Why equity savings funds have lost sheen?

Sep 20, 08:09

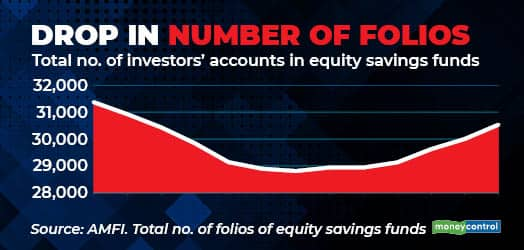

Equity savings funds that combine the characteristics of equity, debt and arbitrage opportunities got fewer investors last year. According to AMFI, the total number of investors' accounts dropped by 3%. Since their equity allocation (equity arbitrage holding) is kept at a minimum of 65%, they give equity tax advantage, just like balanced advantage funds (BAF). But BAFs manage their equity allocation dynamically as equity markets move. Equity savings funds do not; they are comparatively more conservative. That's why, their returns have been lesser than BAFs; though quite decent. But the dynamic nature of a BAF's equity allocations drew more investors to BAFs than equity savings funds, in a raging bull market.