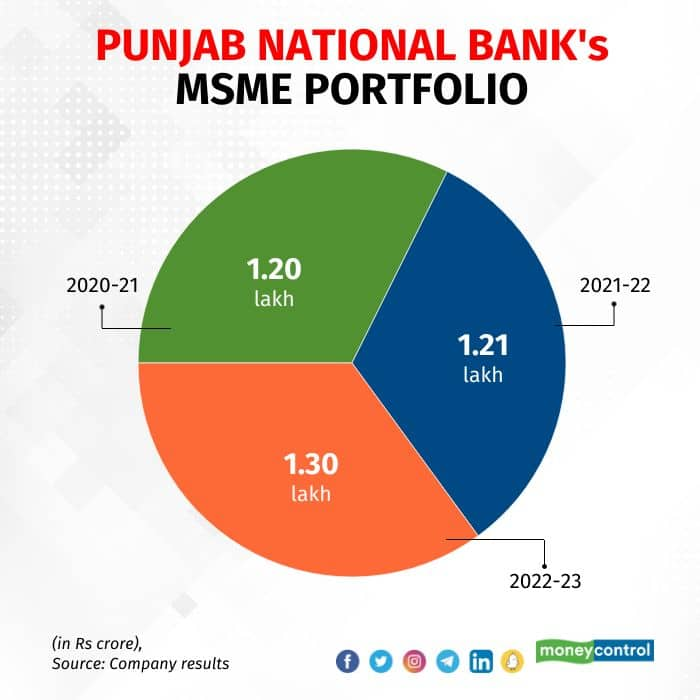

Another state-run lender, Union Bank of India, saw a 13 percent YoY growth in its MSME portfolio where it grew from Rs 1.10 lakh crore in March 2022 to Rs 1.25 lakh crore in March 2023. On the other hand, a year before, the bank’s MSME portfolio till March 2021 stood at Rs 1.22 lakh crore, which witnessed a de-growth of 10 percent till March 2022.Punjab National Bank saw a 5 percent growth in its MSME portfolio YoY.

The bank’s portfolio in March 2023 stood at Rs 1.30 lakh crore compared to Rs 1.21 lakh crore a year ago. This growth comes after the bank witnessed a mere 1 percent growth from March 2021, when it was Rs 1.20 lakh crore, to March 2022.

According to the Reserve Bank of India’s April 2023 sectoral deployment credit growth data, outstanding bank credit to MSMEs was Rs 33.7 lakh crore as of April 2023, a 7 percent YoY growth.

The trend is significant as in the past banks have taken a cautious approach while lending to MSMEs as the percentage of NPAs from the segment is traditionally high. In the event of an economic downturn, MSMEs take the hit first compared with larger companies.

The RBI push

In April 2023, Reserve Bank of India (RBI) Deputy Governor M Rajeshwar Rao had said that banks and other financial institutions should see MSMEs as an opportunity to push more credit.

“A critical issue in India’s credit market has been the consistent gap between the demand and supply of credit to MSMEs. This has to be seen as an area of opportunity by the banks and other financial institutions,” Rao had said.

Experts said that banks are looking at expanding their portfolio to different geographies and this growth, among individual banks and the overall banking sector, is an indicator of the same.

"The MSME sector is a good opportunity for banks to lend to diverse sectors and geography and create a diversified portfolio," said Shyam Mani, Group Head, CSB Bank.

Gopinath Rao, Deputy Director, MSME Development Institute, said banks have been aggressively trying to meet the credit demand from MSME players.

“Banks have a bigger portfolio of MSME loans and they are constantly trying to lend more through different channels of partnerships,” Rao said.

Co-lending and partnerships

Banks, both public sector and private sector, are also aggressively lending to MSMEs through co-lending and partnerships with non-banking finance companies (NBFCs) and fintechs.

SBI has such arrangements with NBFCs and fintech companies like Vedika Credit Capital, Save Microfinance, Paisalo Digital, U GRO Capital, Capri Global Capital and Adani Capital.

The country’s largest private sector bank, HDFC Bank, on June 7 partnered with the Small Industries Development Bank of India (SIDBI) for lending to MSMEs.

Some small banks are also tapping co-lending and partnership models for MSME lending.

Kerala-based CSB Bank partnered with fintech Yubi Loans in January 2023 for lending to SMEs.

Also read: Growth-hungry NBFCs want a bigger share of MSME loan market

Experts highlighted that the credit demand from MSMEs is met with bank partnerships and co-lending deals, which also help banks to reach a wider network.

“If a bank wishes to expand to a new market, generally it would have to set up a physical branch which would involve lots of financial investment. To counter this, they are partnering with NBFCs and fintech players as they can flexibly work on lending to MSMEs,” said Varun Sharma, Director, Advisory, FinAccountants.

“Partnerships are an important move to strengthen distribution in the SME business. Marketplace platforms are a critical forum for us to showcase our products and services and in turn acquire curated proposals with good hygiene. We wish to continue and expand such partnerships,” said Mani.

Experts also highlighted that with banks aggressively lending to MSMEs through co-lending models, the overall MSME sector could have larger benefits.

"This collaborative approach between banks, NBFCs, and fintechs empowers MSMEs to navigate the financial landscape with confidence. The co-lending models and partnerships leverage collective expertise and resources, enabling MSMEs to thrive," said Hemang Mehta, Chief Risk Officer, Vivriti Capital.

Hardika Shah, said Founder and Chief Executive Officer (CEO), Kinara Capital said: "For banks, co-lending enables them to leverage the last mile reach of NBFCs, the tech enabled underwriting, and extend their lending services to a wider customer base. It also helps them to meet their Priority Sector Lending goals."

Will co-lending backfire?

Banks need to be cautious about the underwriting standards while partnering with NBFCs and fintechs, said experts.

For banks when they are looking at partnerships and co-lending with NBFCs and fintechs, experts said there are some things to consider and check on. Firstly, banks have to be conscious of the underwriting standards of NBFCs.

“Ignoring the underwriting standards operated by NBFCs could create problems for banks in the future,” said Challa Sreenivasulu Setty, Managing Director, SBI.

Speaking at the IMC Chamber of Commerce and Industry’s banking and finance conference on May 12, Setty highlighted that banks have to assess the portfolios of the institutions they are partnering with.

Echoing this, Sharma said that banks when working on a partnership can have a mechanism wherein they assess their partner’s underwriting practices every six months.

“A thorough check every six months by banks can help banks mitigate problems easily,” Sharma said.Stay ahead. Stay profitable. Track the Key Performance Indicators of your business through various Utility Tools here. Get smart analysis on the go!!!