Highlights - Significant decline in volume - Macroeconomic and regulatory challenges stay - Operating margin bottoms out, looks up in Q3 FY20 - Business outlook weak for the short term - Buy with an eye on the long term --------------------------------------------------

It turned out to be an uphill climb for India's leading two-wheeler player Hero MotoCorp Ltd (HMCL) (CMP: Rs 2,440, Mcap: Rs 48,767 crore), which drove into a soft patch during the December quarter.

Top line went off-track after a significant drop in volume. The story could have been worse but for a better realisation, which cushioned the blow.

Operating profitability looked up, primarily because of higher spare sales, cheaper raw material and cost control undertaken by the company.

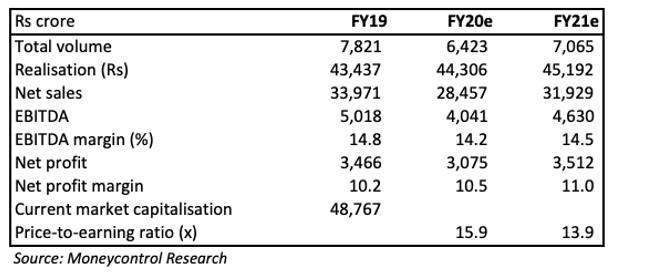

Subdued demand is expected to continue in the near to medium term. However, we believe that long-term demand outlook in India remains promising. We advise investors to accumulate this fundamentally strong business at a reasonable valuation (14.4 times FY21 earnings).

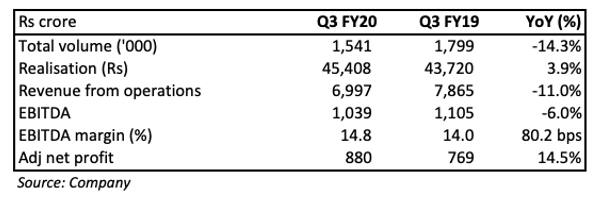

Quarterly snapshot

Year-on-year (YoY), net operating revenue fell 11 percent, hurt by a volume contraction of 14.3 percent. Average realisation, however, rose 3.9 percent on the back of a price increase and higher sales of spare parts.

That rubbed off on earnings before interest, tax, depreciation and amortisation (EBITDA) margin, which expanded 80 bps on a YoY basis.

Muted demand The two-wheeler (2W) industry continues to face headwinds in the form of a significant decline in demand.

There is more. Factors such as the heightened liquidity crunch, non-availability of retail finance, increase in total cost of ownership driven by implementation of long-term mandatory insurance and safety regulations and slowdown in economic activity have all taken a toll on the demand for two-wheelers in India.

Two triggers for the company stand out -- pre-buying ahead of BS VI implementation and a good Rabi sowing. The management expects an increase of Rs 7,000-10,000 in the price in BS VI compliant vehicles, which works out to nearly 12-14 percent higher cost of ownership. That is precisely what may drive pre-buying. On top of that, expectations of a solid Rabi harvest are expected to boost rural income, which in turn could help Hero.

In the long term, India offers a huge potential to the two-wheeler industry, which is expected to cash in on a likely strong demand from both rural and urban areas because of low market penetration and rising disposable income. The government’s focus on rural India and increase in minimum support price (MSP) are also likely to give a leg-up to the rural market.

Margins on the mend Earlier, the management had talked about margins bottoming out, an offshoot of lower commodity prices, which have come off their previous highs. The auto maker made good use of it in Q3 FY20, also benefiting from inclusion of high-value premium products in its portfolio and the cost realisation programme.

Exports take focus again This is visible from the management sticking to its target of doubling its export footprint to 40 countries over next few years. It has chalked out strategies to scale up exports by entering new markets, including Mexico, launching new products and building its brand through various marketing activities. However, it could be be challenge in the exports space as it is a late entrant and Bajaj Auto has already made a significant presence in those markets.

Attractive valuations Given the depressed demand scenario, the stock has corrected 20 percent from its 52-week high, making valuations reasonable. HMCL is trading at 13.9 times FY21 projected earnings, much lower than its 10-year average forward multiple of 15.4 times. We advise investors to buy this strong business with an eye on the long term.

Risks A prolonged weakness in demand could undermine the company's financials. Additionally, any hardening of commodity prices means higher raw material cost, putting operating profitability under strain.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.