Why are FD rates low despite RBI rate hikes?

Jun 27, 06:06

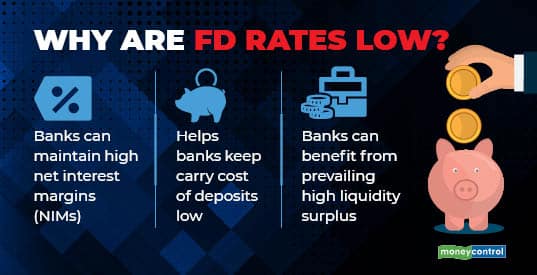

The Monetary Policy Committee's repo rate hikes worth 90 basis points (bps) in May and June marks the beginning of higher interest rates in the country. While banks are quick to pass on the rate hike to loan borrowers, the pass-through to fixed deposit (FD) rates comes with a lag. Since there is adequate liquidity in the system, banks do not have to focus on retail fixed deposits for their needs and lure customers with higher FD rates to park their funds. Secondly, an increase in FD rates, raises the interest burden and the carry cost of deposits for banks. This, in turn, hurts their net interest margins.