personal-finance

Will bank fixed deposit rates now go up?

Feb 26, 04:02

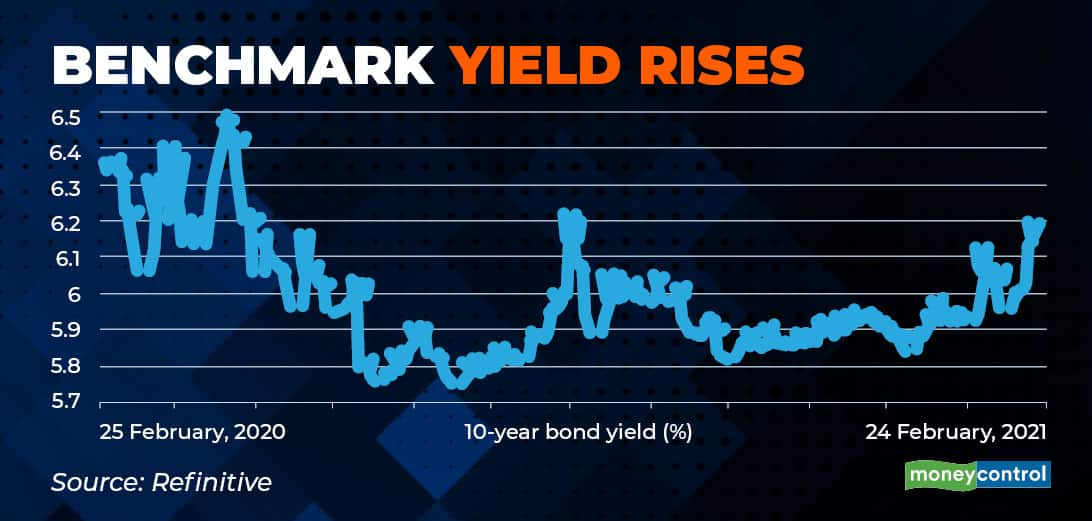

Bond yields have risen thanks to the government's huge borrowing programme. The yield on the benchmark 10-year government security has shot up by around 30 basis points to 6.23 percent since the Union Budget. Government bonds are risk-free securities and thus, an increase in their yield should translate into interest rates rising across the board, including those on fixed deposits. Bond yields and prices move in opposite directions. Falling bond prices mean that investors in long-term bond funds could suffer losses, while those buying shorter-term funds could benefit from higher interest. They can reinvest maturity proceeds at higher rates.