What prompted the government to change its mind on the taxation of debt funds in such a short window—barely two months from when the Budget was presented—is not clear. A partial even if simplistic answer can be found by asking a question: Does the government believe that people are paying less tax than they should?

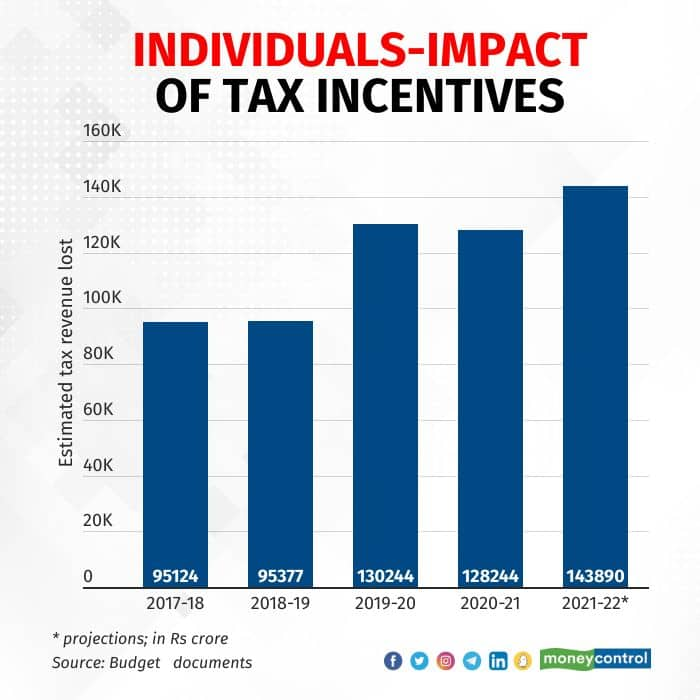

One way to get an answer is to see the benefits availed by individuals in the form of tax incentives, data on which is made available when the budget is presented. In 2021-22, the government estimates a total of Rs 143,890 crore is the impact of the tax incentives given to individuals, in the form of deductions. Five years ago, this amount was only Rs 95,124 crore and has risen steadily.

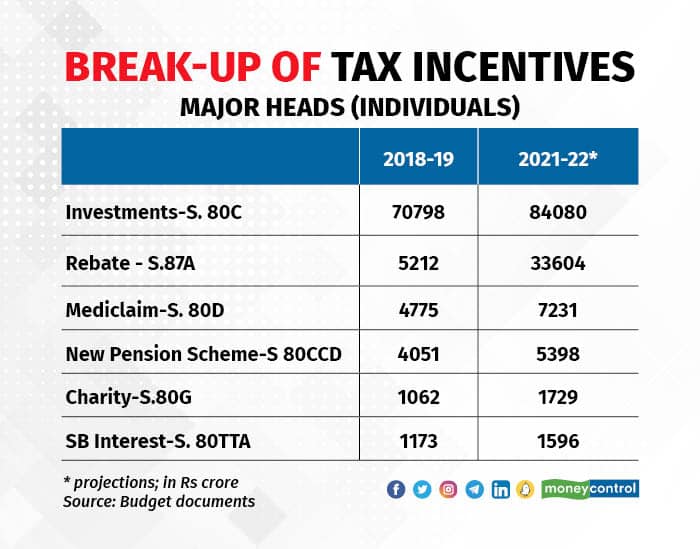

What are these incentives? Most of the incentives considered here are in the form of tax deductions or rebates. The Section 80C benefit alone—tax-saving investments up to Rs 150,000—contributed to 58 percent of the tax incentives, apart from others such as incentives for Mediclaim, charitable donations, new pension scheme contributions and savings bank interest.

But a sizeable sum in recent years has been the rebate under Section 87A that is available to people with taxable income of up to Rs 5 lakh. This sum contributes to 23 percent of the tax impact and is chiefly responsible for the increase from five years ago. While the limit itself has been unchanged, perhaps as more people join the workforce at these income levels, they are availing of these benefits.

Moreover, in Budget 2023, the government’s direct tax proposals meant foregoing revenue of an estimated Rs 38000 crore at the gross level. Most of these can be attributed to benefits for individuals. These include an increase in rebate for those availing of the new tax regime, a wider applicability of the standard deduction benefit and a reduction in the additional surcharge on the highest tax slab from 37 percent to 25 percent. Thus, one can expect amount lost to tax incentives to increase in the coming years as well.

Note that this revenue impact does not include the benefits availed due to standard deductions or even exempt income such as interest on EPF and PPF accounts, under Section 10, and even the benefit of notional loss on house property (interest income). If you add these benefits, then the tax benefits to individual taxpayers will swell further.