personal-finance

Why is MF allocation to floating-rate bonds on the rise?

May 20, 10:05

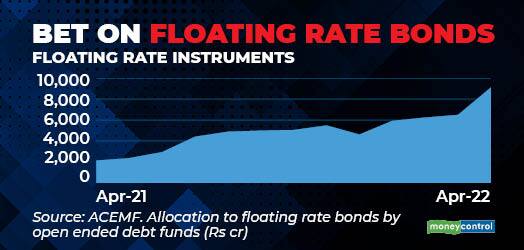

Debt mutual funds find it difficult when interest rates rise. When rate rises the value of the bonds that these funds hold decreases which, in turn, results in lower returns. One of the ways that debt-fund managers contains the fall is increasing allocation to floating-rate bonds (FRBs). Experts believe FRBs tend to offer a reasonable hedge mechanism as their coupons tend to get reset higher periodically. Coupon rate of FRBs are reset based on the reference rate. In rising rate, the reference rate too rises that eventually results in inching up the coupon rate of FRBs.