personal-finance

Why you must review your credit report regularly?

Jun 05, 10:06

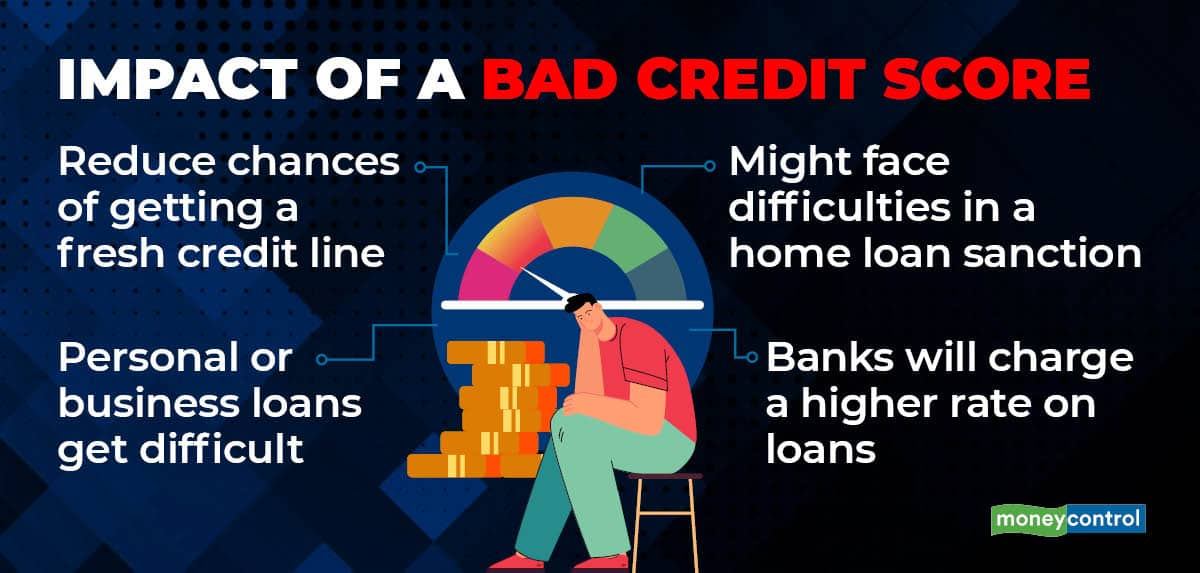

Lately, there are several complaints of fraudulent loan transactions noticed in the credit report by the card users. So, it's important you review the credit report at least once every quarter, and more frequently if you are trying to improve your score. If you see credit accounts that you did not open or missed payments marked on a credit card you never use, you can raise the issue with the respective bureau or lender to rectify. Such errors, if not spotted on time, can lead to long-term consequences that can affect your ability to avail credit. Check your credit report for free once in a year from the credit bureau.