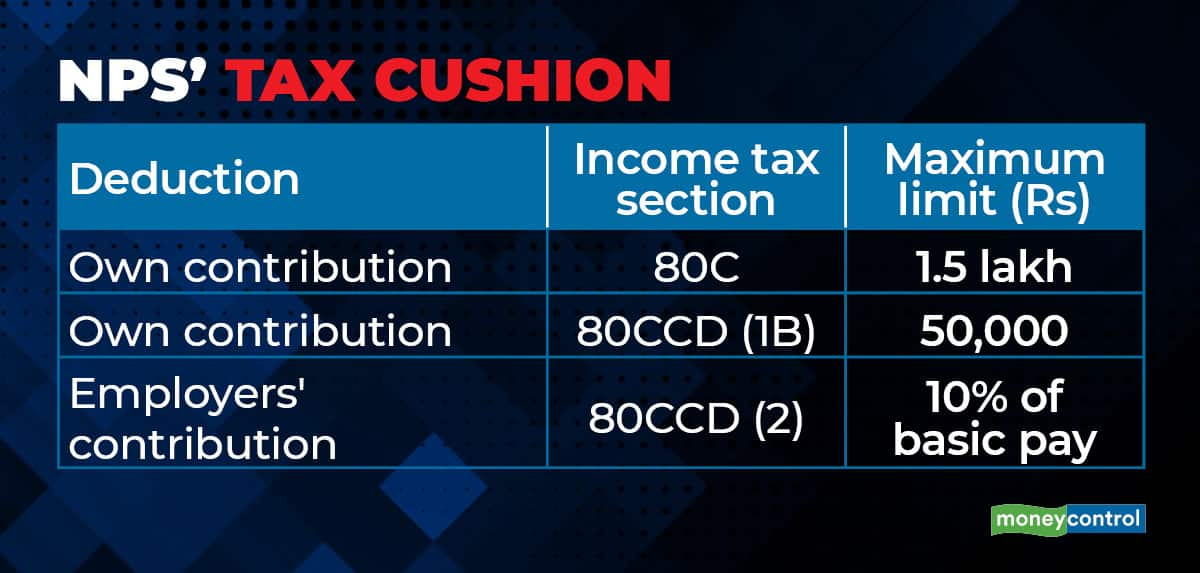

What are the tax benefits that NPS offers?

Feb 09, 08:02

Budget 2022 has brought National Pension System-linked (NPS) tax benefits for central and state government employees on an equal footing. Now, state governments' contribution to their employees' NPS of up to 14 percent of their basic salary plus dearness allowance will be eligible for deduction under section 80CCD (2). The ceiling was 10 percent earlier, which is still the case for private sector employees. This apart, if you contribute up to 10 percent of your basic pay to NPS, it allowed as deduction under section 80CCD (1), though it cannot exceed section 80C's overall Rs 1.5-lakh limit. Over and above this, NPS offers an additional deduction of up to Rs 50,000 under section 80CCD (1B).