Netflix, the world’s largest streaming service by paid users, slashed prices across all subscription plans by as much as 60 percent, hoping to lure more subscribers and making competition tougher in the crowded over-the-top (OTT) market in India.

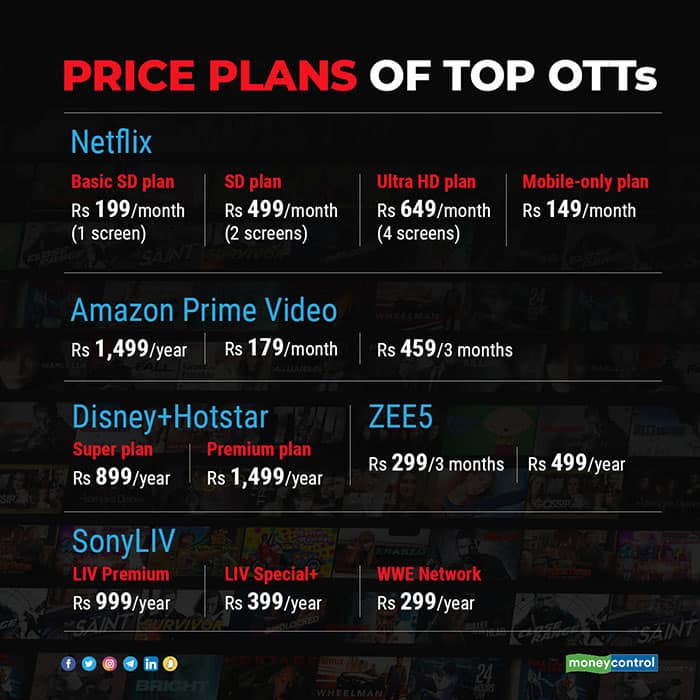

Its basic standard definition monthly plan with one screen will now cost Rs 199, which is 60 percent cheaper than Rs 499 earlier, whereas the high-definition plan with four screens has been reduced to Rs 499 per month from Rs 649. The mobile-only plan has been cut 25 percent to Rs 149 a month.

While Netflix’s decisions will intensify competition, its rivals are unlikely to cut prices, analysts said.

“Netflix going for a larger target audience and making their service more affordable will be a negative for broadcaster-OTT apps as competition intensifies and this may also keep a check on their ARPUs (average revenue per user) as they may be unable to raise prices significantly,” said Karan Taurani, senior vice-president at Elara Capital. “Disney+ Hotstar is almost on par with Netflix now with this new plan.”

Disney+ Hotstar offers its Super plan for Rs 899 per year and its premium annual plan costs Rs 1,499.

OTTs operated by broadcasters including Zee Entertainment’s Zee5 and Sony’s SonyLIV are available at lower price points than Netflix. While Zee5 offers a three-month plan at Rs 299 and an annual plan at Rs 499, SonyLIV has LIV Premium at Rs 999 for 12 months, LIV Special+ at Rs 399 for 12 months and WWE Network at Rs 299 annually.

“We don’t expect other platforms to relook at their prices as they are operating at price points far lower than Netflix’s reduced pricing,” said Shailesh Kapoor, CEO of Ormax Media, a media consulting firm.

Nailing India’s market

Analysts said Netflix, which hosts hit shows such as Money Heist and Squid

Games, may have cut prices to attract more paid users in India, which is expected to be one of the largest markets for streaming services globally.

Taurani said there is increased focus on India as Netflix continues to expand aggressively in the market, considering cheap data, a youthful audience and growth opportunities in the smaller cities and towns.

Experts said Netflix has 214 million paid subscribers globally, of which 30 million are in Asia. While Netflix reported a strong increase in the number of paid users in 2020, subscriber additions slowed this year and this may have prompted the pricing plan changes.

Netflix India’s revenue surged 65 percent year-on-year in FY21 as the pandemic accelerated a shift towards digital media, said Taurani.

Nitin Menon, cofounder of NV Capital, a credit fund for the media and entertainment sector, noted that Netflix’s plan is to push into the smaller cities and towns and this is when it will be aggressive in India.

Revenue share

Although Netflix has only an estimated 5 percent of the country’s OTT subscribers, it dominates the Indian market by subscriber revenue.

Netflix had a 36 percent market share in India’s subscription video on-demand (SVOD) market. It remains the most dominant player in pureplay video OTT service, said Taurani.

Media Partners Asia, an advisory, consulting and research services firm, noted that Netflix leads in terms of SVOD revenue share, followed by Disney+ Hotstar with 25 percent and Amazon Prime with 22 percent market share.

However, it pointed out that Disney+ Hotstar, which has a lower subscription price than Netflix, has the largest number of subscribers, accounting for 50 percent of the market, followed by Amazon Prime with 19 percent and Netflix with 5 percent.

Disney+ Hotstar had 35.1 million subscribers in June this year (26.3 million in December 2020), Amazon Prime Video had 18 million (17 million) and Netflix 4.6 million (4.2 million), according to MPA’s July 2021 report. The number of subscribers is expected to increase to 46 million, 21.8 million and 5.5 million by the end of December for Disney+ Hotstar, Amazon Prime Video and Netflix, respectively.

Menon estimates Netflix will see a double-digit growth in subscribers due to changes in its plans. He pointed out that there are about 100 million subscribers in the Indian SVOD market and Netflix has a lot of catching up to do.

“India is where they are going to get subscribers. They will go on tinkering with prices to boost up paid users because they have plateaued in terms of the subscriber base,” said Menon.

Kapoor of Ormax said Netflix’s high price point had been a deterrent for potential subscribers.

Overdue rationalisation

“Netflix is a premium platform, but even for a premium platform, it was priced too high compared to other leading players in the market like Amazon Prime Video and Disney+ Hotstar,” said Kapoor.

The price rationalisation was long overdue and is a wise move, Kapoor said.

“The price reduction should boost subscribers in India and eventually, revenue too. In our estimate, Netflix has about 6 million paid subscribers in India currently, which is about one-third of Amazon Prime Video’s subscriber base. The price cut should boost this 6 million number,” he said.

Taurani expects a flash sale or low-ticket weekly plans by Netflix in the next few years in India, as the country is a price-sensitive and value-centric market for digital content.

Menon also pointed out competition from new and upcoming OTT players.

“Hayu, which is a subscription platform from Universal Studios, has entered the Indian market. Three big studios – Disney, Universal and Warner – are in the streaming space and with Universal having backing from Comcast, capital will not be an issue. HBO Max (which is expected to enter India soon) will spend money to get subscribers. I see lot of innovation happening in India,” Menon said.

Cost of content

While subscription prices may be going down, the cost of content will only increase due to the streaming wars.

“Netflix’s price change will lead to a sharp increase in content cost. We expect content cost to move up almost 30 percent annually over the next two years as existing apps spend more and more new OTT apps emerge,” Menon said.

Taurani said the shift towards large-scale content in Tamil, Telugu, Malayalam, Kannada and other languages is the next big opportunity for Netflix in the medium term.

“The company has also been aggressive in acquiring film content, both direct OTT and post-theatrical releases, which shows its intent toward content from India,” he said.

Taurani added that the price cut by Netflix will push broadcaster-OTTs to invest heavily in new content and revisit their content strategy.

“Given these scenarios, the path to profitability would be delayed further for broadcaster-OTTs such as SonyLIV, Zee5 and Disney Plus, unless there is consolidation,” he said.

Netflix also plans to push mobile viewership, having cut the mobile-only plan by 25 percent.

“About 80 percent of viewership on OTT is mobile-led. It’s the same as internet penetration because smart TV and broadband penetration is low,” said Taurani.