personal-finance

Why should you avoid the dividend option?

Apr 25, 05:04

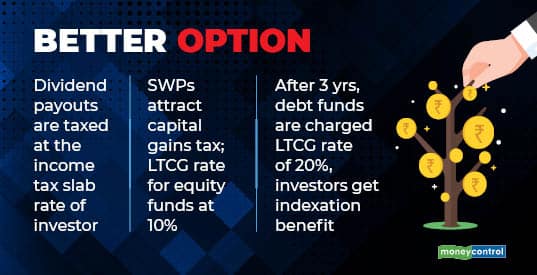

Mutual fund schemes offer dividend and growth options. Often investors looking for regular income go for dividend plans, without realising that these plans are less tax-efficient and are just transferring funds from investors' own investment corpus. Is there a better way to get regular income from MFs? Enter systematic withdrawal plans (SWPs). While dividends get taxed at your income tax slab rate, SWPs are taxed as capital gains. It is advisable to start your SWP after at least a year of your investments, because then your equity MF investment qualifies for long-term capital gains (LTCG), which are taxed at just 10% and under Rs 1 lakh of gains are tax-free.