personal-finance

Why CRED Mint is not easy money?

Aug 25, 03:08

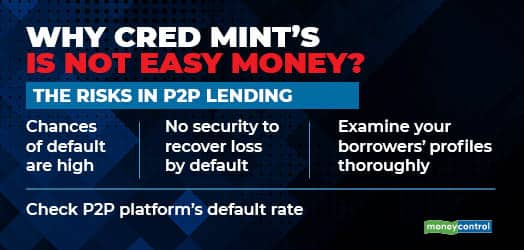

Fintech platform CRED recently launched a peer-to-peer (P2P) lending product called Mint for its members, in partnership with Liquiloans, an RBI-registered P2P firm. CRED's Mint is offering returns up to 9% a year. Members can lend or borrow from Rs 1 lakh to Rs 10 lakh. It is commission-free, and the investor can request withdrawal partially or in full anytime with no penalty, and earn interest for the period invested. Remember, a P2P platform is not an investment. It is merely a platform that allows people to borrow and lend. And therefore defaults can happen. But if you like taking risks, financial planners suggest limiting your exposure at 10% of your investible surplus to P2P lending.