Why Adjusted EBITDA needs a closer look

Aug 05, 03:08

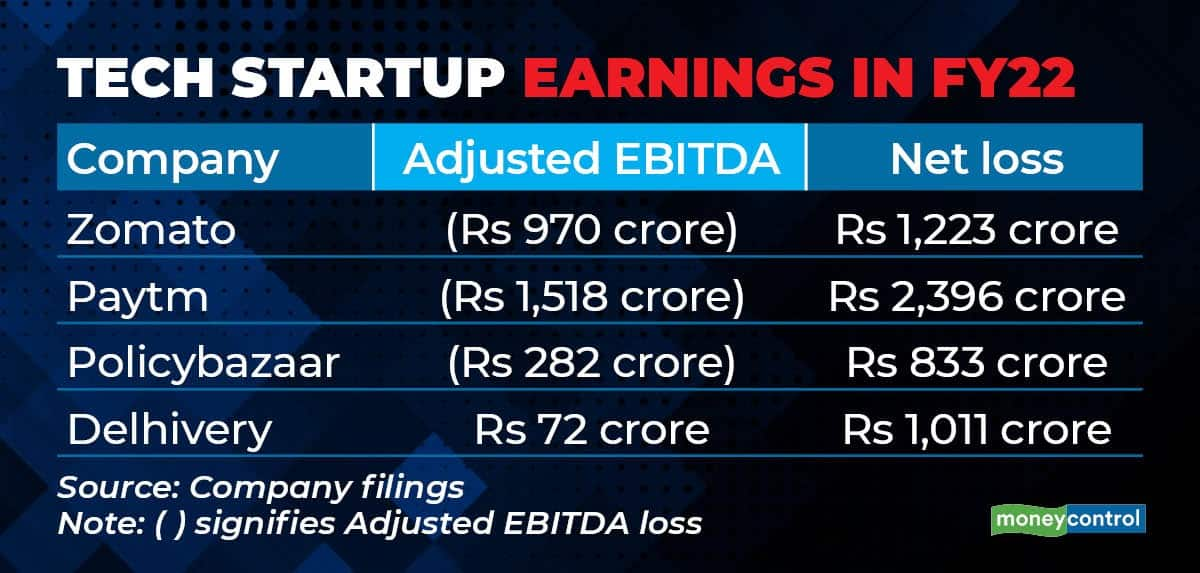

In its June quarter results, Zomato said that the company's food delivery segment has broken even, with an Adjusted EBITDA of zero. Multiple startups have been using this metric since last year, when several went public. What does it mean? Companies such as Zomato, Paytm and Policybazaar define Adjusted EBITDA as 'EBITDA without counting employee stock option (ESOP) costs'. ESOP costs form a lion's share of these businesses' expenses , so excluding them can help mask losses. Adjusted EBITDA can help a promoter keep out any cost he/she wants to. So, should you trust it? Some believe it is a good metric to track loss-making startups, others call it "intellectual dishonesty".