personal-finance

Why do you need both passive and active funds?

Jul 27, 04:07

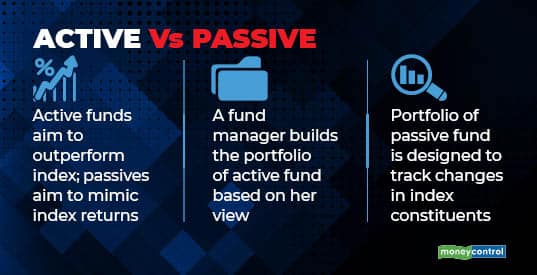

Passively-managed funds have grown in popularity among first-time mutual fund (MF) investors because of their simplicity and low total expense ratios (TERs). A passive fund is aimed at tracking the returns of the benchmark index. As there is no fund manager involved, there is no asset management fee charged. This leads to lower TERs. This doesn't mean that investors should only invest in passive funds as there are going to be periods when popular indices like Nifty and Sensex underperform broader markets. During these periods, the stock-picking ability of your fund manager can help outperform indices. A fund manager can exit or enter stocks, regardless of their weights in indices.