Hindustan Unilever Ltd (HUL) reported a decent quarterly performance aided by volume growth and favourable base effect. An improved traction in naturals and a pick-up in rural growth were the key positive in HUL’s December quarter earnings. Further, trend towards higher promotion spending aids category expansion (mainly naturals) and also positions it well against competition.

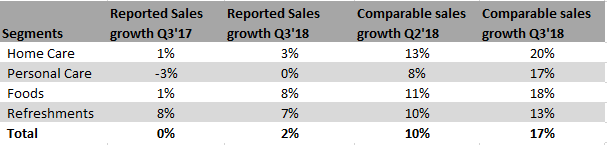

Quarterly update: Comparable sales growth of 17% YoY

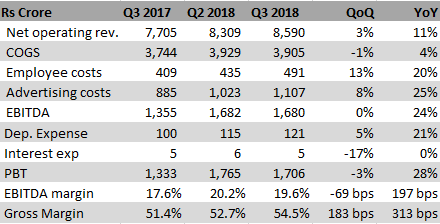

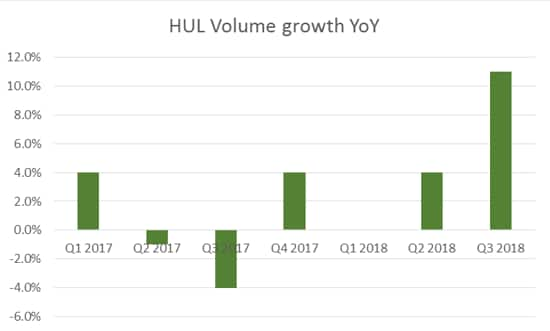

HUL posted a like-for-like domestic sales growth of 17%, taking GST accounting impact into consideration, mainly aided by volume growth of 11 percent. Comparable EBITDA margin improvement of 110 bps YoY was aided by moderate growth in cost of goods sold. Sequentially, reported EBITDA margins have contracted by 69 bps due to surge in employee and advertising cost.

Ad spend were at multi-year high, with the recent spending included campaigns for Lever Ayush, Citra and Indulekha.

Management observed double-digit sales growth for all segments. Home care segment observed double-digit volume growth while personal care gained from broad based growth in hair care. Oral care, unlike previous quarters, reported promotion-led growth. Refreshments segment noticed commendable growth on a strong base.

Overall commentary suggested broad base volume led growth across key brands and both premium and mass categories gaining. Unlike in Q2 FY18, restocking had a marginal role in volume growth this quarter.

Management was quite positive on the campaigns around naturals range led by Lever Ayush campaign. In personal care, Indulekha hair oil witnessed strong growth. Encouraged by the response, Indulekha brand has been extended to shampoo category as well. Overall, company is focusing on three broad trends: incorporating naturals element in existing products (Fair and Lovely Ayurvedic care), building master brand (Lever Ayush) and specialist brands (Citra, Indulekha).

While natural portfolio in itself is small part of overall portfolio, growth is steep. Having said that sourcing natural ingredients can incrementally become challenging as the naturals category gets bigger.

Rural areas growth picked upWhile in last quarter, volume pick up was similar in both urban and rural areas, in this quarter, growth in rural areas was faster. Having said that management pointed out that in the base quarter, rural area was impacted more by demonetization and it would be early to assume that growth in rural areas would be ahead of urban areas in near term.

Positive outlookWhile stock trades at an expensive valuation of 49x 2019e earnings, HUL’s quarterly result suggest steady earnings growth to follow. Trade conditions, both in terms of demand and supply (distribution channels) are normalizing.

Going forward, incremental demand mainly with the revival of consumption demand in rural areas can lead to sustenance of volume growth in near term. Oil price led increasing input cost can pose a challenge in near future which can be partially offset by cost saving program (6-7 percent of turnover).

Overall, HUL with its high rural exposure (40 percent of sales) and well entrenched distribution network, is among the key beneficiaries of further uptick in consumption and related policy announcements, in our view.

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research Page.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!