By Hiren Ved, Director & Chief Investment Officer at Alchemy Capital Management

If you can’t be superlative, you should be good! On that count the budget was not just good, but very good.

The budget achieves a fine balance of maintaining fiscal discipline (though the markets would have been equally comfortable with a 4.5 percent-4.6 percent fiscal deficit), unleashing consumer optimism with a large tax cut and still maintaining capex/GDP at the highest level of 4.3 percent. Investors can also heave a sigh of relief at no increase or tinkering with the much-feared capital gains tax.

In 2019, when economic growth was struggling, the Modi government delivered a corporate tax cut. This time the government rightly, has delivered an income tax cut to lift consumption, and hence economic growth. The tight fiscal discipline allows the RBI to cut rates, which in turn should help consumption as well as aspire for a ratings upgrade which will help lower the cost of capital. The second-order benefit of consumption growth could be bringing in the much-needed private capex. This macro rebalancing of addressing the structural slowdown in consumption while keeping capex engine humming should help the economy exit the cyclical slowdown and regain momentum.

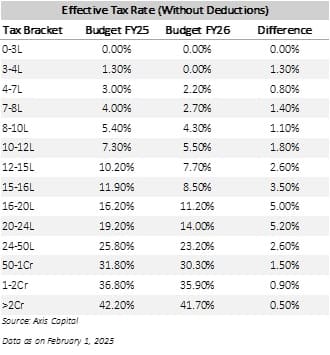

The Rs 1 lakh crore tax stimulus is more impactful in the annual income range of Rs 12 lakh to Rs 50 lakh. Hence higher-end discretionary consumption in sectors (autos, consumer durables, tourism, liquor, QSR, apparel, etc) is likely to do well rather than low-ticket staples. The tax cuts will not only increase consumption but will also increase savings and hence enhanced inflows to equity markets and probably even fixed deposits. We also expect the real estate sector to do well, as enhanced savings lead to more room for EMIs as also presumptive tax on rent for the second home is done away with.

So, has the stimulus in consumption come at the cost of capex?

We don’t think so. The overwhelming perception is that the government has traded the growth in consumption at the cost of capex. This is because most investors read the budgeted allocations of Rs 11.2 lakh crore in FY25-26 V/s the revised estimates for FY24-25 of Rs 10.18 lakh crore, signifying a growth of approximately 10%. However, as the table below indicates if the government ends up executing the capex for the balance of the current fiscal as well as the full budgeted amount of the next fiscal, then the run rate monthly capex at Rs 97,000 crore per month will be 29 percent higher for the next 15 months versus INR 57,000 crore spent per month in the first 9 months of FY 2024-25.

‘Make in India’ is still alive and kicking

The budget continues to give policy stimulus to manufacturing especially in electronic components, EV (electric vehicle) batteries and solar cells and modules by tweaking the basic customs duty to make Indian manufacturing even more competitive. Besides, these traditional areas, the government has given a significant push to labour-intensive areas like shipbuilding, textiles and leather. The outlay on PLI (production-linked incentive) has been increased across the board.

The Risks and Uncertainties

While the government has ignited growth impulse through budget proposals, considerable uncertainties remain from the second-order impact on global growth and supply chain disruptions from President Trump’s trade policies. The government will have to deftly manage the trade tariffs unleashed by the US by negotiating a mutually acceptable trade relationship with the US and other trading partners and seizing the opportunities that could arise for India.

In sum, the budget has taken a bet on both capex and consumption, firing to take India to the vision of Viksit Bharat by 2047!

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!