Amol Agrawal

The case of transferring a higher share of Reserve Bank of India’s (RBI’s) reserves to the government has become a thorny issue in the relations between the two entities.

So much so that one of the first decision by the new RBI Governor Shatikanta Das was to appoint an expert committee under former governor Bimal Jalan to review the status and the need of these reserves, and study best global practices followed by other central banks.

We review some of these global practices in this article.

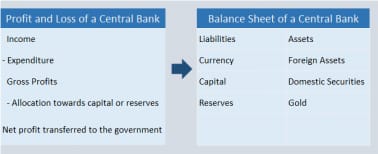

Just like any organisation, central banks have to decide on the allocation of profit after deducting expenditure from income.

The question here is: should the central bank first deploy a part of its profit towards building capital and reserves in order to strengthen its financial position and then transfer the remaining to the government? If yes, the next question will be how should the central bank allocate its profits between its capital and reserves and transfers to the government.

Is there a prescribed rule for this arrangement or is it best left to discretion and judgment of stakeholders?

There has been some recent research on this topic. Two papers are worth mentioning in particular. One by David Archer and Paul Moser-Boehm of Bank for International Settlements (Central bank finances, 2013, BIS Paper No 71) and other by European Central Bank (ECB) economists Daniela Bunea, Polychronis Karakitsos, Niall Merriman and Werner Studener (Profit distribution and loss coverage rules for central banks, 2016).

Archer and Moser-Boehm say that the rule-based regimes have four features: targets for buffers/reserves, retention schemes, dividend smoothing, and arrangements in case of central bank losses. They also add that despite having laws, in most cases central banks are at the mercy of the government. They point to following examples:-The Bank of England is required to distribute to the exchequer 100 percent of any issue department surplus and 50 percent of any banking department surplus, irrespective of the state of equity reserves.

- The Central Bank of Ireland can only retain a maximum of 20 percent of any surplus, independent of the state of equity.

- Having calculated distributable income as a five-year smoothing of accounting income (adjusted for certain revaluation income), the Sveriges Riksbank must distribute 80 percent, irrespective of the equity situation.

- The Bank of Japan may only retain 5 percent of surpluses by right and distribute the rest. However, the minister of finance may allow higher retention.

- Some central banks have targets for reserves. For instance, in Mexico, when reserves become negative, the central bank can retain higher profits to make the reserve in black again.

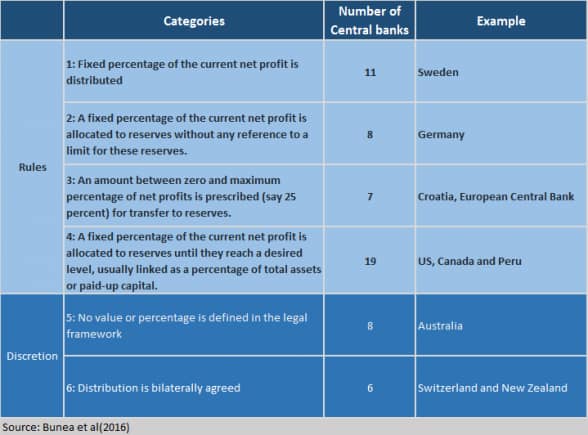

The ECB paper divides different central bank approaches in six categories. They also got responses from 58 central banks on where they fitted across the six categories:

One can read the research paper for more details. But the broad idea is that there is no one way to think about the issue of allocation of central bank profits.

Where does RBI fit in all this? First of all, Section 47 of the RBI Act is on this allocation: “After making provision for bad and doubtful debts, depreciation in assets, contributions to staff and superannuation funds [and for all other matters for which provision is to be made by or under this Act or which] are usually provided for by bankers, the balance of the profits shall be paid to the Central Government."

RBI/India would fall under the fifth category as per categorization by ECB economists.

However, two parts of RBI’s reserves–contingency reserve and asset development reserve–fall under Category 4 as profits were transferred to these two till they reach 12 percent and 1 percent of total assets of RBI by 2005. The eventual share was much higher (20 percent and 2 percent, respectively) and, as a result, no allocation was made into them from 2013-14 onwards.

To sum up, RBI’s expert committee clearly has a tough job on its hands.

First of all, it has to decide the appropriate level of capital and reserves to be held by the central bank and then fix a rule-based regime for the transfer of both current and future surpluses. Though, one should be mindful of these rules as governments can freely tinker with them.

Recently, Turkey made amendments in its central bank act, which pushed it to give an interim dividend to the government ahead of elections. Hence, the allocation rules can help avoid frictions, but at the end of the day, it is a government’s call on whether it wants to accept the rules in the first place or not.

(Amol Agrawal is faculty at Ahmedabad University. The views expressed here are his own.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.