personal-finance

Your child's tuition fee can get you tax benefits

Mar 09, 06:03

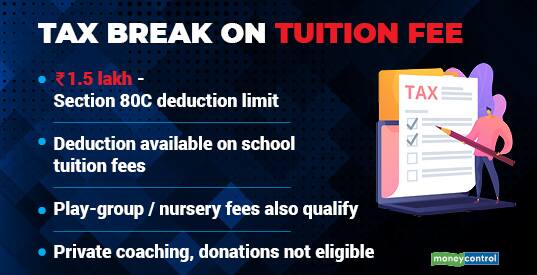

The deadline to make tax-saver investments for the financial year 2021-22 - March 31 - is just a few days away. If you are a salaried person, you may have completed the exercise while submitting investment proof to your employer in January and February. Even if you have missed those deadlines, do not rush to make tax-saver investments eligible for deduction of up to Rs 1.5 lakh under section 80C. Check if you can claim deductions that do not entail fund outflow. For instance, your child's school tuition fees paid can be claimed as deduction. Even play-group, pre-nursery and nursery fees are eligible. The benefit is restricted to two children for an individual.