personal-finance

Why home loan growth showed a burst by end 2020

May 25, 01:05

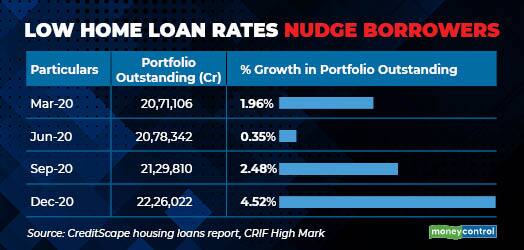

Outstanding home loans rose by nearly 10% between December 2019 and December 2020, per a CRIF High Mark report. What's the big deal, you might ask. Outstanding home loans are actually close to pre-Covid19 levels. But the pick-up largely happened in the last quarter of 2020. The nationwide lockdown due to the COVID-19 pandemic had led to fewer people buying homes for the most part of the last year but picked up towards the end of 2020 when restrictions were eased. State governments also reduced stamp duty charges and developers launched festive offers. With property prices already subdued, the extra offerings nudged people to buy homes. Disbursement of home loans also rose.