What is banks' PCR?

Aug 17, 05:08

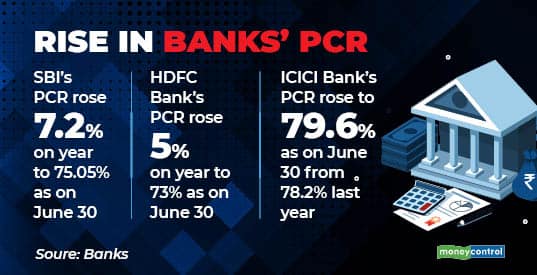

Banks create a pool of funds to cover non-performing assets (NPAs) and potential NPAs and these funds are classified as provisions. Provision coverage ratio (PCR), on the other hand, refers to the percentage of funds created against NPAs. A higher PCR ratio reflects that the bank has sufficient capital to withstand asset quality pressures and will not need significant incremental capital in case of extreme stress. Large banks including State Bank of India (SBI), HDFC Bank and ICICI Bank maintained a PCR of over 70 percent as on June end, which is “prescribed” as an ideal level by the RBI.