personal-finance

Why invest in ultra short duration funds now?

Feb 10, 08:02

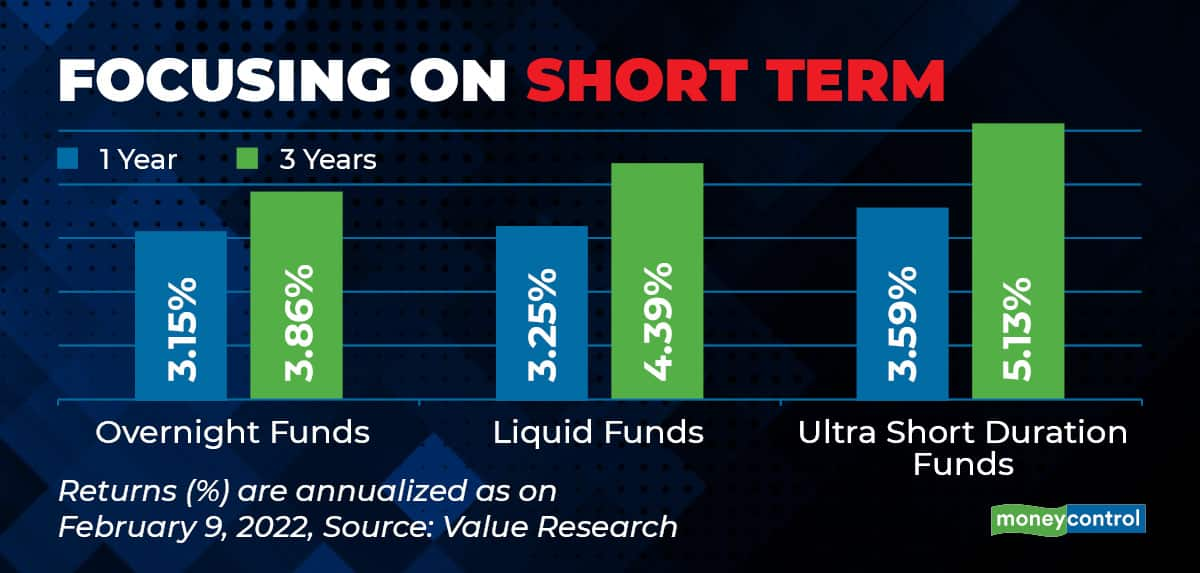

Interest rates are rising across the world and India is no exception. Reserve Bank of India will soon start rising policy rates. In such a scenario, it pays to invest in bonds maturing in near term. Ultra short duration funds (USDF) offer bond portfolios with Macauley duration between three and six months. Many USDF do not charge any exit loads and avoid taking credit risk.

USDF may offer better returns than liquid and overnight funds without compromising on liquidity. These can be attractive to investors with an investment time frame of less than a year. As per AMFI, assets worth Rs 92,095 crore were managed by USDF, as on January 31, 2022.