The Indian Startup ecosystem is basking in a golden period. Many entrepreneurs are swiftly innovating and building in India for the world, thus partaking in the flourishing India growth story. Therefore, it becomes more pertinent that they have the right resources and opportunities at the right time to take the big leap and thrive.

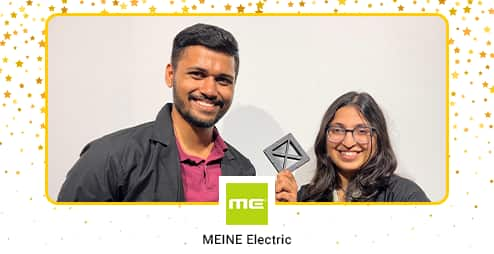

With this intent, IDFC FIRST Bank has joined hands with Moneycontrol and CNBCTV18 to create ‘Leap To Unicorn’, a one-of-its-kind Founder Success Program that provides mentoring, networking, and fundraising opportunities for India’s most promising startups through a meticulously planned journey.

.png)

_Original Logo.png?impolicy=mchigh)

.png?impolicy=mchigh)

.png?impolicy=mchigh)

.png?impolicy=mchigh)

.png?impolicy=mchigh)