Dear Reader,

The Panorama newsletter is sent to Moneycontrol Pro subscribers on market days. It offers easy access to stories published on Moneycontrol Pro and gives a little extra by setting out a context or an event or trend that investors should keep track of.

All’s not well at DMartville. Avenue Supermarts’ shares were down by 5 percent at noon as investors were disappointed by its December quarter financials. Its sales update that was released in the first week of January had looked fine, with standalone sales up by 25 percent over a year ago and up 9 percent sequentially.

But its financial results showed profit numbers nowhere near as good. Profitability declined and its net profit rose by a mere 6.7 percent YoY. Trading at a price to earnings multiple of nearly 100 times its trailing four-quarter earnings pre-results, that’s not an earnings growth you want to see. Before you think all’s over for the stock, do read our research team’s viewpoint on how DMart’s long-term strengths are intact.

What’s behind DMart’s profitability problem? Its management calls it a mix problem, as its sales of FMCG and staples are rising, meaning to say people are buying ample quantities of soaps, detergents and foodstuffs. Since inflation has hit these items the most with price hikes, it also signals that a fair share of the sales growth is due to inflation. That’s one reason for the hit to gross margins. But a bigger problem is that general merchandise and apparel sales are not doing well and discretionary non-FMCG sales have not done well.

Retail stores such as DMart love customers who come for the staples and stay for the impulse shopping. These could be for anything from kitchen goods, apparel, plastic wares, stationery, premium foods, snacks, home furnishings and the like. These are goods that it earns healthy margins on as several of these are sourced directly by DMart, or private labels as the trade calls them. But, if more people come with a shopping list of essentials, complete it and leave, then that’s not great for business.

While such swings in buying behaviour are not uncommon in retail, this is the second quarter where it’s visible in DMart’s performance. What could explain this phenomenon and given DMart’s large national presence? And is there a larger message for investors? Inflation is one reason. Recently, the finance minister spoke about understanding the pressures being faced by the middle class. It appears that consumers, including those visiting low-cost or value-conscious stores such as DMart appear to be hurting from inflation’s squeeze on their disposable incomes.

From FMCG to durables to even automobiles, those buying premium and luxury products are not altering their behaviour, but the lower and perhaps even middle income segments are tapering their consumption.

But there’s another angle to this. Till some years ago, DMart was quite resistant to e-commerce or even home delivery. This was understandable as its business model relies on consumers walking into its stores. But the inroads made by traditional e-commerce, the pandemic’s hit to mobility during lockdowns and now quick commerce have changed that. Now, DMart has rolled out its growing DMart Ready offering in 22 cities, adding four more cities during the quarter.

Sure, you can always pop up some discretionary items as consumers search for their favourite brand of edible oils on the app. But it’s not the same as getting them to walk through an aisle of personal care products when all they wanted to buy was, say, biscuits. Growing competition from e-commerce and their rising share of sales leave players like DMart with no choice but to shift to the omnichannel path.

Worse, quick commerce competition is being fuelled by venture-funding and while they are racking up losses, the business model seems to have found acceptance with customers. The established e-commerce grocery apps are also rolling out faster delivery windows. What this means is that you can easily feed your impulse, to an extent, even while sitting at home. That’s one less set of cravings for players like DMart to fulfil. And, the people who are likely to adapt to quick commerce are also the ones most likely to binge on discretionary consumption while in the store. If fewer of such consumers are going to walk in, then it could also hurt the sales mix.

What the management makes of these new trends will be interesting to hear, as they have their ears to the ground. Once inflation wanes, as most people are expecting to happen in the near to medium term, the trend could revert. There could be some other trends at play too in how people are shopping. How other brick and mortar retailers are reacting to the changing retail environment may also affect how shoppers are behaving. Are they going to category-specific stores, for example?

DMart’s story is one of the fascinating ones among startups, not just for how it grew an organised retail empire, by charting a unique path and being founded by a famous trader turned investor turned businessman, but also in how it created enormous wealth for its early investors. Given India’s nascent organised retail market, one could say its story has just begun, but how it navigates this period may well define how the next chapter plays out.

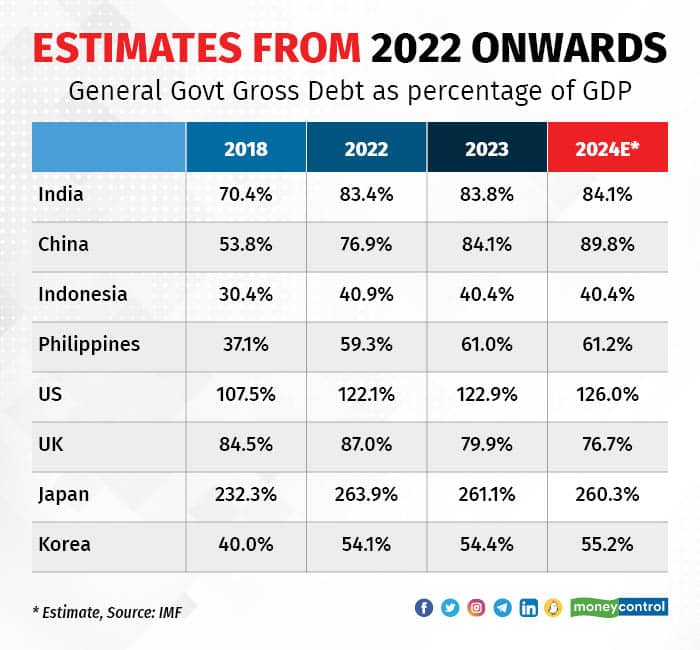

Budget Snapshots: While the Indian government’s gross debt (taking both the Centre and the states) is higher than that of several other countries in the region, it’s much lower than that of the US and Japan, while the Chinese government’s debt is slated to exceed that of India this year.

Investing insights from our research team

These 14 hand-picked stocks will get you ready for the Budget 2023

Budget 2023: Will the government use fiscal war chest, spend big in a pre-election budget?

Better be cautious on Wipro after Q3 FY23

HDFC Bank Q3: Strong balance-sheet growth aids earnings

GM Breweries Q3: Record revenue, robust margins

What else are we reading?

Budget 2023 | Fiscal consolidation or populist tilt? A dilemma for the government

RBI governor's focus on inflation can choke growth

The conflict course in coal import

With a cleaned-up book, IDBI Bank deserves privatisation success

The Eastern Window: China is investing in technology for survival, not global dominance

Government vs Governor: the face off saga

Geopolitics threatens to destroy the world Davos made (republished from the FT)

The Xi Jinping nobody saw coming (republished from the FT)

Why has Davos become an annual pilgrimage for the wealthy & powerful?

RCAP insolvency process shows it’s time to tweak IBC

Aren’t the overseas migrant workers pravasi bharatiya?

Adopt US TSA’s approach to deal with unruly air passengers

Technical Picks: Gold, Power Finance Corporation, Castor seed, Rain Industries, Federal Bank and USD-INR (These are published every trading day before markets open and can be read on the app).

Ravi AnanthanarayananMoneycontrol Pro

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!