personal-finance

Why asset rebalancing is important?

Jan 27, 07:01

Smart people begin their investment journey with asset allocation – spreading their money across asset classes such as stocks, bonds and gold in a predetermined ratio based on their risk profile and financial goals. However, as the time passes, asset prices change and that in turn changes asset allocation.

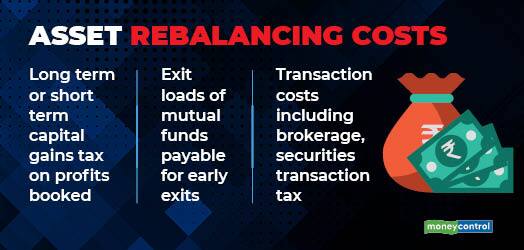

This need to be brought back to the original asset allocation from time to time. It is termed as asset rebalancing, wherein an asset class that has seen appreciation is sold and an asset class that is under-represented is added to. Asset rebalancing at regular intervals or when the prices move too much helps investors to stay on course and book profits.