What are stage 3 assets in NBFC?

Feb 20, 03:02

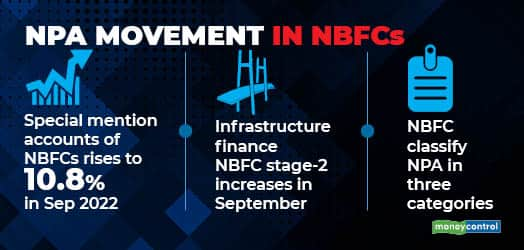

Gross stage 3 assets in non-banking finance companies (NBFC) are loans which have been overdue for more than 90 days. As NBFC follow Indian Accounting Standards (Ind AS), they have to classify bad loans in three categories or stages. Stage 1 which consists of loans overdue by up to 30 days, stage 2 where loans are overdue by 31-89 days, and stage 3 for loans overdue by more than 90 days. But on November 12, 2021, RBI issued circular on the prudent norms on income recognition, asset classification, among others. This was done after observing that some NBFCs were upgrading assets to standard after receiving partial payment.