Regulators and investors have always had a keen interest in the trades that corporates executives and board members make in their companies’ own shares. The government has to look out for the integrity of financial markets, of course, while investors are eager to ride insiders’ coattails. Unfortunately, it’s never been easy to read the insider tea leaves.

Case in point: A new paper by an influential research group finds that insider trades that are disclosed in an opaque fashion are often, suspiciously, among the most lucrative. When insiders disclose their trades to the Securities and Exchange Commission, they’re often — but not always — coded with a “P” (for purchases) or an “S” (for sales). Any armchair regulator can figure out that something’s fishy when S transactions accumulate just before a negative piece of news that moves the stock. Alas, it’s frequently more complicated than that.

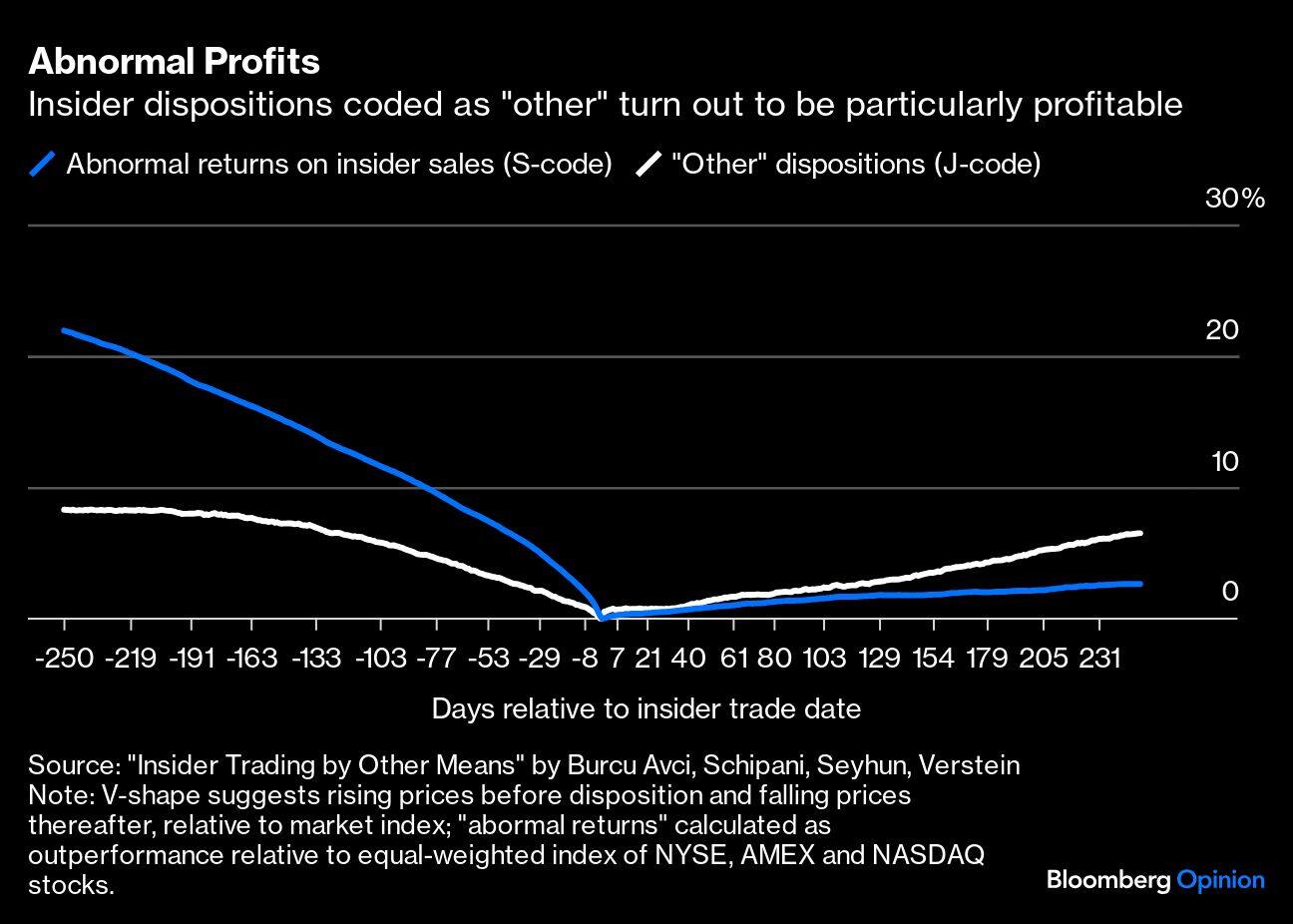

In fact, it turns out that the most profitable trading by insiders doesn’t involve S-coded trades at all, but is instead filed under the umbrella term of “other” dispositions (those with the J code) — a discovery that the researchers suspect is consistent with deliberate and widespread efforts to confuse people and avoid scrutiny. According to “Insider Trading by Other Means,” insider trading involving J-coded share dispositions meaningfully outperforms

the market, and seems to be on few people’s radar. The J-coded trades amount to more than $3 trillion in the sample period and are “mentioned in essentially no criminal indictments, civil complaints, news articles or scholarly papers,” write authors Sureyya Burcu Avci, Cindy A. Schipani, H. Nejat Seyhun and Andrew Verstein. In essence, those profiting from inside information may have found a loophole in the trading disclosure rules that allows them to evade SEC scrutiny.

The key findings are summarized in the following graphic (replicated here courtesy of the authors). It shows what would happen if an investor tracked insiders’ sales and sold on the day of an “other” disposition, reinvesting the proceeds in the market index. The logic is that V-shaped graphics indicate that the shares were transacted near peak prices relative to the market index. The graphic also shows that the effect was significantly more dramatic for J-coded dispositions than for plain vanilla insider sales.

The paper covers a sample period from 1991-2023, but the data also show that the insider outperformance remained quite noteworthy in recent years.

So what does it all mean?

The first takeaway is that tracking insider activity is hard, and the investors who pore over public disclosures looking for leads might have to refine their methods. Second, from the SEC’s standpoint, regulators may need to demand more detailed information on “other” dispositions, as well as retrain humans and computers to crawl for suspicious J-coded transactions.

The SEC press office didn’t respond to emails seeking comment on this paper, and, understandably, they don’t seem to publicize their precise methods for monitoring and auditing the forms where insiders disclose their trading activity. But this research suggests that they have some serious challenges ahead of them.

I have little doubt that they’re paying attention, though. This same group of researchers was widely cited in the SEC’s 2022 changes to insider trading rules, including increased requirements for timely reporting of the equity security gifts.

This appears to be a much larger issue than gifts, and calls for serious scrutiny and a meaningfully larger enforcement staff to tackle it. “It seems to me that the enforcement staff who are there are very productive,” Brian Galle, a professor of law at Georgetown University who recently served as a senior fellow at the SEC, told me in an extremely diplomatic assessment of the situation. “And that implies to me that you could probably add more and still get a lot of productivity out of them.” That should also include, ideally, a stable of top-notch financial economists, so that the SEC doesn’t have to wait for outside researchers to uncover suspicious market outperformance before it can spring into action.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!